welcome

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

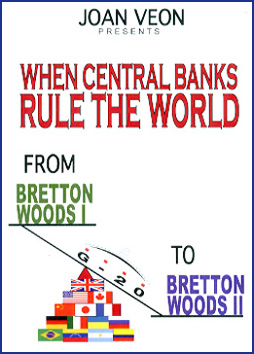

WHEN CENTRAL BANKSRULE THE WORLD

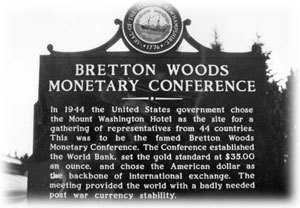

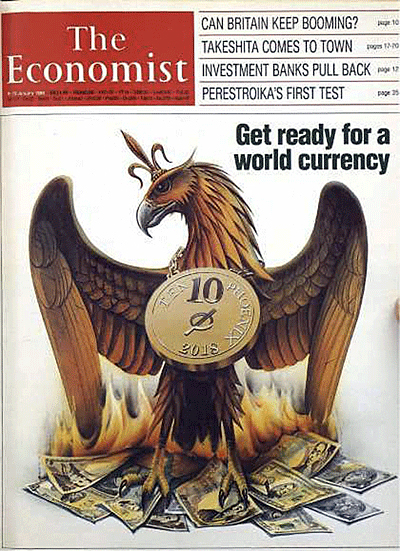

- CNBC Admits We Are Slaves Under Banking Cartel - Established in 1944 and named after the New Hampshire town where the agreements were made, Bretton Woods I created a system that made the dollar the reserve currency of the world. In addition, the International Monetary Fund (IMF) and the World Bank were established. Globalization is the process of breaking through the protective barriers designed to separate the nation-states from the world system. Between 1944 and 2008 (BW I and II) all the nation-state barriers have been removed with exception of the national regulatory laws governing financial institutions, insurance companies, mortgages, and Wall Street. The real purpose of BWII is to establish the framework for a global regulatory system. This also presents the possibility of merging all regional currencies into a global currency.

“I am afraid the ordinary citizen will not like to be told that the

banks can and do create money. And they who control the credit of the nation direct the policy of Governments

and hold in the hollow of their hand the destiny of the people.”

"The modern banking system manufactures money out of nothing. The process is perhaps the most astounding sleight of hand ever invented. Banking was conceived in iniquity and born in sin...Bankers own the earth. Take it away from them but leave them the power to create money, and with the flick of a pen, they will create enough money to buy it back again...Take this power away from them and all great fortunes like mine will disappear and they ought to disappear for then this would be a better and happier world to live in...But if you want to continue to be the slaves of the bankers and pay the cost of your own slavery then let the bankers continue to create money and control credit." -- Sir Josiah Stamp (1880-1941) President of the Bank of England in the 1920's --

N A T I O N A L D E B T ! ! ! ! !

! "...True, the United States does enjoy the “benefit” of appearing supremely powerful, but this is only a cruel joke. When the Network is satisfied that all major obstacles to its unelected rule have been removed, it will be a simple matter to destroy the US dollar, “justifiably” cut off the flow of money and credit to the United States, and create the political incentive (necessity) for the United States to fully enter the new global system..."

LINK: General Summary/Crash Course

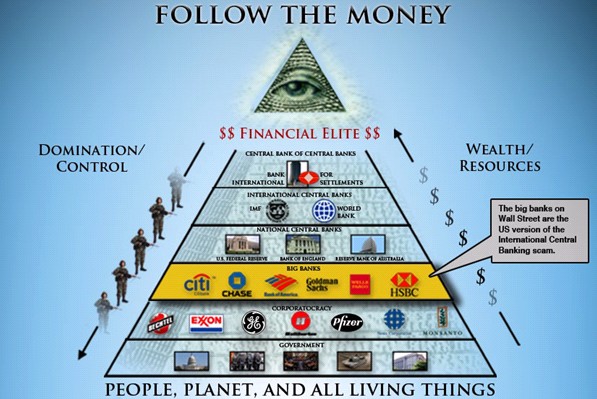

"...All of this federal spending requires an ever-expanding river of money. Follow that river, and you’ll find that it inevitably empties into an ocean of Network-connected industries and “interests.” Even humanitarian “government” services like food stamps are handled by JP Morgan and generate millions of dollars for the firm. Start looking into the military-industrial complex, which serves the ultimate Network interest (its sovereignty-destruction project), and the costs, financial and otherwise, boggle the mind. But as bad as all of this is, we’ve still only scratched the surface. Yes, the income tax essentially handed the Network a license to steal. Without its instrument (government), there would be no way to directly confiscate trillions of dollars annually from the labor of US citizens. The power of this funding mechanism, which did not exist for nearly 140 years of our nation’s history, has strengthened the Network’s global influence beyond measure. However, even on its best day, the so-called income tax runs a distant second to the greatest monetary power of all: the power to create money out of thin air. 3: Create Money—Create Credit—Create In the next chapter, we’ll briefly cover the basic mechanics of creating money, credit, and inescapable debt. For now, let’s cover something that’s arguably more important and definitely easier to understand: the implications of possessing such incredible monetary power and the story of how the Network seized it. First, the implications. We’ll start small and work our way up. Can you imagine if the government gave you 100 million dollars? Think about that for a minute. Tomorrow, at noon, the government has agreed to transfer $100 million into your bank account, no strings attached…Got it? OK, let’s go a little further. Can you imagine if the government gave you 500 million dollars? How about $1 billion? Better yet, what if it simply decided to give you $1 trillion? It’s difficult to get your mind around such large numbers, but really try to imagine what it would be like. For instance, if the government gave you $1 trillion and if you invested it, earning only a 7 percent annual return, you’d wind up with over $5.5 billion per month in additional income (roughly $192 million per day.)15Imagine having the ability to spend $192 million per day without ever depleting a penny of the $1 trillion you were given. How much power would you have? And with so much money to spend, how many individuals and institutions would want to be your friend? Now, let’s take it one step further…What if the government gave you all of the dollars? What if you were given the exclusive right to create every single dollar that exists? Try to get your head around that concept. (If a dollar exists anywhere in the world, it only exists because you were given the right to create it.) Now how much power do you have? The following quote provides a pretty good idea: “I am afraid the ordinary citizen will not like to be told that the banks can, and do, create money…And they who control the credit of the nation direct the policy of Governments and hold in the hollow of their hands the destiny of the people.”—Reginald McKenna, British Chancellor of the Exchequer, as quoted in Tragedy and Hope16 That statement is about as straightforward as it gets, and it comes from a man who had intimate knowledge of the topic. He worked at the highest levels within the system and is stating, unequivocally, exactly how it is. Those who create money and control the credit of the nation “direct the policy of governments and hold in the hollow of their hands the destiny of the people.” So why is it, if creating money and controlling credit confer so much power, that so few people understand either of these topics? Shouldn’t we all be taught the dangers of such power? Is it any surprise that we aren’t? Again, Quigley provides some insight. He explains that, for the Network to achieve its objectives, “it was necessary to conceal, or even to mislead, both governments and people about the nature of money and its methods of operation.”17 This practice of deceiving governments and people about money continues to this day because it’s the only way for the Network to maintain its current level of power. Rest assured, if the vast majority of people do not understand what central banks are or how they operate, it’s because they were not meant to. Our global monetary system was created by men who “conceal” and “mislead” as a matter of course. It’s not only how they conduct their business, it’s how they intend to secure their “far-reaching aim,” reiterated below. The powers of financial capitalism had a far-reaching aim, nothing less than to create a world system of financial control…able to dominate the political system of each country and the economy of the world as a whole. This system was to be controlled…by the central banks of the world acting in secret agreements…Each central bank, in the hands of men like Montagu Norman of the Bank of England [and] Benjamin Strong of the New York Federal Reserve…sought to dominate its government by its ability to control Treasury loans, to manipulate foreign exchanges, to influence the level of economic activity in the country, and to influence cooperative politicians by subsequent economic rewards in the business world. In each country the power of the central bank rested largely on its control of credit and money supply.18 It was, for this purpose, that the Network created the Federal Reserve System." The Federal Reserve System In chapter 3, we covered President Taft’s undoing: he refused to support the Network’s plan to create a central bank in the United States. And since the Network couldn’t fully “dominate the political system” of the United States without control of its “credit and money supply,” Taft was toppled and Wilson was installed. Shortly after taking office, Wilson signed the Federal Reserve Act into law, and the central bank was born.

This is a piece of the puzzle that Quigley seems to have missed. He acknowledges that Network titans like Rockefeller and Morgan had enough power to cause a financial panic whenever they chose. He admits that they used their power to their own advantage, wrecking “individual corporations, at the expense of the holders of common stocks.” He even admits that J. P. Morgan precipitated the “panic of 1907.”19 But the fact that their power could have been used to both take out competition and incite public demands for “monetary reform” (reform that would be directed by the Network itself) is not covered. It’s a glaring omission. In short, the Network needed a central bank to “dominate the political system” of the United States, but it needed another crisis20 to finally sell the scheme. With that perspective in mind, the panic of 1907 looks very different. First, J. P. Morgan causes the panic (which, to this day, is rarely mentioned), then he and Rockefeller halt the panic (for which, to this day, they’re still portrayed as saviors), and out of the suffering and chaos, “public demands” for legislative intervention finally reach critical mass. “The government” then forms a monetary commission to investigate and solve the problem (headed by none other than Network insider and US senator, Nelson Aldrich), and the commission decides that a central bank is needed to solve the nation’s woes. From there, it was simply a matter of writing the legislation and handing it off to the “right” politicians. ** Listen to the complete audio book: Tragedy & Hope 101 by Joe Plummer HERE. Please Listen & Share!

LEARN HOW THE REAL POLITICAL SYSTEM WORKS HERE: TRAGEDY & HOPE 101

"The real purpose of BWII is to establish the framework for a global regulatory system. This also presents the possibility of merging all regional currencies into a global currency." LINK: CASHLESS TRACKABLE SOCIETY

The Federal Reserve Corbett Report Extras | Apr 7, 2020 SHOW NOTES AND MP3: https://www.corbettreport.com/?p=35810 John Titus of Best Evidence joins us to discuss Season 2 of his "Mafiacracy Now" video

series, an exploration of the crimes of the banksters and their multi-trillion dollar heist that is being

perpetrated during the current crisis. Today we talk about the Fed's lies about the coronavirus and what horrifying

truths about the collapsing economy are hidden behind them.

LINK: International Monetary Fund

CNBC Admits We Are Slaves Under Banking Cartel

The Destruction of America: Brought to You By JP Morgan Chase Alex Jones analyzes a JP Morgan Chase ad that was in heavy rotation over the Thanksgiving holiday that is meant to sell the idea that the mega-bank is the backbone of America, and closely tied to its dream. Nothing could be further from the truth, as the predatory institution, along with the other 'Too Big to Fail' banks that received bailouts, have used corporate welfare to sellout the nation, ship jobs overseas, reap profits on money lent from the Federal Reserve at zero interest, while saddling huge debts upon the people through the larger derivatives scheme. JP Morgan Chase is at the heart of Rothschild and Rockefeller monetary interests; no wonder that its CEO Jamie Dimon sits on the New York Federal Reserve board of directors, while wealthy elites like Warren Buffett have called for him to replace Tim Geithner (another Fed insider) at the Treasury Department. LINK: Propaganda History

10 Things That Every American Should Know About The Federal Reserve

The

Economic Collapse What would happen if the Federal Reserve was shut down permanently? That is a question that CNBC asked recently, but unfortunately most Americans don’t really think about the Fed much. Most Americans are content with believing that the Federal Reserve is just another stuffy government agency that sets our interest rates and that is watching out for the best interests of the American people. But that is not the case at all. The truth is that the Federal Reserve is a private banking cartel that has been designed to systematically destroy the value of our currency, drain the wealth of the American public and enslave the federal government to perpetually expanding debt. During this election year, the economy is the number one issue that voters are concerned about. But instead of endlessly blaming both political parties, the truth is that most of the blame should be placed at the feet of the Federal Reserve. The Federal Reserve has more power over the performance of the U.S. economy than anyone else does. The Federal Reserve controls the money supply, the Federal Reserve sets the interest rates and the Federal Reserve hands out bailouts to the big banks that absolutely dwarf anything that Congress ever did. If the American people are ever going to learn what is really going on with our economy, then it is absolutely imperative that they get educated about the Federal Reserve. The following are 10 things that every American should know about the Federal Reserve….

#1 The Federal Reserve System Is A Privately Owned Banking Cartel

The Federal Reserve is not a government agency. The truth is that it is a privately owned central bank. It is owned by the banks that are members of the Federal Reserve system. We do not know how much of the system each bank owns, because that has never been disclosed to the American people. The Federal Reserve openly admits that it is privately owned. When it was defending itself against a Bloomberg request for information under the Freedom of Information Act, the Federal Reserve stated unequivocally in court that it was“not an agency” of the federal government and therefore not subject to the Freedom of Information Act. In fact, if you want to find out that the Federal Reserve system is owned by the member banks, all you have to do is go to the Federal Reserve website….

Foreign governments and foreign banks do own significant ownership interests in the member banks that own the Federal Reserve system. So it would be accurate to say that the Federal Reserve is partially foreign-owned. But until the exact ownership shares of the Federal Reserve are revealed, we will never know to what extent the Fed is foreign-owned.

#2 The Federal Reserve System Is A Perpetual Debt Machine

As long as the Federal Reserve System exists, U.S. government debt will continue to go up and up and up. This runs contrary to the conventional wisdom that Democrats and Republicans would have us believe, but unfortunately it is true. The way our system works, whenever more money is created more debt is created as well. For example, whenever the U.S. government wants to spend more money than it takes in (which happens constantly), it has to go ask the Federal Reserve for it. The federal government gives U.S. Treasury bonds to the Federal Reserve, and the Federal Reserve gives the U.S. government “Federal Reserve Notes” in return. Usually this is just done electronically. So where does the Federal Reserve get the Federal Reserve Notes? It just creates them out of thin air. Wouldn’t you like to be able to create money out of thin air? Instead of issuing money directly, the U.S. government lets the Federal Reserve create it out of thin air and then the U.S. government borrows it. Talk about stupid. When this new debt is created, the amount of interest that the U.S. government will eventually pay on that debt is not also created. So where will that money come from? Well, eventually the U.S. government will have to go back to the Federal Reserve to get even more money to finance the ever expanding debt that it has gotten itself trapped into. It is a debt spiral that is designed to go on perpetually. You see, the reality is that the money supply is designed to constantly expand under the Federal Reserve system. That is why we have all become accustomed to thinking of inflation as “normal”. So what does the Federal Reserve do with the U.S. Treasury bonds that it gets from the U.S. government? Well, it sells them off to others. There are lots of people out there that have made a ton of money by holding U.S. government debt. In fiscal 2011, the U.S. government paid out 454 billion dollars just in interest on the national debt. That is 454 billion dollars that was taken out of our pockets and put into the pockets of wealthy individuals and foreign governments around the globe. The truth is that our current debt-based monetary system was designed by greedy bankers that wanted to make enormous profits by using the Federal Reserve as a tool to create money out of thin air and lend it to the U.S. government at interest. And that plan is working quite well. Most Americans today don’t understand how any of this works, but many prominent Americans in the past did understand it. For example, Thomas Edison was once quoted in the New York Times as saying the following….

We should have listened to men like Edison and Ford. But we didn’t. And so we pay the price. On July 1, 1914 (a few months after the Fed was created) the U.S. national debt was 2.9 billion dollars. Today, it is more than more than 5000 times larger. Yes, the perpetual debt machine is working quite well, and most Americans do not even realize what is happening.

#3 The Federal Reserve Has Destroyed More Than 96% Of The Value Of The U.S. Dollar

Did you know that the U.S. dollar has lost 96.2 percent of its value since 1900? Of course almost all of that decline has happened since the Federal Reserve was created in 1913. Because the money supply is designed to expand constantly, it is guaranteed that all of our dollars will constantly lose value. Inflation is a “hidden tax” that continually robs us all of our wealth. The Federal Reserve always says that it is “committed” to controlling inflation, but that never seems to work out so well. And current Federal Reserve Chairman Ben Bernanke says that it is actually a good thing to have a little bit of inflation. He plans to try to keep the inflation rate at about 2 percent in the coming years. So what is so bad about 2 percent? That doesn’t sound so bad, does it? Well, just consider the following excerpt from a recent Forbes article….

#4 The Federal Reserve Can Bail Out Whoever It Wants To With No Accountability

The American people got so upset about the bailouts that Congress gave to the Wall Street banks and to the big automakers, but did you know that the biggest bailouts of all were given out by the Federal Reserve? Thanks to a very limited audit of the Federal Reserve that Congress approved a while back, we learned that the Fed made trillions of dollars in secret bailout loans to the big Wall Street banks during the last financial crisis. They even secretly loaned out hundreds of billions of dollars to foreign banks. According to the results of the limited Fed audit mentioned above, a total of$16.1 trillion in secret loans were made by the Federal Reserve between December 1, 2007 and July 21, 2010. The following is a list of loan recipients that was taken directly from page 131of the audit report…. Citigroup - $2.513 trillion So why haven’t we heard more about this? This is scandalous. In addition, it turns out that the Fed paid enormous sums of money to the big Wall Street banks to help “administer” these nearly interest-free loans….

Does reading that make you angry? It should.

#5 The Federal Reserve Is Paying Banks Not To Lend Money

Did you know that the Federal Reserve is actually paying banks not to make loans? It is true. Section 128 of the Emergency Economic Stabilization Act of 2008 allows the Federal Reserve to pay interest on “excess reserves” that U.S. banks park at the Fed. So the banks can just send their cash to the Fed and watch the money come rolling in risk-free. So are many banks taking advantage of this? You tell me. Just check out the chart below. The amount of “excess reserves” parked at the Fed has gone from nearly nothing to about 1.5 trillion dollarssince 2008….

But shouldn’t the banks be lending the money to us so that we can start businesses and buy homes? You would think that is how it is supposed to work. Unfortunately, the Federal Reserve is not working for us. The Federal Reserve is working for the big banks. Sadly, most Americans have no idea what is going on. Another example of this is the government debt carry trade. Here is how it works. The Federal Reserve lends gigantic piles of nearly interest-free cash to the big Wall Street banks, and in turn those banks use the money to buy up huge amounts of government debt. Since the return on government debt is higher, the banks are able to make large profits very easily and with very little risk. This scam was also explained in a recent article in the Guardian….

That is a pretty good little scam they have got going, wouldn’t you say?

#6 The Federal Reserve Creates Artificial Economic Bubbles That Are Extremely Damaging

By allowing a centralized authority such as the Federal Reserve to dictate interest rates, it creates an environment where financial bubbles can be created very easily. Over the past several decades, we have seen bubble after bubble. Most of these have been the result of the Federal Reserve keeping interest rates artificially low. If the free market had been setting interest rates all this time, things would have never gotten so far out of hand. For example, the housing crash would have never been so horrific if the Federal Reserve had not created such ideal conditions for a housing bubble in the first place. But we allow the Fed to continue to make the same mistakes. Right now, the Federal Reserve continues to set interest rates much, much lower than they should be. This is causing a tremendous misallocation of economic resources, and there will be massive consequences for that down the line.

#7 The Federal Reserve System Is Dominated By The Big Wall Street Banks

Even since it was created, the Federal Reserve system has been dominated by the big Wall Street banks. The following is from a previous article that I did about the Fed….

#8 It Is Not An Accident That We Saw The Personal Income Tax And The Federal Reserve System Both Come Into Existence In 1913

On February 3rd, 1913 the 16th Amendment to the U.S. Constitution was ratified. Later that year, the United States Revenue Act of 1913 imposed a personal income tax on the American people and we have had one ever since. Without a personal income tax, it is hard to have a central bank. It takes a lot of money to finance all of the government debt that a central banking system creates. It is no accident that the 16th Amendment was ratified in 1913 and the Federal Reserve system was also created in 1913. They have a symbiotic relationship and they are designed to work together. We could fill Congress with people that are committed to ending this oppressive system, but so far we have chosen not to do that. So our children and our grandchildren will face a lifetime of debt slavery because of us. I am sure they will be thankful for that.

#9 The Current Federal Reserve Chairman, Ben Bernanke, Has A Nightmarish Track Record Of Incompetence

The mainstream media portrays Federal Reserve Chairman Ben Bernanke as a brilliant economist, but is that really the case? Let’s go to the videotape. The following is an extended excerpt from an article that I published previously…. ———- In 2005, Bernanke said that we shouldn’t worry because housing prices had never declined on a nationwide basis before and he said that he believed that the U.S. would continue to experience close to “full employment”….

In 2005, Bernanke also said that he believed that derivatives were perfectly safe and posed no danger to financial markets….

In 2006, Bernanke said that housing prices would probably keep rising….

In 2007, Bernanke insisted that there was not a problem with subprime mortgages….

In 2008, Bernanke said that a recession was not coming….

A few months before Fannie Mae and Freddie Mac collapsed, Bernanke insisted that they were totally secure….

For many more examples that demonstrate the absolutely nightmarish track record of Federal Reserve Chairman Ben Bernanke, please see the following articles…. *” Say What? 30 Ben Bernanke Quotes That Are So Stupid That You Won’t Know Whether To Laugh Or Cry” *” Is Ben Bernanke A Liar, A Lunatic Or Is He Just Completely And Totally Incompetent?” But after being wrong over and over and over, Barack Obama still nominated Ben Bernanke for another term as Chairman of the Fed. ———- #10 The Federal Reserve Has Become Way Too Powerful

The Federal Reserve is the most undemocratic institution in America. The Federal Reserve has become so powerful that it is now known as “the fourth branch of government”, but there are less checks and balances on the Fed than there are on the other three branches. The Federal Reserve runs the U.S. economy but it is not accountable to the American people. We can’t vote those that run the Fed out of office if we do not like what they do. Yes, the president appoints those that run the Fed, but he also knows that if he does not tread lightly he won’t get the money from the big Wall Street banks that he needs for his next election. Thankfully, there are a few members of Congress that are complaining about how much power the Fed has. For example, Ron Paul once told MSNBC that he believes that the Federal Reserve is now actually more powerful than Congress…..

As members of Congress such as Ron Paul have started to shed some light on the activities of the Federal Reserve, that has caused many in the mainstream media to come to the defense of the Fed. For example, a recent CNBC article entitled “If The Federal Reserve Is Abolished, What Then?” makes it sound like there is absolutely no other rational alternative to having the Federal Reserve run our economy. But this is not what our founders intended. The founders did not intend for a private banking cartel to issue our money and set our interest rates for us. According to Article I, Section 8 of the U.S. Constitution, the U.S. Congress has been given the responsibility to “coin Money, regulate the Value thereof, and of foreign Coin, and fix the Standard of Weights and Measures”. So why is the Federal Reserve doing it? But the CNBC article mentioned above makes it sound like the sky would fall if control of the currency was handed back over to the American people. At one point, the article asks the following question….

No, the truth is that we don’t need anyone to “manage” our economy. The U.S. Treasury could be in charge of issuing our currency and the free market could set our interest rates. We don’t need to have a centrally-planned economy. We aren’t China. And it goes against everything that our founders believed to be running up so much government debt. For example, Thomas Jefferson once declared that if he could add just one more amendment to the U.S. Constitution it would be a ban on all government borrowing….

Oh, how things would have been different if we had only listened to Thomas Jefferson. Please share this article with as many people as you can. These are things that every American should know about the Federal Reserve, and we need to educate the American people about the Fed while there is still time.

LINK: THE I.R.S.

LINK: International Monetary Fund

Your Guide to the Great Monetary Reset The Corbett Report Official LBRY Channel | December 4th, 2020 SHOW NOTES AND MP3: https://www.corbettreport.com/brettonwoods2/

The Corbett Report Official LBRY Channel | December 2nd, 2020 SHOW NOTES AND MP3: https://www.corbettreport.com/?p=38696

Century of Enslavement: The History of The Federal Reserve What is the Federal Reserve system? How did it come into existence? Is it part of the federal government? How does it create money? Why is the public kept in the dark about these important matters? In this feature-length documentary film, The Corbett Report explores these important question and pulls back the curtain on America's central bank.

Click here to download an mp3 audio version of this documentary. Click here to download an mp4 video version of this documentary. Click here to download a color information pamphlet on The Federal Reserve. Click here to download a black and white information pamphlet on The Federal Reserve.

TRANSCRIPT: Part One: The Origins of the Fed “The real truth of the matter is, as you and I know, that a financial element in the larger centers has owned the Government ever since the days of Andrew Jackson.” – FDR letter to Colonel Edward House, Nov. 21 1933 All our lives we’ve been told that economics is boring. It’s dull. It’s not worth the time it takes to understand it. And all our lives, we’ve been lied to. War. Poverty. Revolution. They all hinge on economics. And economics all rests on one key concept: money. Money. It is the economic water in which we live our lives. We even call it ‘currency’; it flows around us, carries us in its wake. Drowns those who are not careful. We use it every day in nearly every transaction we conduct. We spend our lives working for it, worrying about it, saving it, spending it, pinching it. It defines our social status. It compromises our morals. People are willing to fight, die and kill for it. But what is it? Where does it come from? How is it created? Who controls it? It is a remarkable fact that, given its central importance in our lives, not one person in a hundred could answer such basic questions about money as these.

But why is this? How could we be so ignorant about a topic of such importance? “Where does money come from?” is a basic, childlike question. So why is our only response the childlike answer, meant as a joke: “It grows on trees”? Such a profound state of ignorance could not come about naturally. From the time we are children, we are curious about the world and eager to learn about the way it works. And what could lead to a better understanding of the way the world works than a knowledge of money, its creation and destruction? Yet discussion of this topic is fastidiously avoided in our school years and ignored in our daily life. Our monetary ignorance is artificial, a smokescreen that has been erected on purpose and perpetrated with the help of complicated systems and insufferable economic jargon. But it doesn’t take an economist to understand the importance of money. Deep down we all know that the wars, the poverty, the violence we see around us hinges on this question of money. It seems like a thousand piece jigsaw puzzle just waiting to be solved. And it is. The puzzle pieces, taken together, create an image of the Federal Reserve, America’s central bank and the heart of the country’s banking system. Despite its central importance to the economy, relatively few have heard of it, and fewer still know what it is, despite the bank’s attempts at self-description:

But in order to understand the Federal Reserve, we must first understand its origins and context. We must deconstruct the puzzle. The first piece of that puzzle lies here, in the White House. This is where the Federal Reserve Act, then known as the Currency Bill, was signed into law after passing the House and Senate in late December, 1913. The New York Times of Christmas Eve, 1913, described the festive scene: “The Christmas spirit pervaded the gathering. While the ceremony was a little less impressive than that of the signing of the Tarriff act on Oct. 3 last in the same room, the spectators were much more enthusiastic and seized every occasion to applaud.” There in the White House that fateful December evening, President Wilson signed away the last veneer of control over the American money supply to a cartel; a well-organized gang of crooks so successful, so cunning, so well-hidden that even now, a century later, few know of its existence, let alone the details of its operations. But those details have been openly admitted for decades. Of course, just as we have been taught to find economics boring, we have been taught that this story is boring. This is the way the Federal Reserve itself tells it:

But this is history as told by the victors: a revisionist vision in which the creation of a central bank to control the nation’s money supply is merely a boring historical footnote, about as important as the invention of the zipper or an early 20th century hoola-hoop craze. The truth is that the story of the secret banking conclave that gave birth to that Federal Reserve Act is as exciting and dramatic as any Hollywood screenplay or detective novel yarn, and all the more remarkable for the fact that it is all true. We pick up the story, appropriately enough, under cover of darkness. It was the night of November 22, 1910, and a group of the richest and most powerful men in America were boarding a private rail car at an unassuming railroad station in Hoboken, New Jersey. The car, waiting with shades drawn to keep onlookers from seeing inside, belonged to Senator Nelson Aldrich, the father-in-law of billionaire heir to the Rockefeller dynasty, John D. Rockefeller, Jr. A central figure on the influential Senate Finance Committee where he oversaw the nation’s monetary policy, Aldrich was referred to in the press as the “General Manager of the Nation.” Joining him that evening was his private secretary, Shelton, and a who’s who of the nation’s banking and financial elite: A. Piatt Andrew, the Assistant Treasury Secretary; Frank Vanderlip, President of the National City Bank of New York; Henry P. Davison, a senior partner of J.P. Morgan Company; Benjamin Strong, Jr., an associate of J.P. Morgan and President of Bankers Trust Co., and Paul Warburg, heir of the Warburg banking family and son-in-law of Solomon Loeb of the famed New York investment firm, Kuhn, Loeb & Company. The men had been told to arrive one by one after sunset to attract as little attention as possible. Indeed, secrecy was so important to their mission that the group did not use anything but their first names throughout the journey so as to keep their true identities secret even from their own servants and wait staff. The movements of any one of them would have been reason enough to attract the attention of New York’s voracious press, especially in an era where banking and monetary reform was seen as a key issue for the future of the nation; a meeting of all of them, now that would surely have been the story of the century. And it was. Their destination? The secluded Jekyll Island off the coast of Georgia, home to the prestigious Jekyll Island Club whose members included the Morgans, Rockefellers, Warburgs and Rothschilds. Their purpose? Davison told intrepid local newspaper reporters who had caught wind of the meeting that they were going duck hunting. But in reality, they were going to draft a reform of the nation’s banking industry in complete secrecy. G. Edward Griffin, the author of the bestselling The Creature from Jekyll Island and a long-time Federal Reserve researcher, explains:

Amazingly enough, they were successful, not just in conspiring to write the legislation that would eventually become the Federal Reserve Act, but in keeping that conspiracy a secret from the public for decades. It was first reported on in 1916 by Bertie Charles Forbes, the financial writer who would later go on to found Forbes magazine, but it was never fully admitted until a full quarter century later when Frank Vanderlip wrote a casual admission of the meeting in the February 9, 1935 edition of The Saturday Evening Post: “I was as secretive—indeed, as furtive—as any conspirator.[…]I do not feel it is any exaggeration to speak of our secret expedition to Jekyll Island as the occasion of the actual conception of what eventually became the Federal Reserve System.” Over the course of their nine days of deliberation at the Jekyll Island club, they devised a plan so overarching, so ambitious, that even they could scarcely imagine that it would ever be passed by congress. As Vanderlip put it, “Discovery [of our plan], we knew, simply must not happen, or else all our time and effort would be wasted. If it were to be exposed publicly that our particular group had got together and written a banking bill, that bill would have no chance whatever of passage by Congress.” So what, precisely, did this conclave of conspirators devise at their Jekyll Island meeting? A plan for a central banking system to be owned by the banks themselves, a system which would organize the nation’s banks into a private cartel that would have sole control over the money supply itself. At the end of their nine day meeting, the bankers and financiers went back to their respective offices content in what they had accomplished. The details of the plan changed between its 1910 drafting and the eventual passage of the Federal Reserve Act, but the essential ideas were there. But ultimately, this scene on Jekyll Island, too, is just one piece of a larger puzzle. And like any other puzzle piece, it has to be seen in its wider context for the bigger picture to become visible. To understand the other pieces of the puzzle and their importance in the creation of the Federal Reserve, we have to travel backward in time. The story begins in late 17th century Europe. The Nine Years’ War is raging across the continent as Louis XIV of France finds himself pitted against much of the rest of the continent over his territorial and dynastic claims. King William III of England, devastated by a stunning naval defeat, commits his court to rebuilding the English navy. There’s only one problem: money. The government’s coffers have been exhausted by the waging of the war and William’s credit is drying up. A Scottish banker, William Paterson, has a banker’s solution: a proposal “to form a company to lend a million pounds to the Government at six percent (plus 5,000 “management fee”) with the right of note issue.” By 1694 the idea has been slightly revised (a 1.2 million pound loan at 8 percent plus 4000 for management expenses), but it goes ahead: the magnanimously titled Bank of England is created. The name is a carefully constructed lie, designed to make the bank appear to be a government entity. But it is not. It is a private bank owned by private shareholders for their private profit with a charter from the king that allows them to print the public’s money out of thin air and lend it to the crown. What happens here at the birth of the Bank of England in 1694 is the creation of a template that will be repeated in country after country around the world: a privately controlled central bank lending money to the government at interest, money that it prints out of nothing. And the jewel in the crown for the international bankers that creates this system is the future economic powerhouse of the world, the United States. In many important respects, the history of the United States is the history of the struggle of the American people against the bankers that wish to control their money. By the 1780s, with colonies still fighting for independence from the crown, the bankers will get their wish. In 1781 the United States is in financial turmoil. The Continental, the paper currency issued by the Continental Congress to pay for the war, has collapsed from overissue and British counterfeiting. Desperate to find a way to finance the end stages of the war, Congress turns to Robert Morris, a wealthy shipping merchant who was investigated for war profiteering just two years earlier. Now as “Superintendent of Finance” of the United States from 1781 to 1784 he is regarded as the most powerful man in America next to General Washington. In his capacity as Superintendent of Finance, Morris argues for the creation of a privately-owned central bank deliberately modeled on the Bank of England that the colonies were supposedly fighting against. Congress, backed into a corner by war obligations and forced to do business with the bankers just like King William in the 1690s, acquiesces and charters the Bank of North America as the nation’s first central bank. And exactly as the Bank of England came into existence loaning the British crown 1.2 million pounds, the B.N.A. started business by loaning $1.2 million to Congress. By the end of the war, Morris has fallen out of political favor and the Bank of North America’s currency has failed to win over a skeptical public. The B.N.A. is downgraded from a national central bank to a private commercial bank chartered by the State of Pennsylvania. But the bankers have not given up yet. Before the ink is even dry on the constitution, a group led by Alexander Hamilton is already working on the next privately-owned central bank for the newly formed United States of America. So brazen is Hamilton in the forwarding of this agenda that he makes no attempt to hide his aims or those of the banking interests he serves: “A national debt, if it is not excessive, will be to us a national blessing,” he wrote in a letter to James Duane in 1781. “It will be a powerful cement of our Union. It will also create a necessity for keeping up taxation to a degree which, without being oppressive, will be a spur to industry.” Opposition to Hamilton and his debt-based system for establishing the finances of the US is fierce. Led by Jefferson and Madison, the bankers and their system of debt-enslavement is called out for the force of destruction that it is. As Thomas Jefferson wrote: “[T]he spirit of war and indictment, […] since the modern theory of the perpetuation of debt, has drenched the earth with blood, and crushed its inhabitants under burdens ever accumulating.” Still, Hamilton proves victorious. The First Bank of the United States is chartered in 1791 and follows the pattern of the Bank of England and the Bank of North America almost exactly; a privately-owned central bank with the authority to loan money that it creates out of nothing to the government. In fact, it is the very same people behind the new bank as were behind the old Bank of North America. It was Alexander Hamilton, Robert Morris’ former aide, who first proposed Morris for the position of Financial Superintendent, and the director of the old Bank of North America, Thomas Willing, is brought in to serve as the first director of the First Bank of the United States. Meet the new banking bosses, same as the old banking bosses. In the first five years of the banks’ existence, the US government borrows 8.2 million dollars from the bank and prices rise 72%. By 1795, when Hamilton leaves office, the incoming Treasury Secretary announces that the government needs even more money and sells off the government’s meager 20% share in the bank, making it a fully private corporation. Once again, the US economy is plundered while the private banking cartel laughs all the way to the bank that they created. By the time the bank’s charter comes due for renewal in 1811, the tide has changed for the money interests behind the bank. Hamilton is dead, shot to death in a duel with Aaron Burr. The bank-supporting Federalist party is out of power. The public are wary of foreign ownership of the central bank, and what’s more don’t see the point of a central bank in time of peace. Accordingly, the charter renewal is voted down in the Senate and the bank is closed in 1811. Less than a year later, the US is once again at war with England. After 2 years of bitter struggle the public debt of the US has nearly tripled from $45.2 million to $119.2 million. With trade at a standstill, prices soaring, inflation rising and debt mounting, President Madison signs the charter for the creation of another central bank, the Second Bank of the United States, in 1816. Just like the two central banks before it, it is majority privately-owned and is granted the power to loan money that it creates out of thin air to the government. The 20 year bank charter is due to expire in 1836, but President Jackson has already vowed to let it die prior to renewal. Believing that Jackson won’t risk his chance for reelection in 1832 on the issue, the bankers forward a bill to renew the bank’s charter in July of that year, 4 years ahead of schedule. Remarkably, Jackson vetoes the renewal charter and stakes his reelection on the people’s support of his move. In his veto message, Jackson writes in no uncertain terms about his opposition to the bank: “Whatever interest or influence, whether public or private, has given birth to this act, it can not be found either in the wishes or necessities of the executive department, by which present action is deemed premature, and the powers conferred upon its agent not only unnecessary, but dangerous to the Government and country. It is to be regretted that the rich and powerful too often bend the acts of government to their selfish purposes.[…]If we can not at once, in justice to interests vested under improvident legislation, make our Government what it ought to be, we can at least take a stand against all new grants of monopolies and exclusive privileges, against any prostitution of our Government to the advancement of the few at the expense of the many, and in favor of compromise and gradual reform in our code of laws and system of political economy.” The people side with Jackson and he’s reelected on the back of his slogan, “Jackson and No Bank!” The President makes good on his pledge. In 1833 he announces that the government will stop using the bank and will pay off its debt. The bankers retaliate in 1834 by staging a financial crisis and attempting to pin the blame on Jackson, but it’s no use. On January 8, 1835, President Jackson succeeds in paying off the debt, and for the first and only time in its history the United States is free from the debt chain of the bankers. In 1836 the Second Bank of the United States’ charter expires and the bank loses its status as America’s central bank. It is 77 years before the bankers can regain the jewel in their crown. But it is not for lack of trying. Immediately upon the death of the bank, the banking oligarchs in England react by contracting trade, removing capital from the U.S., demanding payment in hard currency for all exports, and tightening credit. This results in a financial crisis known as the Panic of 1837, and once again Jackson’s campaign to kill the bank is blamed for the crisis. Throughout the late 19th century the United States is rocked by banking panics brought about by wild banking speculation and sharp contractions in credit. By the dawn of the 20th century, the bulk of the money in the American economy has been centralized in the hands of a small clique of industrial magnates, each with a near monopoly on a sector of the economy. There are the Astors in real estate, the Carnegies and the Schwabs in steel, the Harrimans, Stanfords and Vanderbilts in railroads, the Mellons and the Rockefellers in oil. As all of these families start to consolidate their fortunes, they gravitate naturally to the banking sector. And in this capacity, they form a network of financial interests and institutions that centered largely around one man, banking scion and increasingly America’s informal central banker in the absence of a central bank, John Pierpont Morgan. John Pierpont Morgan, or “Pierpont” as he prefers to be called, is born in Hartford, Connecticut in 1837 to Junius Spencer Morgan, a successful banker and financier. Morgan rides his father’s coattails into the banking business and by 1871 is partnered in his own firm, the firm that was eventually to become J.P. Morgan and Company. It is Morgan who finances Cornelius Vanderbilt’s New York Central Railroad. It is Morgan that finances the launch of nearly every major corporation of the period, from AT&T to General Electric to General Motors to Dupont. It is Morgan who buys out Carnegie and creates the United States Steel Corporation, America’s first billion dollar company. It is Morgan who brokers a deal with President Grover Cleveland to “save” the nation’s gold reserves by selling 62 million dollars worth of gold to the Treasury in return for government bonds. And it is Morgan, who, in 1907, sets in motion the crisis that leads to the creation of the Federal Reserve. That year, Morgan begins spreading rumors about the precarious finances of the Knickerbocker Trust Company, a Morgan competitor and one of the largest financial institutions in the United States at the time. The resulting crisis, dubbed the Panic of 1907, shakes the U.S. financial system to its core. Morgan puts himself forward as a hero, boldly offering to help underwrite some of the faltering banks and brokerage houses to keep them from going under. After a bout of hand-wringing over the nation’s finances, a Congressional Committee is assembled to investigate the “money trust,” the bankers and financiers who brought the nation so close to financial ruin and that wield such power over the nation’s finances. The public follows the issue closely, and in the end a handful of bankers are identified as key players in the money trust’s operations, including Paul Warburg, Benjamin Strong, Jr., and J.P. Morgan. Andrew Gavin Marshall, editor of The People’s Book Project, explains:

The public, suspicious of Senator Aldrich’s banking connections, ultimately reject the Jekyll Island cabal’s “Aldrich Plan.” The cabal does not give up, however. They simply revise and rename their plan, giving it a new public face, that of Representative Carter Glass and Senator Robert Owen. In the end, the money trust that was behind the Panic of 1907 uses the public’s own outrage against them to complete their consolidation of control over the banking system. The newly-retitled Federal Reserve Act is signed into law on December 23, 1913 and the Fed begins operations the next year. Part Two: How the Scam Works “The study of money, above all other fields in economics, is one in which complexity is used to disguise truth or to evade truth, not to reveal it.” -John Kenneth Galbraith So how does the Federal Reserve system work? What does it do? Who owns and controls it? These are the basic questions that would get to the heart of the fundamental question: ‘what is money?’ And that is why the answer to these questions have been shrouded in impenetrable economic jargon. Even the Federal Reserve’s own educational propaganda, which has an unusual tendency toward cutesy animation and talking down to its audience, has a difficult time summarizing the Fed’s mission and responsibilities. According to the Fed:

Precisely what imaginary gaggle of schoolchildren is this economic gibberish aimed at? The simple truth, hidden behind the sleight of hand of economic jargon and magisterial titles, is that a banking cartel has monopolized the most important item in our entire economy: money itself. We are taught to think of money as the pieces of paper printed in government printing presses or coins minted by government mints. While this is partially true, in this day and age the actual notes and coins circulating in the economy represent only a tiny fraction of the money in existence. Over 90% of the money supply is in fact created by private banks as loans that are payable back to the banks at interest. Although this simple fact is obscured by the wizards of Wall Street and gods of money who want to make the money creation process into some special art of alchemy carefully overseen by the government, the truth is not hidden from the public. In December 1977, the Federal Reserve Bank of New York published another of its dumbed-down cartoon-ridden information pamphlets for the general public attempting to explain the functions of the Federal Reserve System. There in black and white they carefully explain the money creation process: “Commercial banks create checkbook money whenever they grant a loan, simply by adding new deposit dollars to accounts on their books in exchange for a borrower’s IOU.[...]Banks create money by ‘monetizing’ the private debts of businesses and individuals. That is, they create amounts of money against the value of those IOUs.” There it is, in plain English: the vast majority of money in the economy, the “checkbook” money in our accounts at the bank and that we use in our electronic transfers and digital payments, is created not by a government printing press, but by the bank itself. It is created out of thin air as debt, owed back to the bank that created it at interest. This means that bank loans are not money taken from other bank depositors, but new money simply conjured into existence and placed into your account. And the bank is able to create much more money than it has cash to back up those deposits. The Fed claims to be the entity overseeing and backing up the banking industry. It was established, according to its own propaganda, to stabilize the system and prevent bank runs like the Panic of 1907 from happening again:

If that was indeed its aim, it signally failed to do so in running up one of the greatest bubbles in American history to that point in the 1920s, just a decade after its creation. The popping of that bubble, of course, lead directly into the Great Depression and one of the greatest periods of mass poverty in American history. Economists have long argued that the Fed itself was the cause of the depression by its complete mismanagement of the money supply. As former Federal Reserve Chairman Ben Bernanke admitted in a speech commemorating Fed critic Milton Friedman’s 90th birthday: “Regarding the Great Depression. You’re right, we did it. We’re very sorry. But thanks to you, we won’t do it again.” “Price stability” is another cited tenet of the Federal Reserve’s mandate. But here, too, the Fed has completely failed to live up to its own standards:

Paper money, too, is the responsibility of the Federal Reserve. Hence the dollars in circulation are not Treasury notes, not bills of credit, but Federal Reserve Notes, debt-based notes backed up ultimately by the government’s own promise to pay, its “sovereign bonds” secured by the taxpayers themselves. At one time, the Federal Reserve Banks were legally required to keep large stockpiles of gold in reserve to back up these notes, but that requirement was abandoned and today the notes are backed up mostly by government securities. The Fed no longer keeps any actual gold on its books, but gold “certificates” issued by the treasury and valued not at the spot price of $1300 per troy ounce, but an arbitrarily fixed “statutory price” of $42 2/9 per ounce.

Clearly, there is a discrepancy between what we are led to believe is motivating the Fed and what it actually does. To understand what the Fed is actually intended to do, it’s first important to understand that the Federal Reserve is not a bank, per se, but a system. This system codifies, institutionalizes, oversees and undergirds a form of banking called fractional reserve banking, in which banks are allowed to lend out more money than they actually have in their vaults.

The key to the system, of course, is who controls this incredible power to “regulate” the economy by setting reserve requirements and targeting interest rates. The answer to this question, too, has been deliberately obscured. The Federal Reserve system is a deliberately confusing mish-mash of public and private interests, reserve banks, boards and committees, centralized in Washington and spread out across the United States.

The reason that the Federal Reserve goes to such great lengths to make its organizational structure as confusing as possible is to cover up the massive conflicts of interest that are at the heart of that system. The fact is that the Federal Reserve system is comprised of a Board of Governors, 12 regional banks, and an open market committee. The privately-owned member banks of each Federal Reserve Bank vote on the majority of the Reserve Bank’s directors, and the directors vote on members to serve on the Federal Open Market Committee which determines monetary policy. What’s more, Wall Street is given a prime seat at the table, with tradition holding that the President of the powerful New York Federal Reserve Bank be given the Vice Chairmanship of the FOMC and be made a permanent committee member. In effect, the private banks are the key determinants in the composition of the FOMC which regulates the entire economy. According to the Fed “its monetary policy decisions do not have to be approved by the President or anyone else in the executive or legislative branches of government, it does not receive funding appropriated by the Congress, and the terms of the members of the Board of Governors span multiple presidential and congressional terms.” Or, in the words of Alan Greenspan: “The Federal Reserve is an independent agency and that means there is no other agency of government that can overrule actions that we take.” The Fed goes on in its self-mythologization to state that it is “not a private, profit-making institution.” This characterization is dishonest at best, and an outright lie at worst. The regional banks are themselves private corporations, as noted in a 1928 Supreme Court ruling: “Instrumentalities like the national banks or the federal reserve banks, in which there are private interests, are not departments of the government. They are private corporations in which the government has an interest.” This point is even admitted by the Federal Reserve’s own senior counsel.

These private corporations issue shares that are held by the member banks that make up the system, making the banks the ultimate owners of the Federal Reserve Banks. Although the Fed’s profits are returned to the Treasury each year, the member banks’ shares of the Fed do earn them a 6% dividend. According to the Fed, the fixed nature of these returns mean that they are not being held for profit. Despite the dishonest nature of this description, however, it is important to understand that the bankers who own the Federal Reserve indeed do not make their money from the Fed directly. Instead, the benefits are much less obvious, and much more insidious. The simplest way that this can be understood is that, as a century of history and the specific example of the last financial crisis shows, the Fed was used as a vehicle to bail out the very bankers who own the Fed banks in the most obvious example of fascistic collusion imaginable.

The 2008 crisis and subsequent bailouts are merely the latest and most brazen examples of the fundamental conflicts of interest at the heart of America’s privately-owned central banking system. Beginning with the collapse of Lehman Bros. in September of that year, the Federal Reserve embarked on an unprecedented program of bailouts and special zero interest lending facilities for the very banks that had caused the subprime meltdown in the first place. By the cartelization of the Federal Reserve structure, and thus not by accident, it was the very bank presidents who had overseen their banks’ lending practices that ended up in the director positions of the Federal Reserve Banks that voted on where to direct the trillions of dollars in bailout money. And unsurprisingly, they directed it toward their own banks. A stunning 2011 Government Accountability Office report examined $16 trillion of bailout facilities extended by the Fed in the wake of the crisis and exposed numerous examples of blatant conflicts of interest. Jeffrey Immelt, chief executive of General Electric served as a director on the board of the Federal Reserve Bank of New York at the same time the Fed provided $16 billion in financing to General Electric. JP Morgan Chase chief executive, Jamie Dimon, meanwhile, was also a member of the board of the New York Fed during the period that saw $391 billion in Fed emergency lending directed to his own bank. In all, Federal Reserve board members were tied to $4 trillion in loans to their own banks. These funds were not simply used to keep these banks afloat, but actually to return these Fed-connected banks to a period of record profits in the same period that the average worker saw their real wages actually decrease and the economy on main street slow to a standstill. Then Fed Chairman Ben Bernanke was confronted about these conflicts of interest by Senator Bernie Sanders upon the release of the GAO report in June 2012.

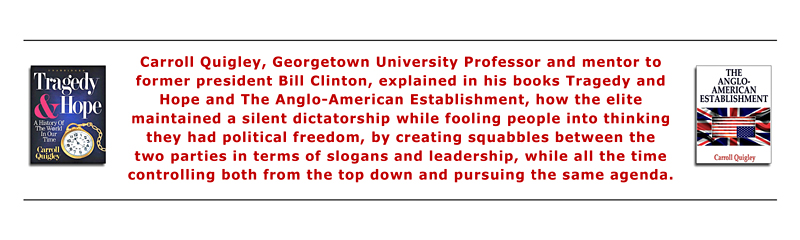

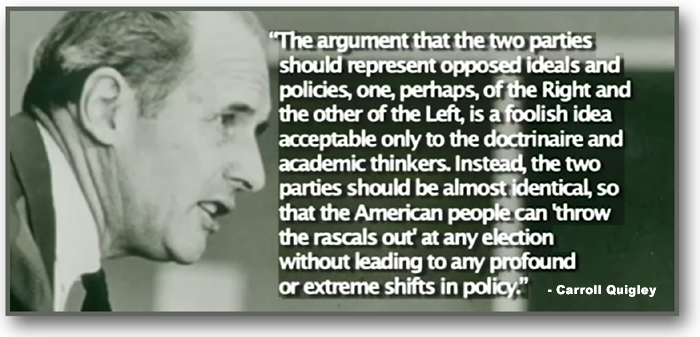

Bernanke is completely right. These conflicts are in fact a part of the institution itself. A structural feature of the Federal Reserve that was baked into the Federal Reserve Act itself over 100 years ago by the bankers who conspired to cartelize the nation’s money supply. You could not ask for a more succinct reason why the Federal Reserve itself, this admitted cartel of banking interests, needs to be abolished…but you could get one. Part Three: End the Fed “They who control the credit of a nation, direct the policy of Governments and hold in the hollow of their hands the destiny of the people.” – Reginald McKenna We now know that for centuries the people of the United States have been at war with the international banking oligarchs. That war was lost, seemingly for good, in 1913, with the creation of the Federal Reserve. With the passage of the Federal Reserve Act, President Woodrow Wilson consigned the American population to a century in which the money supply itself has depended on the whims of the banking cabal. A century of booms and busts, bubbles and depressions, has led to a wholesale redistribution of wealth toward those at the very top of the system. At the bottom, the masses toil in relative poverty, single-income households becoming double-income households out of necessity, their quality of life being slowly eroded as the Federal Reserve Notes that pass for dollars are themselves devalued. Worse yet, the fraud itself perpetuates Alexander Hamilton’s persistent myth that a national debt is necessary at all. The US is now locked into a system whereby the government issues bonds to generate the funds for their operations, bonds that are backed up by the taxation of the public’s own labor. The perpetrators of this fraud, meanwhile, remain in the shadows, largely ignored by a general public that could instantly recognise the latest Hollywood heartthrob or pop idol, but have no clue what the head of Goldman Sachs or the New York Fed does, let alone who they are. This cabal bear allegiance to no nationality, no philosophy or creed, no code of ethics. They are not even motivated by greed, but power. The power that the control of the money supply inevitably brings with it. It did not take long for this lust for power to rear its head. In 1921, just 7 years after the Fed began operations, the same J.P. Morgan-connected banking elite that founded the Federal Reserve incorporated an organization called The Council on Foreign Relations with the goal of taking over the foreign policy apparatus of the United States, including the State Department. In this quest, it was remarkably successful. Although there are only about 4000 members in the organization today, its membership has included 21 Secretaries of Defense, 18 Treasury Secretaries, 18 Secretaries of State, 16 CIA directors and many other high-ranking government officials, military officers, business elite, and, of course, bankers. The first Director of the CFR was John W. Davis, J.P. Morgan’s personal lawyer and a millionaire in his own right. Together with its sister organizations in Britain and elsewhere around the world, these groups would work together toward what they called a “New World Order” of total financial and political control directed by the bankers themselves. As Carroll Quigley, noted Georgetown historian and mentor of Bill Clinton, wrote in his 1966 work, Tragedy and Hope: A History of The World In Our Time: “The powers of financial capitalism had [a] far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole. This system was to be controlled in a feudalist fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent private meetings and conferences. The apex of the system was to be the Bank for International Settlements in Basel, Switzerland, a private bank owned and controlled by the world’s central banks which were themselves private corporations.” This is why the bankers and their partners in government and business conspired to bring about the 2008 crisis. Not for the pursuit of money, but power. In the same way the bankers used the Panic of 1907 to consolidate their control over the money supply, they hope to use the 2008 crisis and subsequent panics, which they themselves have created, to consolidate their political control. The inevitable conclusion, one that flows necessarily from the true understanding of this situation, is that the Federal Reserve system needs to be consigned to the dustbin of history. After a century of enslavement, it is time for the American public to finally throw off the bankers’ debt chains. If you’ve made it this far, congratulations. You are now better informed on the economic history of the United States and the truth about the Federal Reserve than 99% of the population. If you do nothing else, then just working to get those around you educated on this information alone will have a profound effect. Once they learn of the scam, many are motivated to do something about it, and they, in turn, inform others. This is the viral nature of suppressed truth, and it is the reason that more people are aware of and energized by the issue of the Federal Reserve and the nature of money than ever before. Perhaps even more amazingly, this movement is spreading to other parts of the globe. Recognizing the interlocking nature of the modern global economy, and the international nature of the banking oligarchy, movements to abolish the Federal Reserve have sprung up in Europe, where protests against the cartelized central banking system are taking place in over 100 cities attracting 20,000 people on a weekly basis.

But what if the burgeoning movement to End The Fed is successful? What system do people propose as the answer? There have been several proposals along different lines by various researchers. Some argue for a return to America’s colonial roots of debt-free money issued by state run banks, pointing to the Bank of North Dakota as one already functioning, successful model of this approach. Others advocate a decentralized system of alternative and competing currencies that greatly reduce or even eliminate altogether the need for a central bank. Some argue for currencies whose mathematical nature prevent them from being merely conjured into existence whenever a federal government wants to wage another war of aggression or forge another link in the seemingly endless train of governmental tyranny and abuse. Other, even more innovative ideas have been forwarded to harness current technologies to bring credit creation back to the individual level and revolutionize our concept of money altogether: Sound money. Cryptocurrencies. State banks. LETS programs. Self-issued credit. These and many other solutions have all been proposed and many of them are in use in different localities today. Information on all of these ideas and how they are being applied in various parts of the world are widely available online today. The point is that the question of what money is and how it should be created is perhaps the single greatest question facing humanity as a whole, and yet it is one that has been almost completely eliminated from the national conversation…until recently. For the first time in living memory, people are once again rallying around the monetary issue, and American politics stands on the threshold of a transformation almost unimaginable just two decades ago. And so the rest of the story is now in our hands. Once we understand the scam that has taken place, the gradual consolidation of wealth and power in the hands of an elite few banking oligarchs and the growing impoverishment of the masses, all in the name of banking funny money created out of nothing and loaned to the public at interest, we can choose to get active or to do nothing at all. For those who choose to get active, there are some steps that you can take to help change the course of this system: 1) Follow the links and resources from the transcript of this documentary at corbettreport.com/federalreserve to familiarize yourself with the history, the connections and the functions of the Federal Reserve system. If you can’t explain this material to yourself then you will never be able to teach it to others. 2) Begin reaching out to others to bring them up to speed on the issue. It can be as simple as broaching this conversation in the Monday morning water cooler talk or passing out a copy of this documentary or sending out links to this information to your email list. Insert this topic into your conversations. When people start talking about the national debt or the state of the economy or other political talking points, get them to question the roots of these issues, and why there is a national debt at all. 3) When you are able to find or create a group of like-minded people in your area who are engaged with the issue, start a study group on the issue and its solutions. The study group can help source alternative or complementary currencies in the local area, or, if none exist already, the group can form the basis for a community of local businesses and customers who are willing to start experimenting with ways to wean themselves off of the Federal Reserve notes. 4) Use the resources at corbettreport.com, including the Federal Reserve information flyer, or hold DVD screenings, to attract interest in your group and draw others into studying the true nature of the monetary system. The work of building up an alternative to the current system can seem daunting, even at times overwhelming. But it’s important to keep in mind that the Federal Reserve system that seems so monolithic today has only been around for one century. Central banks have been defeated in America before and they can be defeated again. The question of how we decide to change this system is not rhetorical; it will either be answered by an informed, engaged, active population working together to create viable alternatives and to dismantle the current system, or it will be answered by the same banking oligarchy that has been controlling the money supply, and indeed the lifeblood of the country, for generations. Now, one century after the creation of the Federal Reserve system, we have a choice to make: whether the next century, like the one before it, will be a century of enslavement, or, transformed by the actions and choices that we make in the light of this knowledge, a century of empowerment. http://www.corbettreport.com/federalreserve/

YouTube Blacklists Federal

Reserve Information. SHOW NOTES: https://www.corbettreport.com/?p=32264 Breitbart finally covers the story of how Chris Hayes got YouTube to blacklist the search term "federal reserve" and scrub Century of Enslavement from those search results. Today, James puts out the challenge: can you break through the information blockade with good old word of mouth? Links: The Federal Reserve , https://www.corbettreport.com/federalreserve/ , What Can We Do?

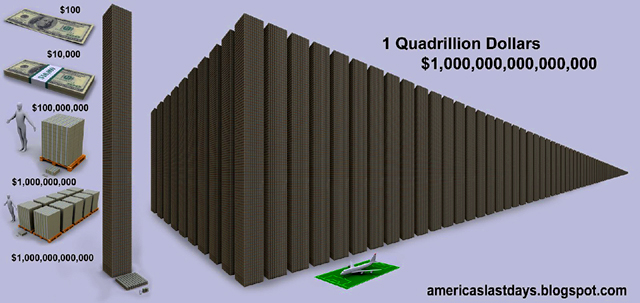

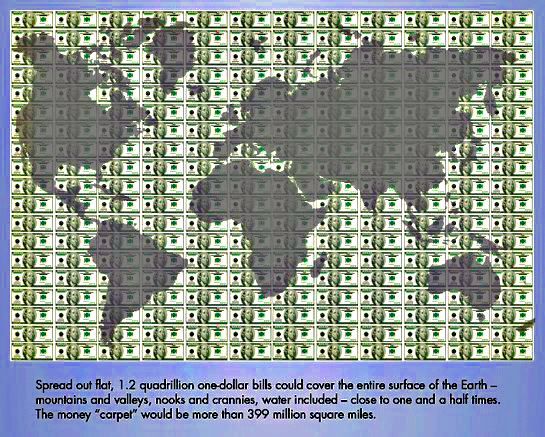

Quadrillions of Fraudulent DEBT!! A WORLD HELD HOSTAGE BY BANKERS

-- Learn about Glass–Steagall Act in FALL OF THE REPUBLIC -- Washington is owned by the private global banking cartel that owns Wall Street. International law does not apply to this criminal cartel. They stole trillions of dollars from the American people with help from corrupt politicians over a stretch of many decades, culminating in the government bailout in 2008, and they have not been held accountable.

The entire business model of the private global banking tricksters is based on stealing the wealth of nations, and destroying national independence in order to allow lawless multinational corporations to completely take over. Read this article about how they do it. Once nations are put into needless debt by these private global bankers, they put the squeeze on them by forcing them to pay back usurious loans that make them go bankrupt. After the inevitable mayhem that follows national collapse, they impose a military dictatorship so that the people can’t resist. Damon Vrabel calls it the “death of nations.” He writes: The fact is that most countries are not sovereign (the few that are are being attacked by CIA/MI6/Mossad or the military). Instead they are administrative districts or customers of the global banking establishment whose power has grown steadily over time based on the math of the bond market, currently ruled by the US dollar, and the expansionary nature of fractional lending. Their cult of economists from places like Harvard, Chicago, and the London School have steadily eroded national sovereignty by forcing debt-based, floating currencies on countries.

Civilized nations stand up for themselves, they don’t bow down to private bankers. America can prove to the world that it is civilized, honest, and free by showing the global banking overlords the door. The way to fight back against the global robbers at the privately owned Federal Reserve Bank/IMF/World Bank and the big banks is entirely peaceful. It is a matter of exposing their deviance and deception to the public, and then hitting the streets. An enemy can’t be defeated unless it remains in the shadows, striking at will. Directing public light at the private global banking cartel’s evil influence over nations that are thought to be free and independent by the people is the only way to bring an end to their crimes, and treachery against Mankind. A new civilization based on the divine values of freedom, justice, truth, and mutual respect among nations, and private institutions, can’t be born unless we all come together as global citizens and fight back against the unlawful rule of the private global banking cartel. Our countries are suffering because of their greed and ruthless control. The austerity measures that are being called for by the banks and the elite is bringing chaos onto the streets of Europe on a scale never before seen, and it won’t be long before America enters the stage. We are nearing the moment when the globalist conspirators behind the plans for a new world order will openly declare the end of America. When they do, we shall declare the end of them, and fight for the rebirth of America, and all of Mankind. Only an order based on the rule of law and freedom should be accepted. The conspiratorial elite intend to achieve a new world order through this period of engineered chaos not by law, but by brutal force because it is the only way to impose a criminal, bank-owned government on a global scale. Despite their rhetoric, these devilish traitors are not visionary thinkers because corrupt designs for a world state isn’t new in history. Their arrogance is a cover. They will fail hard. And America will be set free from bondage, along with other nations. “This is global government, a private corporate global government, taking over every major society with the same formula. It is fraudulent, and it must be resisted, or we have no future. We cannot allow this new dark age to begin,” says radio host Alex Jones in a YouTube video message entitled “It’s the Bankers or Us.” Watch his message, and spread it. There is a peaceful global revolution against the private global banking cartel, and it can’t be stopped. Join it and help everyone live free, or die a slave under the empire of debt.

DERIVATIVES : The Debt Bomb The derivatives market is the Las Vegas of the world's financial super elite, worth anywhere between 2 to 8 quadrillion dollars compared to about 70 trillion dollars of world GDP. We look at the so-called financial innovations of Wall Street from Collateralized Debt Obligations to Mortgage Backed Securities. We also look at US government's complicity; White House and Congress both vested interests not only as recipients of Wall Street largess in the form of campaign donations but as major players with criminal asymmetrical information and influence advantages. LINKS : U.S. Military Killing Its Own Troops! Global Debt Crisis Simply Explained

http://www.infowars.com/america-is-held-hostage-by-global-private-bankers/

- TRUMP, JONES, THE COMPLEX, AND

THE BANKERS - CLICK IMAGE

N A T I O N A L D E B T ! ! ! ! !

!

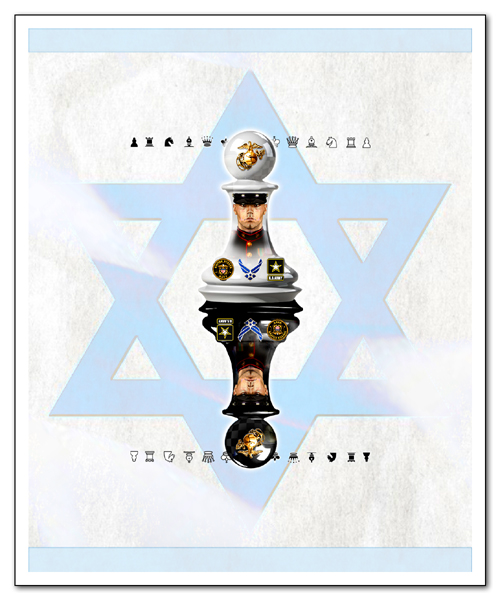

First published at 01:15 UTC on September 6th, 2019. It doesn't matter if you are a hard-working American. YOU are not

entitled to keep your own income. YOU are a cash cow for the Zionist state of Israel. America's labor force is

Israel's Golden Goose. And I am going

China and the New World Order corbettreport SHOW NOTES AND MP3: http://www.corbettreport.com/?p=12816 Military tensions, cyber espionage accusations, a brewing currency war; with every passing day, the headlines paint a convincing portrait of an emerging cold war between China and the West. But is this surface level reality the whole picture, or is there a deeper level to this conflict? Is China an opponent to the New World Order global governmental system or a witting collaborator with it? Join us in this in-depth edition of The Corbett Report podcast as we explore China's position in the New World Order. Whitney is joined by James Corbett of the Corbett Report to discuss the overlap between the oligarchs of China and the United States and how the rise of China is intimately tied to Wall Street and Globalism. Published on 09/28/21. SHOW NOTES

More Here: General Summary/Crash Course , Full Spectrum Dominance , Wall Street , TOTAL POPULATION CONTROL

Written By: Jon Rappoport September 1, 2017