welcome

|

||||||||||||||||

MortgageGate!

The Biggest Mortgage Fraud in History Exposed! The mortgage scandal created by banker endorsed deregulation and MERS (Mortgage

Electronic Registration Systems). The fraud is wide spread and millions of Americans have been affected. What is

most frightening

This Is A Housing Crisis

Truthstream Media | First published at 16:36 UTC on April 29th, 2022. Please help support us on Patreon, read our goals here: https://www.patreon.com/truthstreammedia Truthstream Can Be Found Here: Our First Film: TheMindsofMen.net Our First Series:

Vimeo.com/ondemand/trustgame Twitter: @TruthstreamNews Backup Vimeo: Vimeo.com/truthstreammedia DONATE: http://bit.ly/2aTBeeF Newsletter: http://eepurl.com/bbxcWX

County Investigates Bankster Fraud "Over the course of 12+ years, Mortgage Electronic Registration Systems, Inc. (MERS) has

thoroughly unleashed a confusing mess of concealed electronic data, supplied by virtually all of the major players

in the American financial arena.

Dave Krieger in-studio

On the Friday, August 10 edition of the Alex Jones Show, Alex talks with Dave Krieger in-studio. Mr. Krieger is a former radio news reporter, news director, television news reporter and anchorman and investigative journalist who won national and state news awards from Associated Press Broadcasters. He is the author of Clouded Titles, a book exposing the mortgage scandal created by the banksters that has affected millions of Americans. The book informs readers about foreclosure defense, strategic default, quiet title actions and county land record functions. It is now available at the Infowars Store.

Wall Street's Mortgage Fraud Scandal with David Kreiger

Clouded Titles (new updated edition with case cites) exposes the mortgage scandal created by

banker endorsed deregulation and MERS (Mortgage Electronic Registration Systems). The fraud is wide spread and

millions of Americans have been affected. What is most frightening is that many of them don't even know it yet.

In this one-hour video, Attorney John E. Campbell explains the main aspects of the mortgage

crisis that has devastated the U.S. housing market and the economy.

BOB CHAPMAN:"FRAUDCLOSURE" MAY TAKE 10 YEARS TO FIX

THE CRISIS OF CREDIT VISUALIZED PART 1

THE CRISIS OF CREDIT VISUALIZED PART 2

The End Game Memo with Greg Palast Alex is joined via Skype by fraud analyst Greg Palast to discuss the fines levied against JP

Morgan Chase | ||||||||||||||||

|

|||

|

|

|||

|

|||

Mortgage Scandal Created by Big Banks. Author and Investigative journalist Dave Krieger joins Rob

Dew

in studio to discuss the Big Bank Mortgage Fraud!

Unsealed court-settlement documents reveal banks stole $trillions’ worth of houses

Cory Doctorow

boingboing.net

August 12, 2013

Back in 2012, the major US banks settled a federal mortgage-fraud lawsuit for $95,000,000. The suit was filed by Lynn Szymoniak, a white-collar fraud specialist, whose own house had been fraudulently foreclosed-upon. When the feds settled with the banks, the evidence detailing the scope of their fraud was sealed, but as of last week, those docs are unsealed, and Szymoniak is shouting them from the hills. The banks precipitated the subprime crash by “securitizing” mortgages — turning mortgages into bonds that could be sold to people looking for investment income — and the securitization process involved transferring title for homes several times over. This title-transfer has a formal legal procedure, and in the absence of that procedure, no sale had taken place. See where this is going?

The banks screwed up the title transfers. A lot. They sold bonds backed by houses they didn’t own. When it came time to foreclose on those homes, they realized that they didn’t actually own them, and so they committed felony after felony, forging the necessary documentation. They stole houses, by the neighborhood-load, and got away with it. The $1B settlement sounded like a big deal, back when the evidence was sealed. Now that Szymoniak’s gotten it into the public eye, it’s clear that $1B was a tiny slap on the wrist: the banks stole trillions of dollars’ worth of houses from you and people like you, paid less than one percent in fines, and got to keep the homes.

Now that it’s unsealed, Szymoniak, as the named plaintiff, can go forward and prove the case. Along with her legal team (which includes the law firm of Grant & Eisenhoffer, which has recovered more money under the False Claims Act than any firm in the country), Szymoniak can pursue discovery and go to trial against the rest of the named defendants, including HSBC, the Bank of New York Mellon, Deutsche Bank and US Bank.

The expenses of the case, previously borne by the government, now are borne by Szymoniak and her team, but the percentages of recovery funds are also higher. “I’m really glad I was part of collecting this money for the government, and I’m looking forward to going through discovery and collecting the rest of it,” Szymoniak told Salon.

It’s good that the case remains active, because the $95 million settlement was a pittance compared to the enormity of the crime. By the end of 2009, private mortgage-backed securities trusts held one-third of all residential mortgages in the U.S. That means that tens of millions of home mortgages worth trillions of dollars have no legitimate underlying owner that can establish the right to foreclose. This hasn’t stopped banks from foreclosing anyway with false documents, and they are often successful, a testament to the breakdown of law in the judicial system. But to this day, the resulting chaos in disentangling ownership harms homeowners trying to sell these properties, as well as those trying to purchase them. And it renders some properties impossible to sell.

To this day, banks foreclose on borrowers using fraudulent mortgage assignments, a legacy of failing to prosecute this conduct and instead letting banks pay a fine to settle it. This disappoints Szymoniak, who told Salon the owner of these loans is now essentially “whoever lies the most convincingly and whoever gets the benefit of doubt from the judge.” Szymoniak used her share of the settlement to start the Housing Justice Foundation, a non-profit that attempts to raise awareness of the continuing corruption of the nation’s courts and land title system.

This article was posted: Monday, August 12, 2013 at 4:39 pm

Tags: domestic news, economics

Your Mortgage Is Funding American Black Ops

Published on Dec 5, 2014

Darrin McBreen teases a new interview by David Knight who is getting to the bottom of

one of the biggest cases of fraud in the history of the United States.

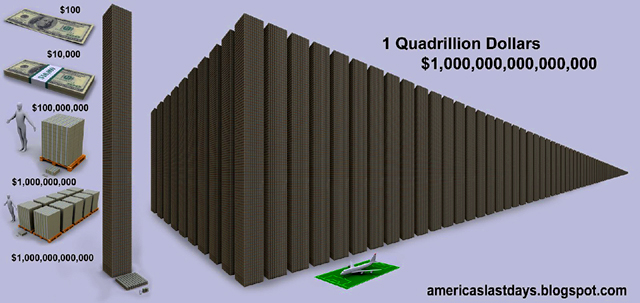

Quadrillions of Fraudulent DEBT!!

A WORLD HELD HOSTAGE BY BANKERS

-- Learn about Glass–Steagall Act in FALL OF THE REPUBLIC --

Washington is owned by the private global banking cartel that owns Wall Street. International law does not apply to this criminal cartel. They stole trillions of dollars from the American people with help from corrupt politicians over a stretch of many decades, culminating in the government bailout in 2008, and they have not been held accountable.

These bandits and looters could care less if America crashes and burns. In fact,

they want America to die because they want to institute a private world government upon its ruins. And they’re

doing a fantastic job at it because they’ve had decades of practice in nations in Latin America, Africa, and

Asia where they bought off greedy politicians, and robbed their people through the IMF/World Bank/WTO.

These bandits and looters could care less if America crashes and burns. In fact,

they want America to die because they want to institute a private world government upon its ruins. And they’re

doing a fantastic job at it because they’ve had decades of practice in nations in Latin America, Africa, and

Asia where they bought off greedy politicians, and robbed their people through the IMF/World Bank/WTO.

The entire business model of the private global banking tricksters is based on stealing the wealth of nations, and destroying national independence in order to allow lawless multinational corporations to completely take over. Read this article about how they do it.

Once nations are put into needless debt by these private global bankers, they put the squeeze on them by forcing them to pay back usurious loans that make them go bankrupt. After the inevitable mayhem that follows national collapse, they impose a military dictatorship so that the people can’t resist. Damon Vrabel calls it the “death of nations.” He writes:

The fact is that most countries are not sovereign (the few that are are being attacked by CIA/MI6/Mossad or the military). Instead they are administrative districts or customers of the global banking establishment whose power has grown steadily over time based on the math of the bond market, currently ruled by the US dollar, and the expansionary nature of fractional lending. Their cult of economists from places like Harvard, Chicago, and the London School have steadily eroded national sovereignty by forcing debt-based, floating currencies on countries.

Civilized nations stand up for themselves, they don’t bow down to private bankers. America can prove to the world that it is civilized, honest, and free by showing the global banking overlords the door.

The way to fight back against the global robbers at the privately owned Federal Reserve Bank/IMF/World Bank and the big banks is entirely peaceful. It is a matter of exposing their deviance and deception to the public, and then hitting the streets. An enemy can’t be defeated unless it remains in the shadows, striking at will. Directing public light at the private global banking cartel’s evil influence over nations that are thought to be free and independent by the people is the only way to bring an end to their crimes, and treachery against Mankind.

A new civilization based on the divine values of freedom, justice, truth, and mutual respect among nations, and private institutions, can’t be born unless we all come together as global citizens and fight back against the unlawful rule of the private global banking cartel. Our countries are suffering because of their greed and ruthless control.

The austerity measures that are being called for by the banks and the elite is bringing chaos onto the streets of Europe on a scale never before seen, and it won’t be long before America enters the stage. We are nearing the moment when the globalist conspirators behind the plans for a new world order will openly declare the end of America. When they do, we shall declare the end of them, and fight for the rebirth of America, and all of Mankind.

Only an order based on the rule of law and freedom should be accepted. The conspiratorial elite intend to achieve a new world order through this period of engineered chaos not by law, but by brutal force because it is the only way to impose a criminal, bank-owned government on a global scale. Despite their rhetoric, these devilish traitors are not visionary thinkers because corrupt designs for a world state isn’t new in history. Their arrogance is a cover. They will fail hard. And America will be set free from bondage, along with other nations.

“This is global government, a private corporate global government, taking over every major society with the same formula. It is fraudulent, and it must be resisted, or we have no future. We cannot allow this new dark age to begin,” says radio host Alex Jones in a YouTube video message entitled “It’s the Bankers or Us.” Watch his message, and spread it.

There is a peaceful global revolution against the private global banking cartel, and it can’t be stopped. Join it and help everyone live free, or die a slave under the empire of debt.

DERIVATIVES: The Debt Bomb

The derivatives market is the Las Vegas of the world's financial super elite, worth anywhere between 2 to 8 quadrillion dollars compared to about 70 trillion dollars of world GDP. We look at the so-called financial innovations of Wall Street from Collateralized Debt Obligations to Mortgage Backed Securities.

We also look at US government's complicity; White House and Congress both vested interests not only as recipients of Wall Street largess in the form of campaign donations but as major players with criminal asymmetrical information and influence advantages.

LINKS :

U.S. Military Killing Its Own Troops!

Global Debt Crisis Simply Explained

http://www.infowars.com/america-is-held-hostage-by-global-private-bankers/

|

BLACKROCK / TECHNOCRACY - TAKEOVER OF THE WORLD

|

|

A General Summary/Crash Course of "The

System" |

|

Catherine Austin Fitts Corbett Report Extras SHOW NOTES AND MP3: https://www.corbettreport.com/?p=33017 Catherine Austin Fitts has been following the story

of the black budget, the missing trillions, and the back door in the US Treasury for decades. Now,

her tireless work on this subject has been published in a comprehensive report from Solari.com,

"The Real Game of Missing Money" Volumes 1 and 2. Today James Corbett talks to Fitts about FASAB

56, the missing trillions and the financial coup d'état which has liquidated the wealth of the

United States |

||

|

|

||

|

Links: I.R.S. | The Govt is Raping You | The Looting Of America | Economy Destroyed By Design! | Full Spectrum Dominance | Global Debt Crisis Simply Explained | BANKS RULE THE WORLD | INFAMOUS 9/11 | Wall Street | MILITARY INDUSTRIAL COMPLEX | MortgageGate! | The Federal Reserve | Media Controllers | Propaganda History | Subverting The Public | |

REACH OUT TO OTHERS

[Help Educate Family And Friends With This Page And The Links Below]

MORE:

We Can't Pay It Back! | The Federal Reserve | BANKS RULE THE WORLD | Global Debt Crisis Simply Explained | International Monetary Fund | Economy Destroyed By Design! | Full Spectrum Dominance | The Govt is Raping You | The Looting Of America | MortgageGate! | Climate Change

These 12 Hellholes Are Examples Of What The Rest Of America Will Look Like Soon