|

When a government is dependent upon bankers for money, they and not the leaders of the government control the situation, since the hand that gives is above the hand that takes… Money has no motherland; financiers are without patriotism and without decency; their sole object is gain.” – Napoleon Bonaparte, Emperor of France, 1815 |

|

|

“The death of Lincoln was a disaster for Christendom. There was no man in the United States great enough to wear his boots and the bankers went anew to grab the riches. I fear that foreign bankers with their craftiness and tortuous tricks will entirely control the exuberant riches of America and use it to systematically corrupt civilization.” Otto von Bismark (1815-1898), German Chancellor, after the Lincoln assassination |

|

|

“Money plays the largest part in determining the course of history.” Karl Marx writing in the Communist Manifesto (1848). |

|

|

“That this House considers that the continued issue of all the means of exchange – be they coin, bank-notes or credit, largely passed on by cheques – by private firms as an interest-bearing debt against the public should cease forthwith; that the Sovereign power and duty of issuing money in all forms should be returned to the Crown, then to be put into circulation free of all debt and interest obligations…” Captain Henry Kerby MP, in an Early Day Motion tabled in 1964. |

|

|

“Banks lend by creating credit. They create the means of

payment out of nothing. ” Ralph M Hawtry, former Secretary to the Treasury. |

welcome

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The Federal Reserve | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

BLACKROCK / TECHNOCRACY - TAKEOVER OF THE WORLD

|

|

Why Americans must

say, Technocracy News & Trends | Premiered Jul 22, 2020 Nonstop propaganda

from national media continues to frighten people into mental paralysis and submission to health

authorities. This Technocrat-led tsunami can only be resisted by |

Blame The Fed: Crisis Ahead

RonPaulLibertyReport

Streamed live on May 4, 2018

America’s monetary system was hijacked in 1913. The U.S. Constitution wasn’t amended to bring

about The Federal Reserve….it was just ignored. We use unconstitutional money every day. This “system” is the

monetary system of Empire. It was constructed for that purpose. We’ll, anyone with even a passing knowledge of

history knows what happens to Empires.

There’s a crisis ahead, and you’d be correct to blame the Fed!

What is The Federal Reserve?

Infowars Nightly News reporter Dan Bidondi polls public knowledge in about the privately-owned Federal Reserve bank, comparing the informed position taken by 'End the Fed' protesters and that of the average person on the streets of San Antonio. What is it the critics understand that the general population has been kept in the dark about? Find out more in this special report about the importance of the Fed and how it holds a grasp over our economy.

Texans Resist The Private Federal Reserve

Texans Resist The Private Federal Reserve

Occupy Wall Street Protestor on Federal Reserve

This young man is brilliant.

It's A Wonderful Lie — 100 Years of the Federal Reserve

[YOUTUBE BANNED THIS VIDEO]

As we look back over the past hundred years, America has experienced the Great

Depression, multiple recessions, stagflation and the loss of 99% of the dollarʼs purchasing power - none of it

wouldʼve been possible without the Federal Reserve, creating bubbles and bursting them, enslaving us with debt

and destroying our purchasing power through inflation

Yes, itʼs been a wonderful lie — for the banksters and many Americans are left

like George Bailey. Facing the collapse of their dreams and financial ruin

There are striking parallels in Frank Capraʼs Itʼs a Wonderful Life to lies and tricks of the modern banker

elite.

Human nature doesnʼt change and the greedy elite of 1913 and 2013 look much like Potter

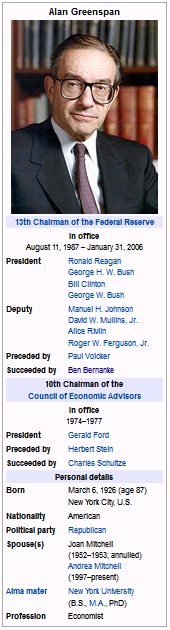

Greenspan Admits The Federal Reserve Is Above The Law & Answers To No One

**>> Greenspan implies the

Fed is above the law. <<**

He states this at 7:40

Truth in Media: 100 Years of the Federal Reserve

100 years ago, this December, the United States Congress created a central bank today, we

know it as the Federal Reserve Bank of the United States. What most people don't know is that the bank isn't a

federal entity and candidly, it really has nothing in reserves. Is the Federal Reserve good for the United

States? Is it even possible to get rid of it?

The first step toward truth is to be informed.

The Secret of OZ

The world economy is doomed to spiral downwards until we do 2 things: outlaw government borrowing; 2. outlaw fractional reserve lending. Banks should only be allowed to lend out money they actually have and nations do not have to run up a "National Debt". Remember: It's not what backs the money, it's who controls its quantity.

Support The Film Makers & Spread The Word : HQ Version

THE MONEY MASTERS

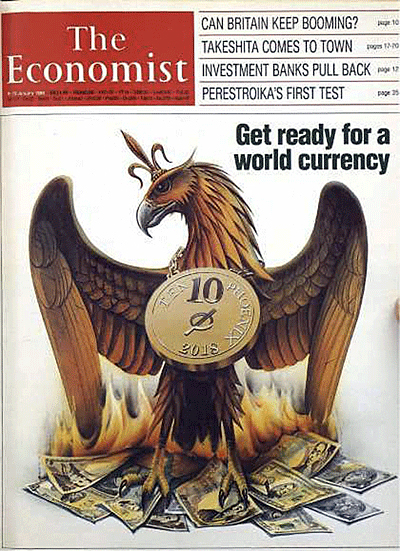

The powers of financial capitalism had a far-reaching plan, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole...Their secret is that they have annexed from governments, monarchies, and republics the power to create the world's money..." THE MONEY MASTERS is a 3 1/2 hour non-fiction, historical documentary that traces the origins of the political power structure that rules our nation and the world today. The modern political power structure has its roots in the hidden manipulation and accumulation of gold and other forms of money. The development of fractional reserve banking practices in the 17th century brought to a cunning sophistication the secret techniques initially used by goldsmiths fraudulently to accumulate wealth. With the formation of the privately-owned Bank of England in 1694, the yoke of economic slavery to a privately-owned "central" bank was first forced upon the backs of an entire nation, not removed but only made heavier with the passing of the three centuries to our day. Nation after nation, including America, has fallen prey to this cabal of international central bankers. Segments: The Problem; The Money Changers; Roman Empire; The Goldsmiths of Medieval England; Tally Sticks; The Bank of England; The Rise of the Rothschilds; The American Revolution; The Bank of North America; The Constitutional Convention; First Bank of the U.S.; Napoleon's Rise to Power; Death of the First Bank of the U.S. / War of 1812; Waterloo; Second Bank of the U.S.; Andrew Jackson; Fort Knox; World Central Bank

Support The Film Makers & Spread The Word : HQ Version

FIAT EMPIRE

Why the Federal Reserve Violates the U.S. Constitution

Some

feel the "Fed" is a "bunch of organized crooks" (as John Adams put it) and others feel some of its practices

"are in violation of the U.S. Constitution." Discover why experts agree the Fed is a banking cartel that

benefits mainly bankers and their clients in need of "easy money" and bailouts.

A James Jaeger Film featuring RON PAUL, Congressman/Presidential Candidate; G. EDWARD GRIFFIN, Author/Producer;

EDWIN VIEIRA, Author/Constitutional Attorney and TED BAEHR, Founder of MovieGuide and Christian Film & TV

Commission.

The Fed also benefits a Congress that would rather go deeper in debt than seek funding from its constituents.

Long-term studies indicate the Federal Reserve System encourages war, destabilizes the economy (by causing boom and

bust cycles), generates inflation (a hidden tax) and is the supreme instrument of unjust enrichment for a select

group of insiders. If you are fed up with an ever-expanding state and corporations that are "too-big-to-fail," look

no farther than the fiat currency printed by the Federal Reserve System.

Get this, and other James Jaeger films, on higher quality DVD at www.MoviePubs.Net/dvds. Donations and DVD sales

are what make these films possible. If you can't afford a DVD, please at least refer this movie and its URLs to

your list of family, friends and associates.

Support The Film Makers & Spread The Word : HQ Version

http://www.fiatempire.org/single.htm

Peter Schiff - The Fed Unspun: The Other Side of the Story

"Ben Bernake fancies himself as a

student of the Great Depression," says renowned investment broker, global strategist, author, and Austrian

economist Peter Schiff, "but... if he were my student he would have gotten an F."

During a lecture entitled "The Fed Unspun: The Other Side of the Story", Schiff responded to Bernake's recent

four-part college lecture series, rebutting many of the Federal Reserve Chairman's claims about the cause of the

housing crisis, the role of the Federal Reserve, the value of the gold standard, and more.

Cosponsored by the FreedomWorks Foundation and hosted at Reason Foundation's DC office on March 29, 2012, the

lecture was followed by a lively Q&A with the assembled audience, including students who attended

Bernanke's George Washington University lectures.

Shot by Meredith Bragg and Jim Epstein. Edited by Swain. Additional help from Anthony Fisher.

Approximately 1 hour and 26 minutes long.

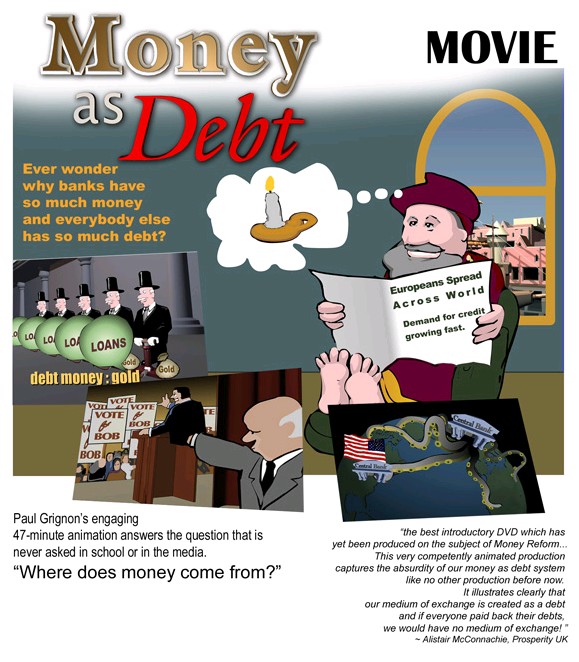

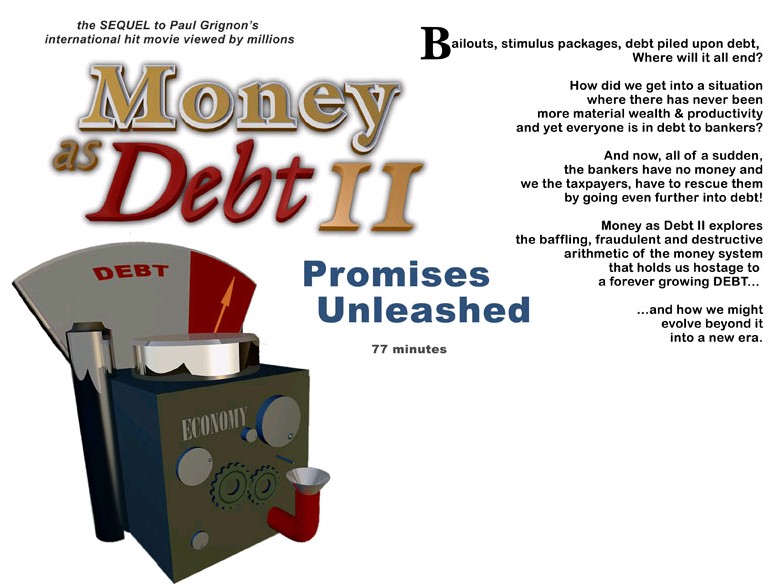

- MONEY IS NOT A COMMODITY, IT IS A CONTRACT -

EASY TO

UNDERSTAND

ANIMATED

SERIES

[PRESS PLAY AND PLEASE GIVE IT TIME TO LOAD]

[PRESS PLAY AND PLEASE GIVE IT TIME TO LOAD]

[PRESS PLAY AND PLEASE GIVE IT TIME TO LOAD]

Support The Film Makers & Spread The Word: HQ Version

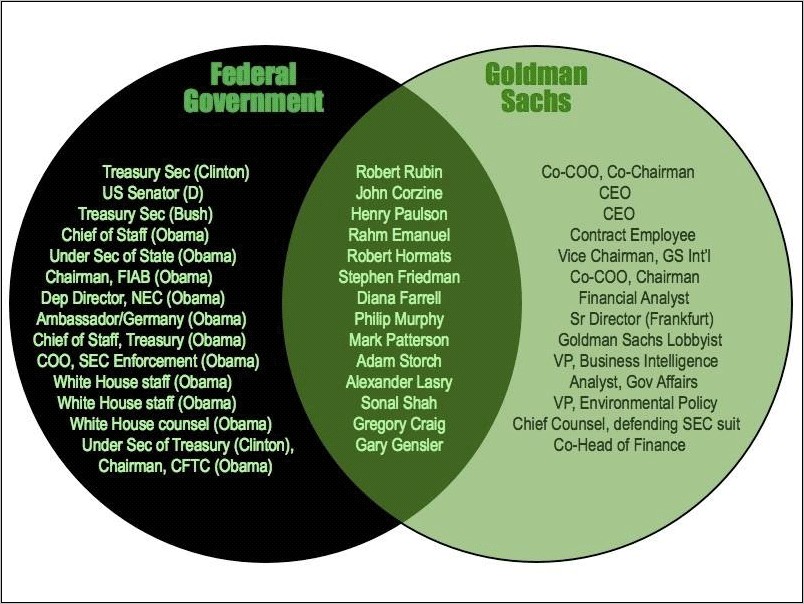

Meet Goldman Sachs, the Vampire Squid

corbettreport

Published on Mar 17, 2017

SHOW NOTES AND MP3 AUDIO: https://www.corbettreport.com/?p=21730

We all know Goldman Sachs is the very embodiment of evil...or do we? What is Goldman Sachs? What does it do? Where did it come from and where is it going, and is there anything that can be done to stop it? Buckle in for this edition of The Corbett Report where James dares to take on the vampire squid itself.

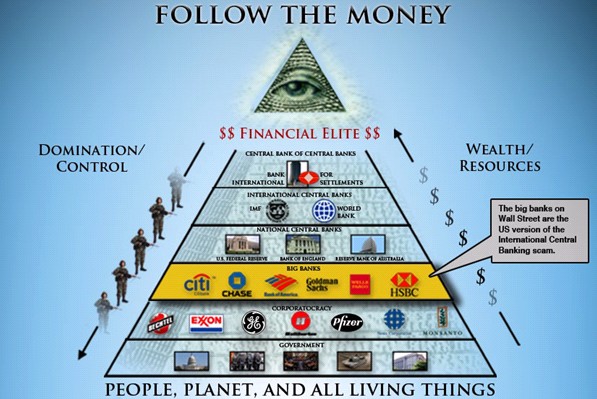

“In the real executive power

structure, the president serves the military industrial complex, itself owned by the international

bankers...”

-- Alex Jones...before he soldout --

|

How Trump Filled The Swamp corbettreport With promises to "drain the swamp!" still ringing in our ears, we have watched Trump appoint nothing but Goldman banksters, Soros stooges, neocon war hawks and police state zealots to head his cabinet. Join us this week on The Corbett Report as we examine the swamp-dwellers with which Trump has filled his swamp. Phoenix as the Model for Homeland Security and the War On Terror - Douglas Valentine - CIA Pacification Programs, Secret Interrogation Centers, Counter Terror Teams, Propaganda Teams and military and civilian tribunals in all 44 provinces of South Vietnam; 1965 US military sent in; National Liberation Front; secret 1967 CIA General Staff For Pacification combining all CIA, military, and South Vietnamese programs to became The Phoenix Program; Phoenix based on systems analysis theory combining 20-30 programs to pacify South Vietnamese civilians to support the government; Phoenix instituted to more perfectly coordinate CIA and military operations; streamlined and bureaucratized a system of political repression in South Vietnam; media cover-up; CIA Foreign Intelligence including the Hamlet Information Program, the Province Interrogation Center program and Agent Penetrations; CIA Covert Action Program; reliance on corruption; Pacific Architects and Engineers oversaw design and construction of interrogation centers in South Vietnam which became the model for the black sites. Originally Aired: January 11, 2017 |

Trump Fills the Swamp With Steven Mnuchin

Trump has named Steven Mnuchin as his Treasury Secretary. So who is Mnuchin, and

what does his background tell us about his ideology and what kind of administration Trump is

assembling? Today we talk to Michael Krieger of LibertyBlitzkrieg.com about Mnuchin's career, his

Goldman Sachs and Soros ties, and his shady business practices, as well as the other people being

appointed to helm the Trump White House.

RT With his first year in office drawing to a close, the US president has been talking up his economic record in typical Trump style. But one man who does not share Trump's optimism is former congressman Ron Paul. He told RT the growth is not even for all people.

|

The Fed Is Safe Under Trump RonPaulLibertyReport President Trump is great at stirring up controversies and throwing red meat to the media. He's great at keeping the left in a permanent state of hyperventilation. He's great at rallying his supporters. But when it comes to actual policies, the status quo has been maintained across the board. The warfare is safe. The welfare is safe. Even the Federal Reserve is safe under Trump. Links: The Fed , BANKS RULE THE WORLD , Economy Destroyed By Design!

Trump Admin Raising Phoenix Program From the Ashes corbettreport SHOW NOTES AND MP3: As The Corbett Report reported last year, Erik Prince, the founder of Blackwater, has slithered out from his hiding place and re-emerged as a figure on the political stage. He is now advocating for a rebirth of the US' infamous "Phoenix Program" to target the ISIS terrorists the US created, and he is advising Trump from the shadows. Today Douglas Valentine, author of The Phoenix Program and The CIA As Organized Crime joins us to discuss what The Phoenix Program is and why its resurrection is so ominous. |

|

The Incredible Trump Deception We examine some of the early political appointments of the new Trump administration and the geopolitical shift in American foreign policy that it represents. The powers behind the Trump presidency - the Netanyahu Likud connected think-tank, The Foundation for the Defense of Democracies, including General Mike Flynn, Walid Phares; James Woolsey, and Michael Ledeen, among others; an attack on the nuclear deal with Iran; the failed strategy of using radical political Islam to destabilize and destroy countries; a strengthened alliance between Russia, China and Iran; the failed CIA coup in Turkey of July 2016; a strong dollar policy and a weakened European Union; rising interest rates and concomitant flight capital to a Wall Street safe-haven; making America great again by re-building Americas defense industry infrastructure. #356 |

||

- TRUMP, JONES, THE COMPLEX, AND

THE BANKERS -

CLICK IMAGE

Wake Up: Trump is a Compromised Puppet of Private Interests

[PLEASE WATCH THE VIDEO BELOW]

Banksta's Paradise feat. Donald Trump [A MUST

SEE]

Know More News with Adam Green

Patreon - https://www.patreon.com/AdamGreen

Paypal Donations/Tips - https://www.paypal.me/KnowMoreNews

Twitter - https://twitter.com/Know_More_News

Facebook - https://www.facebook.com/KnowMoreNews

SUBSCRIBE ON BITCHUTE!!!

https://www.bitchute.com/channel/know...

This is an excerpt from my documentary "The Chosen Ones" COMING

SOON!

Please help support my efforts :)

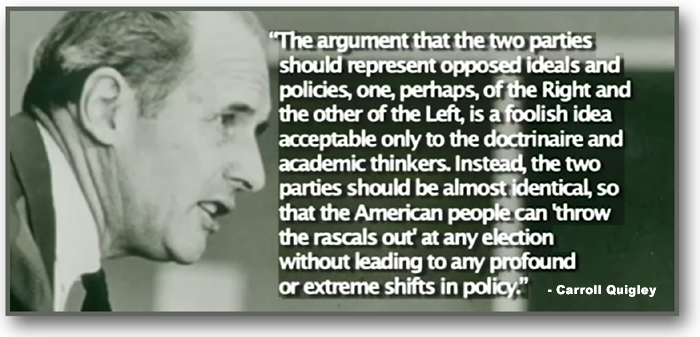

More Here: SYRIA , FALSE LEFT/RIGHT PARADIGM

N A T I O N A L D E B T ! ! ! ! !

!

How Zionist Israel is Robbing America

Blind!

|

|

First published at 01:15 UTC on September 6th, 2019.

It doesn't matter if you are a hard-working American. YOU are not

entitled to keep your own income. YOU are a cash cow for the Zionist state of Israel. America's labor force is

Israel's Golden Goose. And I am going

to show you the financial statistics to prove it.

LINKS:

SUBVERSION | I.R.S. | The Federal Reserve | BANKS RULE THE WORLD | FALSE

LEFT/RIGHT PARADIGM |

The Govt is Raping You | Free

Speech | MILITARY INDUSTRIAL

COMPLEX | SYRIA | YEMEN | Pawns On The Chessboard

10 Things That Every American Should Know About The Federal Reserve

The

Economic Collapse

Thursday, February 9, 2012

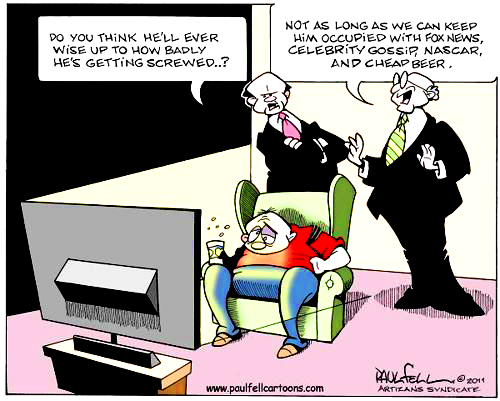

What would happen if the Federal Reserve was shut down permanently? That is a question that CNBC asked recently, but unfortunately most Americans don’t really think about the Fed much. Most Americans are content with believing that the Federal Reserve is just another stuffy government agency that sets our interest rates and that is watching out for the best interests of the American people.

But that is not the case at all. The truth is that the Federal Reserve is a private banking cartel that has been designed to systematically destroy the value of our currency, drain the wealth of the American public and enslave the federal government to perpetually expanding debt. During this election year, the economy is the number one issue that voters are concerned about. But instead of endlessly blaming both political parties, the truth is that most of the blame should be placed at the feet of the Federal Reserve. The Federal Reserve has more power over the performance of the U.S. economy than anyone else does. The Federal Reserve controls the money supply, the Federal Reserve sets the interest rates and the Federal Reserve hands out bailouts to the big banks that absolutely dwarf anything that Congress ever did. If the American people are ever going to learn what is really going on with our economy, then it is absolutely imperative that they get educated about the Federal Reserve.

The following are 10 things that every American should know about the Federal Reserve….

#1 The Federal Reserve System Is A Privately Owned Banking Cartel

The Federal Reserve is not a government agency. The truth is that it is a privately owned central bank. It is owned by the banks that are members of the Federal Reserve system. We do not know how much of the system each bank owns, because that has never been disclosed to the American people.

The Federal Reserve openly admits that it is privately owned. When it was defending itself against a Bloomberg request for information under the Freedom of Information Act, the Federal Reserve stated unequivocally in court that it was“not an agency” of the federal government and therefore not subject to the Freedom of Information Act.

In fact, if you want to find out that the Federal Reserve system is owned by the member banks, all you have to do is go to the Federal Reserve website….

The twelve regional Federal Reserve Banks, which were established by Congress as the operating arms of the nation’s central banking system, are organized much like private corporations–possibly leading to some confusion about “ownership.” For example, the Reserve Banks issue shares of stock to member banks. However, owning Reserve Bank stock is quite different from owning stock in a private company. The Reserve Banks are not operated for profit, and ownership of a certain amount of stock is, by law, a condition of membership in the System. The stock may not be sold, traded, or pledged as security for a loan; dividends are, by law, 6 percent per year.

Foreign governments and foreign banks do own significant ownership interests in the member banks that own the Federal Reserve system. So it would be accurate to say that the Federal Reserve is partially foreign-owned.

But until the exact ownership shares of the Federal Reserve are revealed, we will never know to what extent the Fed is foreign-owned.

#2 The Federal Reserve System Is A Perpetual Debt Machine

As long as the Federal Reserve System exists, U.S. government debt will continue to go up and up and up.

This runs contrary to the conventional wisdom that Democrats and Republicans would have us believe, but unfortunately it is true.

The way our system works, whenever more money is created more debt is created as well.

For example, whenever the U.S. government wants to spend more money than it takes in (which happens constantly), it has to go ask the Federal Reserve for it. The federal government gives U.S. Treasury bonds to the Federal Reserve, and the Federal Reserve gives the U.S. government “Federal Reserve Notes” in return. Usually this is just done electronically.

So where does the Federal Reserve get the Federal Reserve Notes?

It just creates them out of thin air.

Wouldn’t you like to be able to create money out of thin air?

Instead of issuing money directly, the U.S. government lets the Federal Reserve create it out of thin air and then the U.S. government borrows it.

Talk about stupid.

When this new debt is created, the amount of interest that the U.S. government will eventually pay on that debt is not also created.

So where will that money come from?

Well, eventually the U.S. government will have to go back to the Federal Reserve to get even more money to finance the ever expanding debt that it has gotten itself trapped into.

It is a debt spiral that is designed to go on perpetually.

You see, the reality is that the money supply is designed to constantly expand under the Federal Reserve system. That is why we have all become accustomed to thinking of inflation as “normal”.

So what does the Federal Reserve do with the U.S. Treasury bonds that it gets from the U.S. government?

Well, it sells them off to others. There are lots of people out there that have made a ton of money by holding U.S. government debt.

In fiscal 2011, the U.S. government paid out 454 billion dollars just in interest on the national debt.

That is 454 billion dollars that was taken out of our pockets and put into the pockets of wealthy individuals and foreign governments around the globe.

The truth is that our current debt-based monetary system was designed by greedy bankers that wanted to make enormous profits by using the Federal Reserve as a tool to create money out of thin air and lend it to the U.S. government at interest.

And that plan is working quite well.

Most Americans today don’t understand how any of this works, but many prominent Americans in the past did understand it.

For example, Thomas Edison was once quoted in the New York Times as saying the following….

That is to say, under the old way any time we wish to add to the national wealth we are compelled to add to the national debt.

Now, that is what Henry Ford wants to prevent. He thinks it is stupid, and so do I, that for the loan of $30,000,000 of their own money the people of the United States should be compelled to pay $66,000,000 — that is what it amounts to, with interest. People who will not turn a shovelful of dirt nor contribute a pound of material will collect more money from the United States than will the people who supply the material and do the work. That is the terrible thing about interest. In all our great bond issues the interest is always greater than the principal. All of the great public works cost more than twice the actual cost, on that account. Under the present system of doing business we simply add 120 to 150 per cent, to the stated cost.

But here is the point: If our nation can issue a dollar bond, it can issue a dollar bill. The element that makes the bond good makes the bill good.

We should have listened to men like Edison and Ford.

But we didn’t.

And so we pay the price.

On July 1, 1914 (a few months after the Fed was created) the U.S. national debt was 2.9 billion dollars.

Today, it is more than more than 5000 times larger.

Yes, the perpetual debt machine is working quite well, and most Americans do not even realize what is happening.

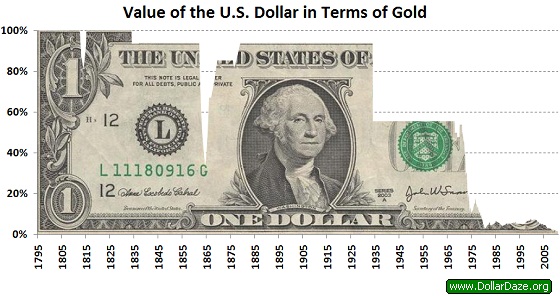

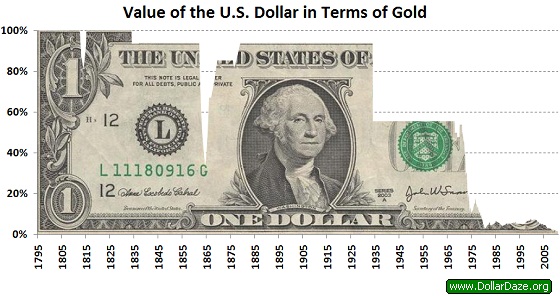

#3 The Federal Reserve Has Destroyed More Than 96% Of The Value Of The U.S. Dollar

Did you know that the U.S. dollar has lost 96.2 percent of its value since 1900? Of course almost all of that decline has happened since the Federal Reserve was created in 1913.

Because the money supply is designed to expand constantly, it is guaranteed that all of our dollars will constantly lose value.

Inflation is a “hidden tax” that continually robs us all of our wealth. The Federal Reserve always says that it is “committed” to controlling inflation, but that never seems to work out so well.

And current Federal Reserve Chairman Ben Bernanke says that it is actually a good thing to have a little bit of inflation. He plans to try to keep the inflation rate at about 2 percent in the coming years.

So what is so bad about 2 percent? That doesn’t sound so bad, does it?

Well, just consider the following excerpt from a recent Forbes article….

The Federal Reserve Open Market Committee (FOMC) has made it official: After its latest two day meeting, it announced its goal to devalue the dollar by 33% over the next 20 years. The debauch of the dollar will be even greater if the Fed exceeds its goal of a 2 percent per year increase in the price level.

#4 The Federal Reserve Can Bail Out Whoever It Wants To With No Accountability

The American people got so upset about the bailouts that Congress gave to the Wall Street banks and to the big automakers, but did you know that the biggest bailouts of all were given out by the Federal Reserve?

Thanks to a very limited audit of the Federal Reserve that Congress approved a while back, we learned that the Fed made trillions of dollars in secret bailout loans to the big Wall Street banks during the last financial crisis. They even secretly loaned out hundreds of billions of dollars to foreign banks.

According to the results of the limited Fed audit mentioned above, a total of$16.1 trillion in secret loans were made by the Federal Reserve between December 1, 2007 and July 21, 2010.

The following is a list of loan recipients that was taken directly from page 131of the audit report….

Citigroup - $2.513 trillion

Morgan Stanley - $2.041 trillion

Merrill Lynch - $1.949 trillion

Bank of America - $1.344 trillion

Barclays PLC - $868 billion

Bear Sterns - $853 billion

Goldman Sachs - $814 billion

Royal Bank of Scotland - $541 billion

JP Morgan Chase - $391 billion

Deutsche Bank - $354 billion

UBS - $287 billion

Credit Suisse - $262 billion

Lehman Brothers - $183 billion

Bank of Scotland - $181 billion

BNP Paribas - $175 billion

Wells Fargo - $159 billion

Dexia - $159 billion

Wachovia - $142 billion

Dresdner Bank - $135 billion

Societe Generale - $124 billion

“All Other Borrowers” - $2.639 trillion

So why haven’t we heard more about this?

This is scandalous.

In addition, it turns out that the Fed paid enormous sums of money to the big Wall Street banks to help “administer” these nearly interest-free loans….

Not only did the Federal Reserve give 16.1 trillion dollars in nearly interest-free loans to the “too big to fail” banks, the Fed also paid them over 600 million dollars to help run the emergency lending program. According to the GAO, the Federal Reserve shelled out an astounding $659.4 million in “fees” to the very financial institutions which caused the financial crisis in the first place.

Does reading that make you angry?

It should.

#5 The Federal Reserve Is Paying Banks Not To Lend Money

Did you know that the Federal Reserve is actually paying banks not to make loans?

It is true.

Section 128 of the Emergency Economic Stabilization Act of 2008 allows the Federal Reserve to pay interest on “excess reserves” that U.S. banks park at the Fed.

So the banks can just send their cash to the Fed and watch the money come rolling in risk-free.

So are many banks taking advantage of this?

You tell me. Just check out the chart below. The amount of “excess reserves” parked at the Fed has gone from nearly nothing to about 1.5 trillion dollarssince 2008….

But shouldn’t the banks be lending the money to us so that we can start businesses and buy homes?

You would think that is how it is supposed to work.

Unfortunately, the Federal Reserve is not working for us.

The Federal Reserve is working for the big banks.

Sadly, most Americans have no idea what is going on.

Another example of this is the government debt carry trade.

Here is how it works. The Federal Reserve lends gigantic piles of nearly interest-free cash to the big Wall Street banks, and in turn those banks use the money to buy up huge amounts of government debt. Since the return on government debt is higher, the banks are able to make large profits very easily and with very little risk.

This scam was also explained in a recent article in the Guardian….

Consider this: we pretend that banks are private businesses that should be allowed to run their own affairs. But they are the biggest scroungers of public money of our time. Banks are lent vast sums of money by central banks at near-zero interest. They lend that money to us or back to the government at higher rates and rake in the difference by the billion. They don’t even have to make clever investments to make huge profits.

That is a pretty good little scam they have got going, wouldn’t you say?

#6 The Federal Reserve Creates Artificial Economic Bubbles That Are Extremely Damaging

By allowing a centralized authority such as the Federal Reserve to dictate interest rates, it creates an environment where financial bubbles can be created very easily.

Over the past several decades, we have seen bubble after bubble. Most of these have been the result of the Federal Reserve keeping interest rates artificially low. If the free market had been setting interest rates all this time, things would have never gotten so far out of hand.

For example, the housing crash would have never been so horrific if the Federal Reserve had not created such ideal conditions for a housing bubble in the first place. But we allow the Fed to continue to make the same mistakes.

Right now, the Federal Reserve continues to set interest rates much, much lower than they should be. This is causing a tremendous misallocation of economic resources, and there will be massive consequences for that down the line.

#7 The Federal Reserve System Is Dominated By The Big Wall Street Banks

Even since it was created, the Federal Reserve system has been dominated by the big Wall Street banks.

The following is from a previous article that I did about the Fed….

The New York representative is the only permanent member of the Federal Open Market Committee, while other regional banks rotate in 2 and 3 year intervals. The former head of the New York Fed, Timothy Geithner, is now U.S. Treasury Secretary. The truth is that the Federal Reserve Bank of New York has always been the most important of the regional Fed banks by far, and in turn the Federal Reserve Bank of New York has always been dominated by Wall Street and the major New York banks.

#8 It Is Not An Accident That We Saw The Personal Income Tax And The Federal Reserve System Both Come Into Existence In 1913

On February 3rd, 1913 the 16th Amendment to the U.S. Constitution was ratified. Later that year, the United States Revenue Act of 1913 imposed a personal income tax on the American people and we have had one ever since.

Without a personal income tax, it is hard to have a central bank. It takes a lot of money to finance all of the government debt that a central banking system creates.

It is no accident that the 16th Amendment was ratified in 1913 and the Federal Reserve system was also created in 1913.

They have a symbiotic relationship and they are designed to work together.

We could fill Congress with people that are committed to ending this oppressive system, but so far we have chosen not to do that.

So our children and our grandchildren will face a lifetime of debt slavery because of us.

I am sure they will be thankful for that.

#9 The Current Federal Reserve Chairman, Ben Bernanke, Has A Nightmarish Track Record Of Incompetence

The mainstream media portrays Federal Reserve Chairman Ben Bernanke as a brilliant economist, but is that really the case?

Let’s go to the videotape.

The following is an extended excerpt from an article that I published previously….

———-

In 2005, Bernanke said that we shouldn’t worry because housing prices had never declined on a nationwide basis before and he said that he believed that the U.S. would continue to experience close to “full employment”….

“We’ve never had a decline in house prices on a nationwide basis. So, what I think what is more likely is that house prices will slow, maybe stabilize, might slow consumption spending a bit. I don’t think it’s gonna drive the economy too far from its full employment path, though.”

In 2005, Bernanke also said that he believed that derivatives were perfectly safe and posed no danger to financial markets….

“With respect to their safety, derivatives, for the most part, are traded among very sophisticated financial institutions and individuals who have considerable incentive to understand them and to use them properly.”

In 2006, Bernanke said that housing prices would probably keep rising….

“Housing markets are cooling a bit. Our expectation is that the decline in activity or the slowing in activity will be moderate, that house prices will probably continue to rise.”

In 2007, Bernanke insisted that there was not a problem with subprime mortgages….

“At this juncture, however, the impact on the broader economy and financial markets of the problems in the subprime market seems likely to be contained. In particular, mortgages to prime borrowers and fixed-rate mortgages to all classes of borrowers continue to perform well, with low rates of delinquency.”

In 2008, Bernanke said that a recession was not coming….

“The Federal Reserve is not currently forecasting a recession.”

A few months before Fannie Mae and Freddie Mac collapsed, Bernanke insisted that they were totally secure….

“The GSEs are adequately capitalized. They are in no danger of failing.”

For many more examples that demonstrate the absolutely nightmarish track record of Federal Reserve Chairman Ben Bernanke, please see the following articles….

*” Say What? 30 Ben Bernanke Quotes That Are So Stupid That You Won’t Know Whether To Laugh Or Cry”

*” Is Ben Bernanke A Liar, A Lunatic Or Is He Just Completely And Totally Incompetent?”

But after being wrong over and over and over, Barack Obama still nominated Ben Bernanke for another term as Chairman of the Fed.

———-

#10 The Federal Reserve Has Become Way Too Powerful

The Federal Reserve is the most undemocratic institution in America.

The Federal Reserve has become so powerful that it is now known as “the fourth branch of government”, but there are less checks and balances on the Fed than there are on the other three branches.

The Federal Reserve runs the U.S. economy but it is not accountable to the American people. We can’t vote those that run the Fed out of office if we do not like what they do.

Yes, the president appoints those that run the Fed, but he also knows that if he does not tread lightly he won’t get the money from the big Wall Street banks that he needs for his next election.

Thankfully, there are a few members of Congress that are complaining about how much power the Fed has. For example, Ron Paul once told MSNBC that he believes that the Federal Reserve is now actually more powerful than Congress…..

“The regulations should be on the Federal Reserve. We should have transparency of the Federal Reserve. They can create trillions of dollars to bail out their friends, and we don’t even have any transparency of this. They’re more powerful than the Congress.”

As members of Congress such as Ron Paul have started to shed some light on the activities of the Federal Reserve, that has caused many in the mainstream media to come to the defense of the Fed.

For example, a recent CNBC article entitled “If The Federal Reserve Is Abolished, What Then?” makes it sound like there is absolutely no other rational alternative to having the Federal Reserve run our economy.

But this is not what our founders intended.

The founders did not intend for a private banking cartel to issue our money and set our interest rates for us.

According to Article I, Section 8 of the U.S. Constitution, the U.S. Congress has been given the responsibility to “coin Money, regulate the Value thereof, and of foreign Coin, and fix the Standard of Weights and Measures”.

So why is the Federal Reserve doing it?

But the CNBC article mentioned above makes it sound like the sky would fall if control of the currency was handed back over to the American people.

At one point, the article asks the following question….

“How would the U.S. economy then function? Something has to take its place, right?”

No, the truth is that we don’t need anyone to “manage” our economy.

The U.S. Treasury could be in charge of issuing our currency and the free market could set our interest rates.

We don’t need to have a centrally-planned economy.

We aren’t China.

And it goes against everything that our founders believed to be running up so much government debt.

For example, Thomas Jefferson once declared that if he could add just one more amendment to the U.S. Constitution it would be a ban on all government borrowing….

I wish it were possible to obtain a single amendment to our Constitution. I would be willing to depend on that alone for the reduction of the administration of our government to the genuine principles of its Constitution; I mean an additional article, taking from the federal government the power of borrowing.

Oh, how things would have been different if we had only listened to Thomas Jefferson.

Please share this article with as many people as you can. These are things that every American should know about the Federal Reserve, and we need to educate the American people about the Fed while there is still time.

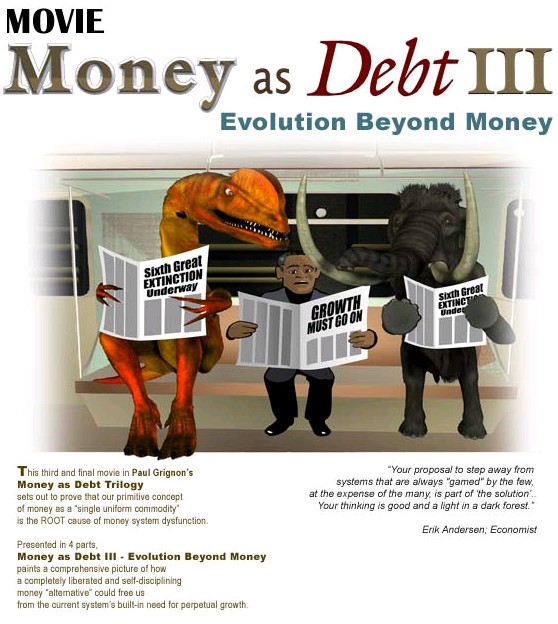

The International Banking Cartel (I)

A look at the International Banking Cartel led by the

Bank for International Settlement (in Basel, Switzerland) known as the bank of central banks (58 central banks) and

The US Federal reserve System. Also a look at banking tycoons: from the Rothschild family in Europe to JP Morgan

and others in the US. How banks not only control governments but also appoint politicians through huge campaign

donations. Governments at the service of the major banks, the best example: the Obama administration and the

history's biggest bail out of the same institutions that caused the Great Recession.

Watch this video on our Website: http://www.presstv.ir/Program/272398....

Follow our Facebook on: https://www.facebook.com/presstvchannel

Follow our Twitter on: http://twitter.com/presstv

Follow our Tumblr on: http://presstvchannel.tumblr.com

The International Banking Cartel (II)

A look at the International Banking Cartel led by the

Bank for International Settlement (in Basel, Switzerland) known as the bank of central banks (58 central banks) and

The US Federal reserve System. Also a look at banking tycoons: from the Rothschild family in Europe to JP Morgan

and others in the US. How banks not only control governments but also appoint politicians through huge campaign

donations. Governments at the service of the major banks, the best example: the Obama administration and the

history's biggest bail out of the same institutions that caused the Great Recession.

Watch this video on our Website: http://www.presstv.ir/Program/273928....

Follow our Facebook on: https://www.facebook.com/presstvchannel

Follow our Twitter on: http://twitter.com/presstv

Follow our Tumblr on: http://presstvchannel.tumblr.com

The International Banking Cartel (III)

A look at the International Banking Cartel led by the

Bank for International Settlement (in Basel, Switzerland) known as the bank of central banks (58 central banks) and

The US Federal reserve System. Also a look at banking tycoons: from the Rothschild family in Europe to JP Morgan

and others in the US. How banks not only control governments but also appoint politicians through huge campaign

donations. Governments at the service of the major banks, the best example: the Obama administration and the

history's biggest bail out of the same institutions that caused the Great Recession.

Watch this video on our Website: http://www.presstv.ir/Program/275189....

Follow our Facebook on: https://www.facebook.com/presstvchannel

Follow our Twitter on: http://twitter.com/presstv

Follow our Tumblr on: http://presstvchannel.tumblr.com

The shocking connections between our government and banking and investment giant Goldman Sachs.

http://www.infowars.com/goldman-sachs-investing-in-political-influence/

TIMELESS QUOTES

QUOTES TAKEN FROM : http://www.themoneymasters.com/

http://www.themoneymasters.com/the-money-masters/famous-quotations-on-banking/

PRESIDENTS

|

If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks…will deprive the people of all property until their children wake-up homeless on the continent their fathers conquered…. The issuing power should be taken from the banks and restored to the people, to whom it properly belongs. – Thomas Jefferson in the debate over the Re-charter of the Bank Bill (1809) “I believe that banking institutions are more dangerous to our liberties than standing armies.” – Thomas Jefferson … The modern theory of the perpetuation of debt has drenched the earth with blood, and crushed its inhabitants under burdens ever accumulating. -Thomas Jefferson |

|

|

|

History records that the money changers have used every form of abuse, intrigue, deceit, and violent means possible to maintain their control over governments by controlling money and its issuance. -James Madison |

|

|

If congress has the right under the Constitution to issue paper money, it was given them to use themselves, not to be delegated to individuals or corporations. -Andrew Jackson |

|

|

The Government should create, issue, and circulate all the currency and credits needed to satisfy the spending power of the Government and the buying power of consumers. By the adoption of these principles, the taxpayers will be saved immense sums of interest. Money will cease to be master and become the servant of humanity. -Abraham Lincoln |

|

|

Issue of currency should be lodged with the government and be protected from domination by Wall Street. We are opposed to…provisions [which] would place our currency and credit system in private hands. – Theodore Roosevelt |

|

Despite these warnings, Woodrow Wilson signed the 1913 Federal Reserve Act. A few years later he wrote: I am a most unhappy man. I have unwittingly ruined my country. A great industrial nation is controlled by its system of credit. Our system of credit is concentrated. The growth of the nation, therefore, and all our activities are in the hands of a few men. We have come to be one of the worst ruled, one of the most completely controlled and dominated Governments in the civilized world no longer a Government by free opinion, no longer a Government by conviction and the vote of the majority, but a Government by the opinion and duress of a small group of dominant men. -Woodrow Wilson

|

|

Years later, reflecting on the major banks’ control in Washington, President Franklin Roosevelt paid this indirect praise to his distant predecessor President Andrew Jackson, who had “killed” the 2nd Bank of the US (an earlier type of the Federal Reserve System). After Jackson’s administration the bankers’ influence was gradually restored and increased, culminating in the passage of the Federal Reserve Act of 1913. Roosevelt knew this history. The real truth of the matter is,as you and I know, that a

financial |

POLITICIANS

BANKERS

|

|

“The bank hath benefit of interest on all moneys which it creates out of nothing.” William Paterson, founder of the Bank of England in 1694, then a privately owned bank |

|

“Let me issue and control a nation’s money and I care not who writes the laws.” Mayer Amschel Rothschild (1744-1812), founder of the House of Rothschild. “The few who understand the system will either be so interested in its profits or be so dependent upon its favours that there will be no opposition from that class, while on the other hand, the great body of people, mentally incapable of comprehending the tremendous advantage that capital derives from the system, will bear its burdens without complaint, and perhaps without even suspecting that the system is inimical to their interests.” The Rothschild brothers of London writing to associates in New York, 1863. |

|

|

“I am afraid the ordinary citizen will not like to be told that the banks can and do create money. And they who control the credit of the nation direct the policy of Governments and hold in the hollow of their hand the destiny of the people.” Reginald McKenna, as Chairman of the Midland Bank, addressing stockholders in 1924. “The banks do create money. They have been doing it for a long time, but they didn’t realise it, and they did not admit it. Very few did. You will find it in all sorts of documents, financial textbooks, etc. But in the intervening years, and we must be perfectly frank about these things, there has been a development of thought, until today I doubt very much whether you would get many prominent bankers to attempt to deny that banks create it.” H W White, Chairman of the Associated Banks of New Zealand, to the New Zealand Monetary Commission, 1955. |

OTHERS

|

|

“Money is a new form of slavery, and distinguishable from the old simply by the fact that it is impersonal – that there is no human relation between master and slave.” Leo Tolstoy, Russian writer. |

|

“It is well enough that people of the nation do not understand our banking and money system, for if they did, I believe there would be a revolution before tomorrow morning.” Henry Ford, founder of the Ford Motor Company. |

|

|

“The modern banking system manufactures money out of nothing. The process is, perhaps, the most astounding piece of sleight of hand that was ever invented. Banks can in fact inflate, mint and un-mint the modern ledger-entry currency.” Major L L B Angus.

|

|

|

“The study of money, above all other fields in economics, is one in which complexity is used to disguise truth or to evade truth, not to reveal it. The process by which banks create money is so simple the mind is repelled. With something so important, a deeper mystery seems only decent.” John Kenneth Galbraith (1908- ), former professor of economics at Harvard, writing in ‘Money: Whence it came, where it went’ (1975). |

|

|

As Nicolas Trist – secretary to President Andrew Jackson – said about the incredibly

powerful privately owned Second Bank of the United States, “Independently of its misdeeds,

the mere power, — the bare existence of such a power, — is a thing irreconcilable

with the nature and spirit of our institutions.” (Schlesinger, The Age of Jackson,

p.102)

|

|

"By a continuing process of inflation, governments can confiscate, secretly and

unobserved, an important part of the wealth of their citizens. There is no subtler, no surer means of

overturning the existing basis of society than to debauch the currency. The process engages all the

hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a

million is able to diagnose."

-- Fabian socialist John Maynard Keynes

--

Nazi Counterfeiters and the Fed

Economic law applies regardless of political circumstances

Tim Kelly

Infowars.com

December 15, 2013

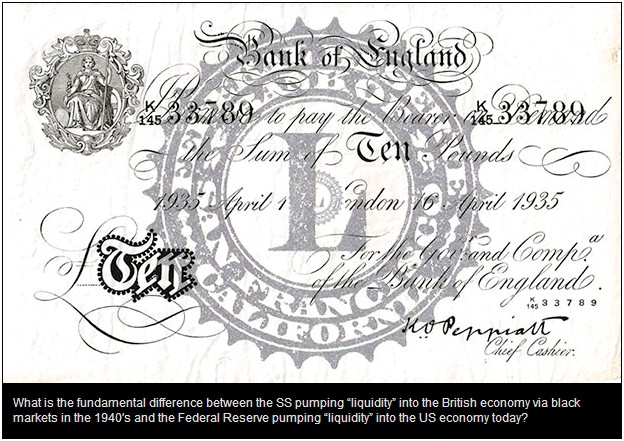

During the Second World War, Germany devised a secret plan to undermine the British economy by flooding the country with counterfeit Bank of England notes.

Codenamed Operation Bernhard, in recognition of its mastermind, SS Major Bernhard Krüger, the plan involved a team of 142 counterfeiters, drawn primarily from the inmate populations at Sachsenhausan and Auschwitz concentration camps. Beginning in 1942, the dragooned engravers and artists worked feverishly, forging huge quantities of £5, £10, £20, and £50 notes. By the time of Germany’s surrender in May of 1945, the operation had produced 8,965,080 banknotes worth a total value of £134,610,810, an amount exceeding all the reserves in the Bank of England’s vaults.

The original plan called for the dropping of the forged notes from aircraft flying over Great Britain in the expectation that they would be picked up and eagerly circulated but that part of the scheme was never put into effect. By 1943, the Luftwaffe lacked the capacity to deliver the “economic weapon” in sufficient quantities and the operation was taken over by SS foreign intelligence agents who laundered the counterfeit currency, using it to finance their own espionage activities and pay for strategic imports.

Although Operation Bernhard failed to meet its primary objective (the collapse of the British wartime economy), it was successful in flooding the European black markets with counterfeit pounds, thus undermining confidence in Britain’s currency abroad, and causing its value to plummet.

The Nazi plot may have been the most ambitious counterfeiting racket in history but it pales in comparison to the recent exploits of the world’s central banks, especially those of the Federal Reserve.

The Fed is currently creating, ex nihlio, more than a trillion dollars a year and using the funny money to buy U.S. government debt and mortgage-backed securities and then taking them out of circulation. These purchases have propped up the bond market and kept banks solvent. But they have also caused the Fed’s balance sheet to quadruple, growing from just under $1 trillion in 2008 to nearly $4 trillion today.

And there appears to be no end in sight to the reckless money creation. Janet Yellen, a “monetary policy dove” by all accounts, is about to be confirmed by the U.S. Senate as the next head of the Federal Reserve. Were Messrs. Bernanke and Greenspan “monetary policy hawks?”

Now if a Nazi plot to flood Great Britain with counterfeit currency was a considered a serious threat to that nation’s economy, what are we to make of our own central bank’s policies? What is the fundamental difference between the SS pumping “liquidity” into the British economy via black markets in the 1940′s and the Federal Reserve pumping “liquidity” into the US economy today?

The answer, of course, is there really is no difference. Economic law applies regardless of political circumstances. If you print money faster than the rate of production, you will have more money chasing fewer goods and sooner or later you will have price inflation. It really is just that simple.

An important distinction, however, between the Nazi counterfeiting scheme and the Fed’s current monetary policy is that the US dollar is still the dominant international reserve currency. This “exorbitant privilege” enables US monetary authorities to engage in periodic devaluations without being immediately confronted with a balance of payments crisis or domestic price inflation.

Right now the Fed’s inflationary policies have yet to show up in the Consumer Price Index though there are those who claim the rate of price inflation has been purposely understated by the US government. And indeed consumer prices have gone up in the last five years.

It should also be taken into consideration that the consequences of currency devaluation can manifest themselves in ways other than overt sticker shock. For instance, producers anticipating consumer resistance to price inflation can reduce the quality or quantity of their goods rather than raise prices. This is happening today as many products are now being packaged in smaller amounts yet are being sold at the same price.

Moreover, when you’re measuring price inflation, your baseline is crucial to your analysis. Absent intervention by the US government and the Fed, the Crash of 2008 would have precipitated widespread deflation. This did not happen as the US Treasury and central bank pumped in trillions of new dollars to arrest the panic. The new money has created relative “price stability” in the past few years but this itself is evidence of inflation because otherwise prices would have fallen.

And we can look at bond prices as evidence of inflation. The bond market is an enormous bubble that has been intentionally created by the Fed in order to forestall the inevitable reckoning for decades of overspending by the Congress.

That said, the dreaded hyperinflation that many predicted would happen has yet to occur. Why?

It appears the inflationary deluge is being held back by the Fed’s policy of paying banks not to lend money. Boston University economist Laurence Kotlikoff elaborated on this very point in Forbes last September. He wrote:

But why haven’t prices started rising already if there is so much money floating around? This year’s inflation rate is running at just 1.5 percent. There are three answers.

First, three quarters of the newly created money hasn’t made its way into the blood stream of the economy – into M1 – the money supply held by the public. Instead, the Fed is paying the banks interest not to lend out the money, but to hold it within the Fed in what are called excess reserves.

Since 2007, the Monetary Base – the amount of money the Fed’s printed – has risen by $2.7 trillion and excess reserves have risen by $2.1 trillion. Normally excess reserves would be close to zero. Hence, the banks are sitting on $2.1 trillion they can lend to the private sector at a moment’s notice. i.e., we’re looking at an gi-normous reservoir filling up with trillions of dollars whose dam can break at any time. Once interest rates rise, these excess reserves will be lent out.

But, and this is point two, other things aren’t equal. As interest rates and prices take off, money will become a hot potato. i.e., its velocity will rise. Having money move more rapidly through the economy – having faster money – is like having more money. Today, money has the slows; its velocity – the ratio GDP to M1 — is 6.6. Everybody’s happy to hold it because they aren’t losing much or any interest. But back in 2007, M1 was a warm potato with a velocity of 10.4.

If banks fully lend out their reserves and the velocity of money returns to 10.4, we’ll have enough M1, measured in effective units (adjusted for speed of circulation), to support a nominal GDP that’s 3.5 times larger than is now the case. I.e., we’ll have the wherewithal for almost a quadrupling of prices. But were prices to start moving rapidly higher, M1 would switch from being a warm to a hot potato. i.e., velocity would rise above 10.4, leading to yet faster money and higher inflation.

So, if commercial banks began lending at a rate resembling the historical norm, we would soon be experiencing hyperinflation. That is hardly a comforting thought. I suppose the only saving grace at that point would be in an economy already laden with massive debt, there might be very little demand for more credit and thus the money multiplier effect may not kick-in, at least not with the vengeance foreseen by Mr. Kotlikoff.

The Fed’s massive intervention into the market has been defended by the usual Keynesian suspects as a necessary measure to spur economic recovery. And yes, the Fed’s overheated printing presses have fueled a stock market boom. Unfortunately, this latest bubble has not lifted the real economy which remains in the doldrums. Private sector investment remains low and unemployment high.

The problem with this situation is the moment the Fed takes away the easy money, the market will collapse. Indeed, we have reached a point where just the suggestion of the Fed “tapering off” sends financial markets into a panic.

So the Fed has painted itself, and the entire U.S economy, into a corner. There is no way the Fed can stop creating money and liquidate its bloated balance sheet without reaping a deflationary whirlwind. And with an economy addicted to perennial trillion-dollar budget deficits and consumer debt, the political will to stomach such a painful yet necessary correction is not likely to be manifested anytime soon.

Vladimir Lenin is reported to have said, “the best way to destroy the capitalist system is to debauch the currency.” He was right. So why is the Fed following the advice of a deceased communist revolutionary?

No, I don’t think it is because the Federal Reserve Board has been infiltrated by communist moles, or Nazi agents for that matter. Although it is difficult to imagine commie saboteurs doing more damage to the U.S. economy than the monetary commissars now in charge at the Eccles building.

Perhaps the famed economist and alleged Fabian socialist John Maynard Keynes provided the answer when he wrote:

By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.

That ratio has probably improved somewhat lately. A greater portion of the public appears to be catching on to the Fed’s monetary sleights of hand. The increasing demand for physical gold and silver as well as the various state initiatives to re-monetize those precious metals are auspicious signs of such an awakening.

This article was posted: Sunday, December 15, 2013 at 6:09 am

Related Articles

We live amidst the most modern version of this story. Through a long and steady process, we now regard the paper as not being a receipt for money, but as the actual money itself. Banks lend out enormous amounts of credit based on paper reserves. Central banks stand ready to create whatever new amount of money is required to prevent the spread of panics.

This can only end with the complete debasement of the currency as it is printed into oblivion.

In the twentieth century, many currencies have experienced this fate.

| Currency | Year |

|---|---|

| Austian krone | 1923 |

| Russian ruble | 1922 |

| German mark | 1923 |

| Polish marka | 1923 |

| Austian krone | 1923 |

| Hungarian korona | 1926 |

| Brazilian real | 1942 |

| Greek drachma | 1944 |

| Hungarian pengo | 1946 |

| Romanian leu | 1947 |

| Chinese yuan | 1948 |

| Taiwan yuan | 1949 |

| Chinese renminbi | 1955 |

| Brazilian cruzeiro | 1967 |

| Chilean escudo | 1973 |

| Argentine peso | 1983 |

| Israeli shekel | 1984 |

| Bolivian peso bolivianos | 1984 |

| Peruvian soles de oro | 1984 |

| Brazilian cruzeiro novo | 1986 |

| Brazilian cruzado | 1989 |

| Nicaraguan cordoba | 1990 |

| Peruvian inti | 1990 |

| Yugoslav dinar | 1990 |

| Angola kwanza | 1995 |

| Argentine australes | 1992 |

| Soviet ruble | 1992 |

| Polish zloty | 1993 |

| Yugoslav dinar | 1993 |

| Zaire zaires | 1993 |

| Bosnia and Herzegovina dinar | 1993 |

| Brazilian cruzado novo | 1993 |

| Georgian kupon | 1993 |

| Yugoslav dinar | 1994 |

| Belarus ruble | 1994 |

| Ukrainian karbovanet | 1995 |

| Bulgarian lev | 1997 |

| Zaire zaires | 1998 |

N A T I O N A L D E B T ! ! ! ! !

!

Visit USADebtClock.com to learn more!

"Hyperinflation is not a bizarre event without cause. It is the ultimate end state of policy involving the continual printing of currency."

[EDUCATE YOUR FAMILY AND FRIENDS]

We Will

Be Told Hyperinflation is

Necessary, Proper, Patriotic and Ethical

Patrick Barron

Mises

January 14, 2014

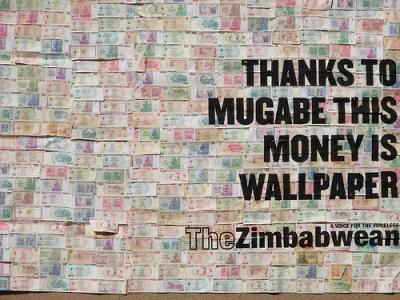

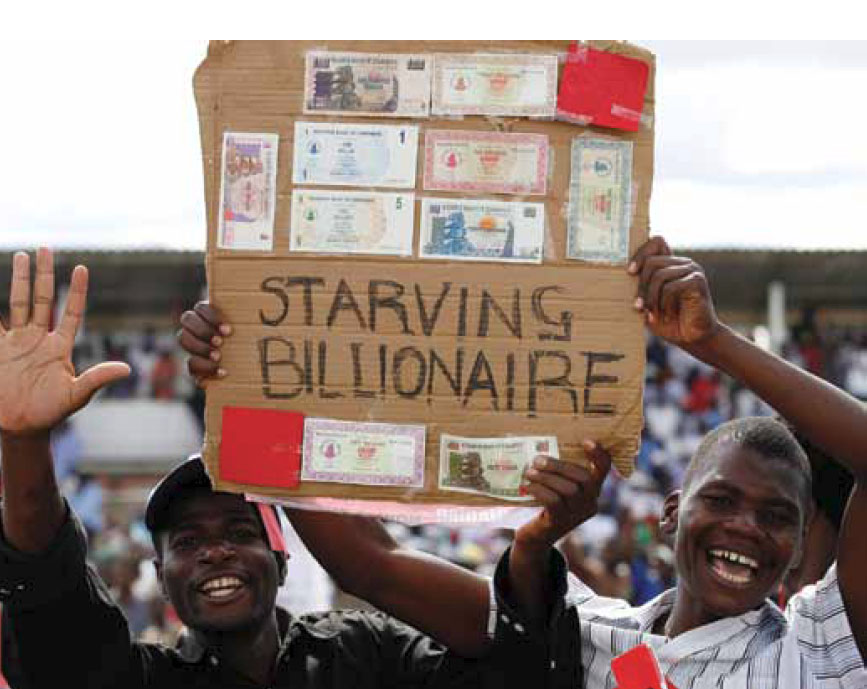

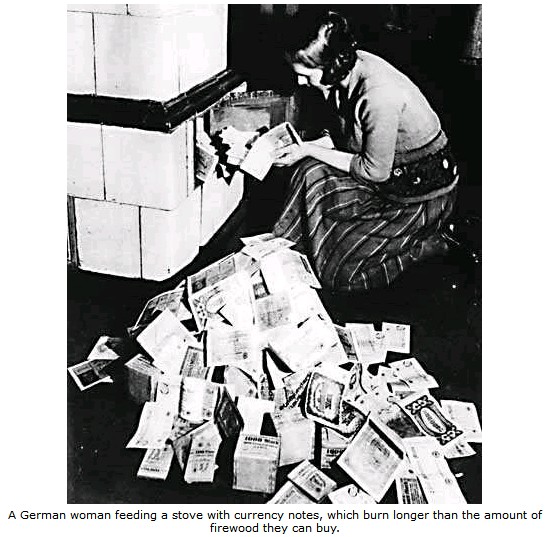

Hyperinflation leads to the complete breakdown in the demand for a currency, which means simply that no one wishes to hold it. Everyone wants to get rid of that kind of money as fast as possible. Prices, denominated in the hyper-inflated currency, suddenly and dramatically go through the roof. The most famous examples, although there are many others, are Germany in the early 1920s and Zimbabwe just a few years ago. German Reichsmarks and Zim dollars were printed in million and even trillion unit denominations.

We may scoff at such insanity and assume that America could never

suffer from such an event. We are modern. We know too much. Our monetary leaders are wise and have

unprecedented power to prevent such an awful outcome.

We may scoff at such insanity and assume that America could never

suffer from such an event. We are modern. We know too much. Our monetary leaders are wise and have

unprecedented power to prevent such an awful outcome.

Think again.

Our monetary leaders do not understand the true nature of money and banking; thus, they advocate monetary expansion as the cure for every economic ill. The multiple quantitative easing programs perfectly illustrate this mindset. Furthermore, our monetary leaders actually advocate a steady increase in the price level, what is popularly known as inflation. Any perceived reduction in the inflation rate is seen as a potentially dangerous deflationary trend, which must be countered by an increase in the money supply, a reduction in interest rates, and/or quantitative easing. So an increase in inflation will be viewed as success, which must be built upon to ensure that it continues. This mindset will prevail even when inflation runs at extremely high rates.

Like previous hyperinflations throughout time, the actions that produce an American hyperinflation will be seen as necessary, proper, patriotic, and ethical; just as they were seen by the monetary authorities in Weimar Germany and modern Zimbabwe. Neither the German nor the Zimbabwean monetary authorities were willing to admit that there was any alternative to their inflationist policies. The same will happen in America.

The most likely trigger to hyperinflation is an increase in prices following a loss of confidence in the dollar overseas and its repatriation to our shores. Committed to a low interest rate policy, our monetary authorities will dismiss the only legitimate option to printing more money — allowing interest rates to rise. Only the noninflationary investment by the public in government bonds would prevent a rise in the price level, but such an action would trigger a recession. This necessary and inevitable event will be vehemently opposed by our government, just as it has been for several years to this date.

Instead, the government will demand and the Fed will acquiesce in even further expansions to the money supply via direct purchases of these government bonds, formerly held by our overseas trading partners. This will produce even higher levels of inflation, of course. Then, in order to prevent the loss of purchasing power by politically connected groups, the government will print even more money to fund special payouts to these groups. For example, government will demand that Social Security beneficiaries get their automatic increases; likewise for the quarter of the population getting disability benefits. Military and government employee pay will be increased. Funding for government cost-plus contracts will ratchet up. As the dollar drops in value overseas, local purchases by our overextended military will cost more in dollar terms (as the dollar buys fewer units of the local currencies), necessitating an emergency increase in funding. Of course, such action is necessary, proper, patriotic, and ethical.

Other federal employee sectors like air traffic controllers and the TSA workers will likely threaten to go on strike and block access to air terminal gates unless they get a pay increase to restore the purchasing power of their now meager salaries.

State and local governments will also be under stress to increase the pay of their public safety workers or suffer strikes which would threaten social chaos. Not having the ability to increase taxes or print their own money, the federal government will be asked to step in and print more money to placate the police and firemen. Doing so will be seen as necessary, proper, patriotic, and ethical.

Each round of money printing eventually feeds back into the price system, creating demand for another round of money printing … and another … and another, with each successive increase larger than the previous one, as is the nature of foolishly trying to restore money’s purchasing power with even more money. The law of diminishing marginal utility applies to money as it does to all goods and services. The political and social pressure to print more money to prevent a loss of purchasing power by the politically connected and government workers will be seen as absolutely necessary, proper, patriotic, and ethical.

Many will not survive. Just as in Weimar Germany, the elderly who are retired on the fruits of a lifetime of savings will find themselves impoverished to the point of despair. Suicides among the elderly will be common. Prostitution will increase, as one’s body becomes the only saleable resource for many. Guns will disappear from gun shops, if not through panic buying then by outright theft by armed gangs, many of whom may be your previously law-abiding neighbors.

Businesses will be vilified for raising prices. Goods will disappear from the market as producer revenue lags behind the increase in the cost of replacement resources. Government’s knee-jerk solution is to impose wage and price controls, which simply drive the remaining goods and services from the white market to the gangster-controlled black market. Some will sit out the insanity. Better to build inventory than sell it at a loss. Better still to close up shop and wait out the insanity. So government does the necessary, proper, patriotic, and ethical thing: it prints even more money and prices increase still more.

The money you have become accustomed to using and saving eventually becomes worthless; it no longer serves as a medium of exchange. No one will accept it. Yet the government continues to print it in ever greater quantities and attempts to force the citizens to accept it. Our military forces overseas cannot purchase food or electrical power with their now worthless dollars. They become a real danger to the local inhabitants, most of whom are unarmed. The US takes emergency steps to evacuate dependents back to the States. It even considers abandoning our bases and equipment and evacuating our uniformed troops when previously friendly allies turn hostile.

And yet the central bank continues to print money. Politically-connected constituents demand that it do so, and it is seen as the absolutely necessary, proper, patriotic, and ethical thing to do.

This post originally appeared at the Mises Daily Blog.

This article was posted: Tuesday, January 14, 2014 at 9:54 am

FIGHTING BACK!!

"All the

perplexities, confusion and distress in America arise, not from defects in their Constitution or Confederation,

not from want of honor or virtue, so much as from the downright ignorance of the nature of coin,

credit and circulation."

John Adams

https://www.corbettreport.com/episode-122-hello-iceland/#

Hello, Iceland

Episode 122 – 03/21/2010

Running Time: 1:00:02

Description:Devastated by a banking collapse that has brought this once great nation to its economic knees, the people of Iceland are not giving up without a fight. Now they are gearing up to give the banksters and the globalists a taste of their own medicine with the Icelandic Modern Media Initiative. Get informed and get involved this week with The Corbett Report as we outline the efforts to make this small North Atlantic island a beacon of hope for freedom of expression the world over.

_Iceland Takes on The NWO_

|

Birgitta Jónsdóttir on Alex Jones Tv

1/4:

|

Birgitta

Jónsdóttir on Alex Jones Tv 2/4:

|

|

Birgitta

Jónsdóttir on Alex Jones Tv 3/4:

|

Birgitta

Jónsdóttir on Alex Jones Tv 4/4:

|

Additional guests include Birgitta

Jónsdóttir, a leading member of the Icelandic parliament who has called for the country to declare a debt

moratorium and stop attempting to pay the $6 billion which the British and Netherlands governments are seeking

to extort from Iceland with the help of the International Monetary Fund

and the European Commission in Brussels,.

http://www.voltairenet.org/auteur1249...

NET CLOSING-IN - ICELAND JAILS

4 BANKERS

(Rothschilds next?) [We Can Hope]

Four former bank bosses in Iceland have been jailed for financial fraud. They were accused of hiding the fact a Qatari investor bought into the firm, with money lent illegally by the bank itself. It went bust in 2008, helping to cripple Iceland's economy.

'Iceland model: How to deal with

bankers

should be standard for whole world'

In Iceland four former bank chiefs have been jailed for fraud - the sentences go as far as five years behind bars. They're accused of concealing that a Qatari investor bought a stake in their firm, using cash lent from the bank itself - illegally. The deal took place just ahead of the collapse of the bank due to huge debts. RT talks to economic expert Charlie McGrath, founder of news website Wide Awake News about Iceland's economy.

WE ARE UNDER

ECONOMIC SIEGE!

LINK: Economy Destroyed By Design!

...Bankers have embedded themselves into the economy, building up infrastructure for a time, then bringing down the system within the United States in concert with the international economic warfare and the rise of global government...This stage of the game is De-industrialization. Inside this agenda is a plan for global government to emerge from the ashes of the once great United States and for the era of national sovereignty itself to subside. To achieve their goal, an economic squeeze is placed upon the nation and environmental pretexts are being used to strangle independence and viability – in America it has been the NAFTA, GATT, WTO and United Nations treaties that have wrecked her integrity and pillaged her productiveness.

LINK: These 12 Hellholes Are Examples

Of What The Rest Of America Will Look Like Soon

LINK: THE I.R.S.

MORE: International Monetary Fund

The Real Meaning Of "Austerity"

And THE IMF RIOTS

TRANSCRIPT AND SOURCES: http://ur1.ca/0balr

..."Austerity" is one of those Orwellian terms that has been injected

into our political discourse precisely because it is a nice-sounding word for a very painful reality.

"Austerity" implies discipline, self-restraint, even nobility. "Austerity" is prudent. "Austerity" is modest.

"Austerity" is a virtue. It is an end in itself.

If the IMF or the European Central Bank come to the people of a collapsing European nation and tell them to

sacrifice their pensions and their savings and their very standard of living all for a debt that their government

has fraudulently racked up in their name, no one would go for it, and rightly so.

But tell those same people that they need to implement "austerity measures" in order to "get back on their feet"

economically, and many will be willing to live in the harshest of conditions, content to put up with the

dismantling of their nation itself in the vain hope that by giving more power to the international financial

institutions they can somehow avoid economic collapse...

LINK: CASHLESS TRACKABLE SOCIETY

On The

100th Anniversary Of The Federal Reserve Here Are 100 Reasons

To Shut It Down Forever

Michael Snyder

Economic Collapse

December 23, 2013

December 23rd, 1913 is a date which will live in infamy. That was the day when the Federal Reserve Act was pushed through Congress. Many members of Congress were absent that day, and the general public was distracted with holiday preparations.

Now we have reached the 100th anniversary of the Federal Reserve, and most

Americans still don’t know what it actually is or how it functions. But understanding the Federal Reserve is

absolutely critical, because the Fed is at the very heart of our economic problems. Since the Federal Reserve

was created, there have been 18 recessions or depressions, the value of the U.S. dollar has declined by 98

percent, and the U.S. national debt has gotten more than 5000 times larger. This insidious debt-based

financial system has literally made debt slaves out of all of us, and it is systematically destroying the

bright future that our children and our grandchildren were supposed to have. If nothing is done, we are

inevitably heading for a massive amount of economic pain as a nation. So please share this article with as

many people as you can. The following are 100 reasons why the Federal Reserve should be shut down forever…

Now we have reached the 100th anniversary of the Federal Reserve, and most

Americans still don’t know what it actually is or how it functions. But understanding the Federal Reserve is

absolutely critical, because the Fed is at the very heart of our economic problems. Since the Federal Reserve

was created, there have been 18 recessions or depressions, the value of the U.S. dollar has declined by 98

percent, and the U.S. national debt has gotten more than 5000 times larger. This insidious debt-based

financial system has literally made debt slaves out of all of us, and it is systematically destroying the

bright future that our children and our grandchildren were supposed to have. If nothing is done, we are

inevitably heading for a massive amount of economic pain as a nation. So please share this article with as

many people as you can. The following are 100 reasons why the Federal Reserve should be shut down forever…

#1 We like to think that we have a government “of the people, by the people, for the people”, but the truth is that an unelected, unaccountable group of central planners has far more power over our economy than anyone else in our society does.

#2 The Federal Reserve is actually “independent” of the government. In fact, the Federal Reserve has argued vehemently in federal court that it is “not an agency” of the federal government and therefore not subject to the Freedom of Information Act.

#3 The Federal Reserve openly admits that the 12 regional Federal Reserve banks are organized “much like private corporations“.

#4 The regional Federal Reserve banks issue shares of stock to the “member banks” that own them.

#5 100% of the shareholders of the Federal Reserve are private banks. The U.S. government owns zero shares.

#6 The Federal Reserve is not an agency of the federal government, but it has been given power to regulate our banks and financial institutions. This should not be happening.

#7 According to Article I, Section 8 of the U.S. Constitution, the U.S. Congress is the one that is supposed to have the authority to “coin Money, regulate the Value thereof, and of foreign Coin, and fix the Standard of Weights and Measures”. So why is the Federal Reserve doing it?

#8 If you look at a “U.S. dollar”, it actually says “Federal Reserve note” at the top. In the financial world, a “note” is an instrument of debt.

#9 In 1963, President John F. Kennedy issued Executive Order 11110which authorized the U.S. Treasury to issue “United States notes” which were created by the U.S. government directly and not by the Federal Reserve. He was assassinated shortly thereafter.

#10 Many of the debt-free United States notes issued under President Kennedy are still in circulation today.

#11 The Federal Reserve determines what levels some of the most important interest rates in our system are going to be set at. In a free market system, the free market would determine those interest rates.

#12 The Federal Reserve has become so powerful that it is now known as “the fourth branch of government“.

#13 The greatest period of economic growth in U.S. history was when there was no central bank.

#14 The Federal Reserve was designed to be a perpetual debt machine. The bankers that designed it intended to trap the U.S. government in a perpetual debt spiral from which it could never possibly escape. Since the Federal Reserve was established 100 years ago, the U.S. national debt has gotten more than 5000 times larger.

#15 A permanent federal income tax was established the exact same year that the Federal Reserve was created. This was not a coincidence. In order to pay for all of the government debt that the Federal Reserve would create, a federal income tax was necessary. The whole idea was to transfer wealth from our pockets to the federal government and from the federal government to the bankers.

#16 The period prior to 1913 (when there was no income tax) was the greatest period of economic growth in U.S. history.

#17 Today, the U.S. tax code is about 13 miles long.

#18 From the time that the Federal Reserve was created until now, the U.S. dollar has lost 98 percent of its value.

#19 From the time that President Nixon took us off the gold standard until now, the U.S. dollar has lost 83 percent of its value.

#20 During the 100 years before the Federal Reserve was created, the U.S. economy rarely had any problems with inflation. But since the Federal Reserve was established, the U.S. economy has experienced constant and never ending inflation.