welcome

|

||||||||||||||||||||||||

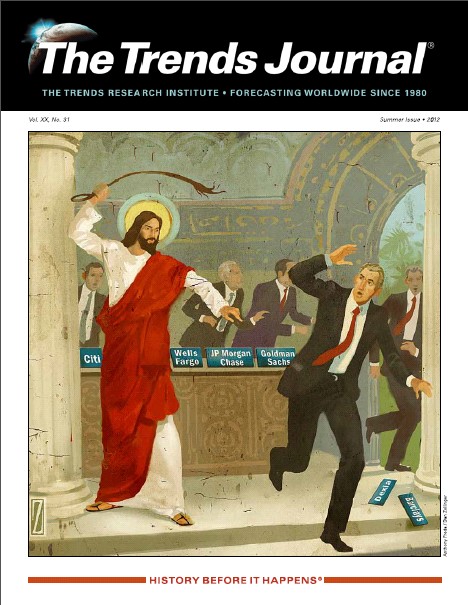

CASHLESS TRACKABLE SOCIETY Paper Currencies Are Being Destroyed By Design It should be blatantly obvious to Christians where this is going... An open letter to America's Pastors ->> Link : Asleep at the Switch

The Royal Canadian Mint recently introduced

the MintChip | ||||||||||||||||||||||||

|

|

||

|

|

|

|

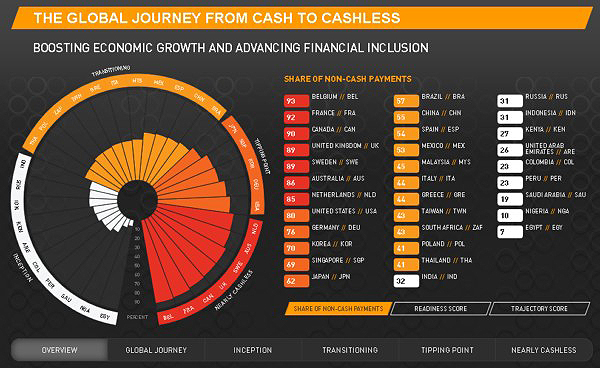

http://www.mastercardadvisors.com/cashlessjourney/

IBM RFID Commercial - The Future Market

The evolution of Supermarkets is the RFID technology revolutioning the logistics

services.

A video from IBM.

(Article Continued)

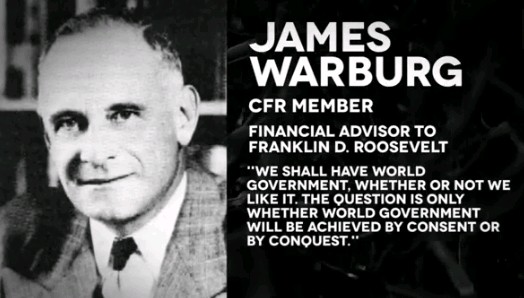

According to filmmaker Aaron Russo, a personal friend of Nick Rockefeller – a direct heir to the Rockefeller banking empire, the final goal of the banking elite is to move the entire civilized world to a cashless system under their total control. All of your personal financial information and wealth, stored on an electronic chip which they can turn off any time they like.

This disgusting, duplicitous and evil ‘cashless society’ meme has picked up considerable steam in the mainstream financial press. As I highlighted in my article CNBC Anchor and CFR Member Erin Burnett Pushes Her Bankster Master’s Agenda: What if We BANNED Cash?, the Rockefeller founded CFR has been busy using its shill TV personalities to peddle their cashless society agenda via their mainstream mocking bird media outlets. It’s transparent and pathetic, but only if you know what your are watching. Sadly, million of Americans don’t.

Recently on CNBC, Erin Burnett, a CFR member and shill for the Rockefeller banking syndicate stated the following: “What if we got rid of cash? After all, cash is what keeps terrorists, drug dealers and gun dealers in business.”

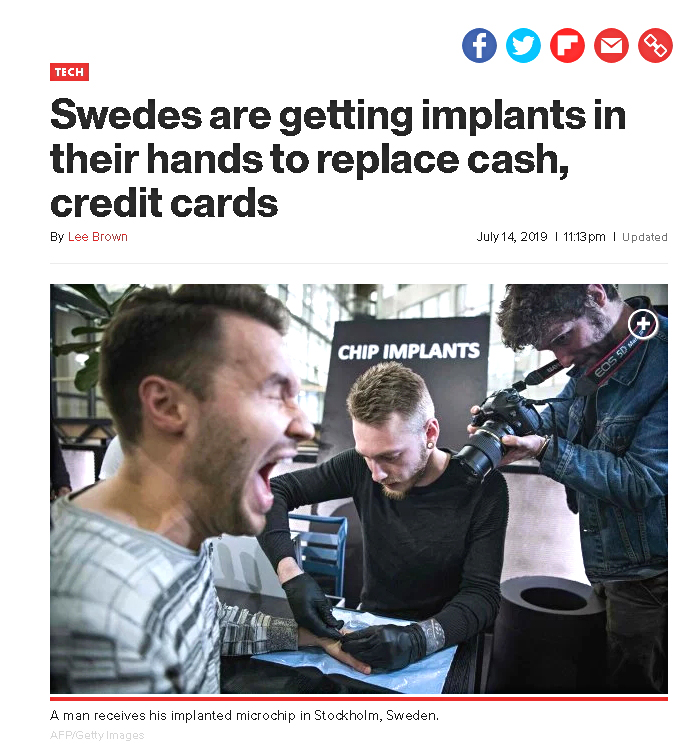

But with MintChip the hard sell for a move to a cashless society has gotten far more sexy. Now the marketing will be targeted at the youth who will find the convenience of having their “money” on their iPhone trendy and cool. Soon after, the Bankster’s will begin the push to implantable chips that can be “safely” stored in the human body. Why bother with a clumsy e-device which you can simply scan your hand?

MintChip marks the slippery slop into absolute pit of hell despotism, serfdom and slavery. Your every financial move will be tracked and your every purchase logged. And if you step out of NWO line you will relinquish the “privilege” of buying or selling. It will be the fulfillment of the Lucifierian Bankster dream.

It will be a nightmare for free

humanity. Resist. Resist. Resist.

At all costs, resist.

12 Simple Steps to VeriChip

the World

Regardless of who may be behind all the media attention being given the VeriChip – be it sinister spiritual forces preparing the way for the Antichrist or capitalists eager to create a new billion-dollar industry or both – the goal is the same: to get people used to the idea, so they will buy it. This is standard advertising strategy. The more people see or hear a product being promoted, the more appealing it becomes. Eventually they are convinced they need it. (Joseph Candel)

Via Activist Post

We are the last generation with a voice and free will to change the course of history. Everyone connected everywhere – smart phones are to be the tools of the Smart World Order; bringing an end to physical cash, keys, drivers’ licences, etc. They are also intended to be used daily to validate identity in the new ‘trusted’ Internet community.

The phone, or the chip that links the user’s ID to the phone, then becomes too valuable to lose, and the only safe place is under the skin. Unless we refuse to comply….

It goes something like this:

1.

Create a climate of fear.

2.

Get everyone online.

3.

Enable even the poor to carry a cell phone.

4.

Get everyone to talk about RFID and biometrics: the first phase of acceptance is expectation.

5.

Chip as many things and people as you can (phones, pets, clothing, etc.) to make it normal.

6.

Set up a global ID system but keep it hush hush.

7.

Promote implants for health and safety, so people think they’re good.

8.

Make it so you can use your phone for everything, especially payments and proving identity.

9.

How do we know it’s really you? Your biometrics please!

10.

Cyber attack! Revolution! Please protect us!

11.

The economy collapses….. cash is gone, and all payments are now digital.

12.

Phones get lost and stolen; biometrics get spoofed; carrying a phone is such a bother – and Verichips are just easier all round….

But… “Pssst!! Rewind!”

Time to change our minds.

We don’t have to cooperate. Awake and determined, we refuse to sign up with an Identity Provider, and we refuse to pay for anything with a phone.

We make it plain: they can stick their NSTIC up their ***

Their planned revolution takes a different course:

Be part of the movement they didn’t expect.

We are the warriors, writing history:

By the year 2020, in a bid to be free, we stood up to the corporatocracy, and won.

“He that overcometh shall inherit all things; and I will be his God, and he shall be my son.” – Revelation 21:7

http://endtimeinfo.com/2012/11/12-simple-steps-to-verichip-the-world/

Bilderberg and the Digital New World Order

Truthstream Media

Published on Jun 15, 2018

Please help support us on Patreon, read our goals here: https://www.patreon.com/truthstreammedia

Truthstream Can Be Found Here:

Website: http://TruthstreamMedia.com

Minds: @InformedDissent (Join here! https://tinyurl.com/y8voad27 ... we're going to dump Facebook soon.)

FB: http://Facebook.com/TruthstreamMedia

Twitter: @TruthstreamNews

DONATE: http://bit.ly/2aTBeeF

Amazon Affiliate Link (help support TSM with every Amazon purchase, no cost to you!): http://amzn.to/2aTARRx

Newsletter: http://eepurl.com/bbxcWX

LINK: Bilderberg Group

Israel Hacking the World

Know More News

Premiered May 16, 2019

Know More News with Adam Green

https://www.KnowMoreNews.org/

Support Know More News!

Paypal Donations - https://www.paypal.me/KnowMoreNews

Patreon - https://www.patreon.com/AdamGreen

Venmo - @Know-More-News

Follow me on Social Media:

TWITTER https://twitter.com/Know_More_News

FACEBOOK https://www.facebook.com/KnowMoreNews

INSTAGRAM https://www.instagram.com/know_more_n...

BITCHUTE https://www.bitchute.com/channel/know...

Who Runs the Internet?

Know More News

Published on Jul 25, 2018

Know More News with Adam Green

Patreon - https://www.patreon.com/AdamGreen

Paypal Donations/Tips - https://www.paypal.me/KnowMoreNews

Venmo - @Know-More-News

Twitter - https://twitter.com/Know_More_News

Facebook - https://www.facebook.com/KnowMoreNews

SUBSCRIBE ON BITCHUTE!!!

https://www.bitchute.com/channel/know...

Benjamin Netanyahu's

Plan to Rule the World

Know More News

Premiered Mar 21, 2019

Know More News with Adam Green

https://www.KnowMoreNews.org/

Support Know More News!

Paypal Donations - https://www.paypal.me/KnowMoreNews

Patreon - https://www.patreon.com/AdamGreen

Venmo - @Know-More-News

Follow me on Social Media:

TWITTER https://twitter.com/Know_More_News

FACEBOOK https://www.facebook.com/KnowMoreNews

INSTAGRAM https://www.instagram.com/know_more_n...

BITCHUTE https://www.bitchute.com/channel/know...

Israel's Tech

Supremacy Agenda

Know More News Premiered May 22, 2019 Know More News with Adam Green https://www.KnowMoreNews.org/ Support Know More News! Paypal Donations - https://www.paypal.me/KnowMoreNews Patreon - https://www.patreon.com/AdamGreen Venmo - @Know-More-News

Know More News

Premiered May 22, 2019

Know More News with Adam Green

https://www.KnowMoreNews.org/

Support Know More News! Paypal Donations - https://www.paypal.me/KnowMoreNews Patreon - https://www.patreon.com/AdamGreen Venmo - @Know-More-News

Adam Green's Documentary can be seen here: Subverting The Public

LINK: INTERNET FALSE FLAGS

No, US Banks Are Not Terrified of

Chinese Payment Apps

- #PropagandaWatch -

corbettreport

Published on Jun 5, 2019

SHOW NOTES: https://www.corbettreport.com/?p=31412

Bloomberg would have us believe that the banksters are quaking in their boots over the possibility that Chinese-style payment apps and a truly cashless economy will be making its way to the West in the near future. But is this the banksters' nightmare or their ultimate dream come true? Find out in this week's edition of #PropagandaWatch.

Links: Propaganda History , BANKS RULE THE WORLD , Full Spectrum Dominance , Bilderberg Group

LINK : The Deliberate Dumbing Down Of America

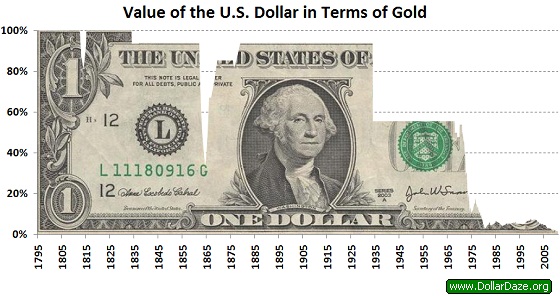

THE GLOBALISTS ARE PREYING OFF OF THE PUBLIC'S IGNORANCE OF MONEY, AND THE FRAUD SYSTEM WE'VE BEEN UNDER FOR OVER A HUNDRED YEARS!

What is The Federal Reserve?

Infowars Nightly News reporter Dan Bidondi polls public knowledge in about the privately-owned Federal Reserve bank, comparing the informed position taken by 'End the Fed' protesters and that of the average person on the streets of San Antonio. What is it the critics understand that the general population has been kept in the dark about? Find out more in this special report about the importance of the Fed and how it holds a grasp over our economy.

Texans Resist The Private Federal Reserve

Texans Resist The Private Federal Reserve

Occupy Wall Street Protestor on Federal Reserve

This young man is brilliant.

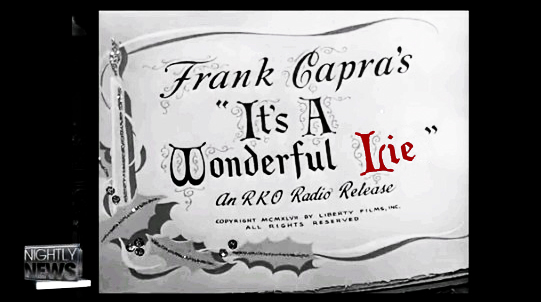

It's A Wonderful Lie — 100 Years of the Federal Reserve

[YOUTUBE BANNED THIS VIDEO]

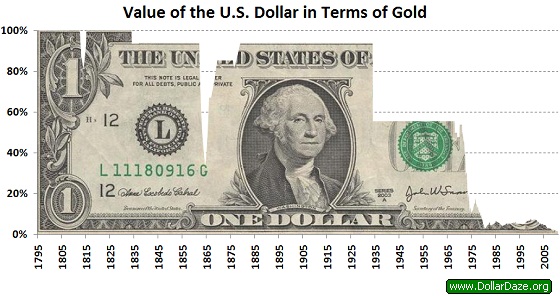

As we look back over the past hundred years, America has experienced the Great

Depression, multiple recessions, stagflation and the loss of 99% of the dollarʼs purchasing power - none of it

wouldʼve been possible without the Federal Reserve, creating bubbles and bursting them, enslaving us with debt and

destroying our purchasing power through inflation

Yes, itʼs been a wonderful lie — for the banksters

And many Americans are left like George Bailey. Facing the collapse of their dreams and financial ruin

There are striking parallels in Frank Capraʼs Itʼs a Wonderful Life to lies and tricks of the modern banker elite.

Human nature doesnʼt change and the greedy elite of 1913 and 2013 look much like Potter

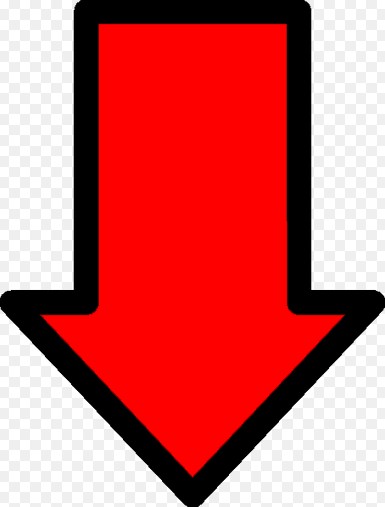

A CONTROLLED SOCIETY DOMINATED BY AN ELITE

***BACKGROUND REFERENCE***

Technocracy is a replacement economic system for Capitalism and Free Enterprise, and is represented by the United Nations’ program for Sustainable Development and “Green Economy.” It proposes that all means of production and consumption would be controlled by an elite group of scientists and engineers (technocrats) for the good of mankind. Technocracy was originally architected in the 1930s but regained favor when adopted by the Trilateral Commission in 1973, under their “New International Economic Order” program. https://www.technocracy.news/faq-2/

The Roots of Technocracy with Expert Patrick M. Wood

Alex welcomes to the broadcast The August Forecast & Review Editor Patrick M. Wood to discuss

how the global elite within the Trilateral Commission are replacing capitalism with their own technocracy in

order to create a New International Economic Order.

http://www.augustforecast.com/

|

[TECHNOCRACY] Exposing the Dark Agenda Behind the "Resource-Based Economy" Published on May 28, 2015 SHOW NOTES AND MP3: https://www.corbettreport.com/?p=14902 24/7 surveillance. Smart grid controls. Carbon rationing. Today we talk to "Technocracy Rising" author Patrick Wood about the hidden history of technocracy, the dark plan for a resource-based economy that is being pushed by the Trilateral Commission, the UN, and other globalist institutions in order to bring about a completely managed, controlled and regulated society.

|

|||||||||

|

FOR AN OVERVIEW OF THE BIG PICTURE GO HERE: General Summary/Crash Course |

|||||||||

MORE:

**A MUST-SEE**

Glenn Greenwald "The Goal Of The U.S.

Government Is

To Eliminate ALL Privacy Globally!"

“Domestically, they’re pulling together all the data about virtually every U.S. citizen in the country and assembling that information, building communities that you have relationships with, and knowledge about you; what your activities are; what you’re doing. So the government is accumulating that kind of information about every individual person and it’s a very dangerous process.”

LINK : NSA CAUGHT SPYING ON EVERYONE!

Facebook (Privacy Hater) CEO Refers to It's Users as Dumb Fucks

NWOTASER - Corbettreport — May 23, 2010 — http://www.corbettreport.com

Sunday Update is a public service of The Corbett Report.

Zuckerberg calls Facebook users "dumb fucks"

http://ur1.ca/00rx7

Facebook gave advertisers personal info of users who clicked on ads

http://ur1.ca/02vce

Zuckerberg used Facebook data to hack users' private email accounts

http://ur1.ca/02vcg

Do You Have Facebook?

http://ur1.ca/a9bk

Facebook CEO Mark Zuckerberg and his company are suddenly facing a big new round of scrutiny and criticism about their cavalier attitude toward user privacy.

An early instant messenger exchange Mark had with a college friend won't help put these concerns to rest.

According to SAI sources, the following exchange is between a 19-year-old Mark Zuckerberg and a friend shortly after Mark launched The Facebook in his dorm room:

Zuck: Yeah so if you ever need info about anyone at Harvard

Zuck: Just ask.

Zuck: I have over 4,000 emails, pictures, addresses, SNS

[Redacted Friend's Name]: What? How'd you manage that one?

Zuck: People just submitted it.

Zuck: I don't know why.

Zuck: They "trust me"

Zuck: Dumb fucks.

LINK : FACESCANS

NSA to Control

the Stock Market

Spy agency can easily manipulate the market through

latest surveillance hub

Kit Daniels

Infowars.com

May 7, 2014

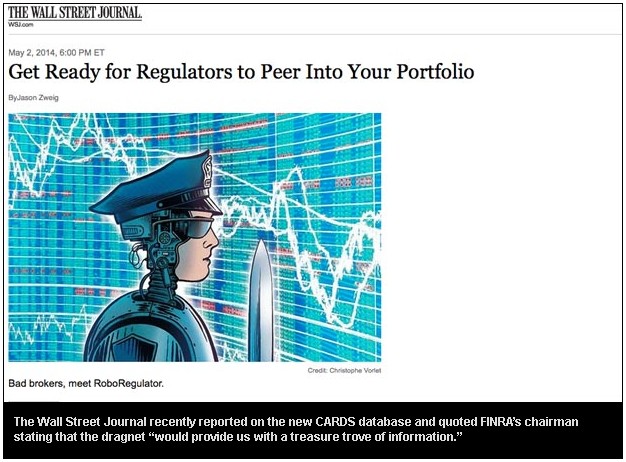

An upcoming surveillance hub monitoring all investment transactions in real-time will allow the National Security Agency unparalleled ability to manipulate the stock market.

[vid]

Through the use of the Financial Industry Regulatory Authority (FINRA)’s latest database, which keeps investor data in the same centralized location, the NSA could easily capture private, financial data on targeted investors and even influence the stock market as a whole.

And it appears that the dragnet database, called the Comprehensive Automated Risk Data System (CARDS), was designed with such vulnerabilities in mind.

“I can’t think of any other reason that someone would invest so much time and so much effort into trying to monitor every brokerage account in the United States in real time,” Porter Stansberry, the founder of the Stansberry & Associates Investment Research Conference, said on the Alex Jones Show. “That is an enormous technical challenge.”

He also added that even knowing something as simple as how many individual investors own certain securities could be very, very valuable to select interests.

While one of the NSA’s roles is undoubtedly financial espionage, the database will also make it easier for corporate entities and high frequency traders to rig markets.

Indeed, three traders have already filed a lawsuit against CME Group Inc. for selling sensitive data to high frequency traders.

“The plaintiffs allege CME charged exchange and data fees for real-time price data, and purported that the data was sold to the users in real time. The suit further states that CME allegedly also charged high-frequency traders for the ability to see the data before others, including people who paid and continue to pay CME for seeing the same data first,” reports the Wall Street Journal.

Since the 1987 stock market crash, the Working Group on Financial Markets, otherwise known as the Plunge Protection Team, has also been a target of charges of market manipulation.

The government itself routinely manipulates markets with the timing of announcements and the actual execution of quantitative easing and bond buying programs.

Oher revelations in the past reveal that the NSA is more than willing to monitor and manipulate financial transactions.

Last December, the White House report on the activities of the NSA suggested that the spy agency was already hacking into financial institutions and altering the amounts held in bank accounts.

“Governments should not use their offensive cyber capabilities to change the amounts held in financial accounts or otherwise manipulate the financial systems,” the report recommended.

Trevor Timm, a former analyst at the Electronic Frontier Foundation, asked if the recommendation implied that the NSA was already doing just that.

And a few months earlier, in September, German news outlet Der Spiegel reported that the spy agency was also tracking the global flow of money.

Under the “Follow the Money” program, the NSA collects credit card and other financial transactions into its own financial databank, called “Tracfin,” which contains nearly 200 million records if not more.

“Further NSA documents from 2010 show that the NSA also targets the transactions of customers of large credit card companies like VISA for surveillance,” the article continued. “NSA analysts at an internal conference that year described in detail how they had apparently successfully searched through the U.S. company’s complex transaction network for tapping possibilities.”

And the upcoming CARDS database, which a law professor suggested is as tempting of a target as the American fleet at Pearl Harbor, would grant the NSA almost unlimited possibilities to influence the stock market.

Alex Jones will make a rare public appearance as a featured speaker at the upcoming Stansberry & Associates Investment Research Conference in Dallas, Texas on Saturday, May 31. For more information and tickets, please visit alexjonesdallas.com.

This article was posted: Thursday, May 8, 2014 at 5:54 am

LINK: WALLSTREET RIGGED

RESEARCH LINKS:

Fusion Centers | Big Brother/Sis And Surveillance Systems | The NSA (National Security Agency) |

Cell Phones Are Tracking Devices | DHS SPY GRID | SMART METERS | National I.D. Card | GOOGLE GLASS |

RFID chip Mandatory at Schools | Facedeals scans your face to customize deals |

10 Reasons Why Nothing You Do On The Internet Will EVER Be Private Again

(Black Friday In Parking Lot)

LINK: DIVIDE AND CONQUER

"When through a

process of law the common people have lost their homes, they will be more tractable and more easily governed by

the strong arm of the law applied by the central power of leading financiers. People

without homes will not quarrel with their leaders. This is well known among

our principle men now engaged in forming an imperialism of [crony] capitalism to govern the world. By dividing the people we

can get them to expend their energies in fighting over questions of no importance to us except as teachers of

the common herd."

-- J.P. Morgan American financier, banker. --

History records that the money changers have used every form of abuse, intrigue, deceit, and violent means possible to maintain their control over governments by controlling money and its issuance.

-- James Madison --

THE DOLLAR

DESTROYED BY DESIGN!

The Federal Reserve

What would happen if the Federal Reserve was shut down permanently? That is a question that CNBC asked recently, but unfortunately most Americans don’t really think about the Fed much. Most Americans are content with believing that the Federal Reserve is just another stuffy government agency that sets our interest rates and that is watching out for the best interests of the American people.

But that is not the case at all. The truth is that the Federal Reserve is a private banking cartel that has been designed to systematically destroy the value of our currency, drain the wealth of the American public and enslave the federal government to perpetually expanding debt.

"Fed" is a "bunch of organized crooks"

John Adams

"All the perplexities, confusion and distress in America arise, not from defects in their Constitution or Confederation, not from want of honor or virtue, so much as from the downright ignorance of the nature of coin, credit and circulation."

John Adams

Greenspan Admits The Federal Reserve Is Above The Law & Answers To No One

**>> Greenspan implies the

fed is above the law. <<**

He states

this at 7:40

Truth in Media: 100 Years of the Federal Reserve

100 years ago, this December, the United States Congress

created a central bank today, we know it as the Federal Reserve Bank of the United States. What most people don't

know is that the bank isn't a federal entity and candidly, it really has nothing in reserves.Is the Federal Reserve

good for the United States? Is it even possible to get rid of it?

The first step toward truth is to be informed.

Global Debt Crisis

Simply Explained

In Conclusion in the face of this massive global social, political, and economic crisis, the reaction of the world’s elite is to further centralize power structures on a global scale, to further remove power from the rest of humanity and move it upwards to a tiny elite. This not only creates massive disparity and inequality, but it establishes the conditions for an incredibly radicalized, restless, and angry world population. As such, the centralized global power structures that elites seek to strengthen and build anew will ultimately be authoritarian, oppressive, and dehumanizing.

** Watch, DERIVATIVES : The Debt Bomb **

N A

T I O N A L D E B T ! ! ! ! ! !

Visit USADebtClock.com to

learn more!

(A very easy to understand 5min cartoon)

Wondering about the American economy? This animated video explains inflation, stagflation, recession and more, all in 5 minutes.

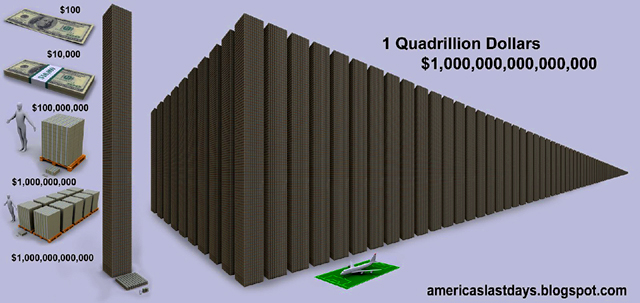

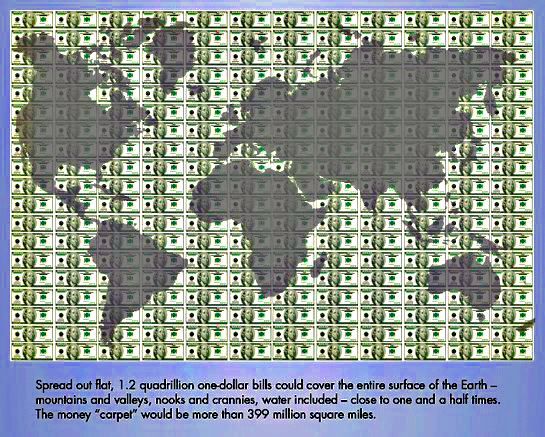

Quadrillions of Fraudulent DEBT!!

A WORLD HELD HOSTAGE BY BANKERS

-- Learn about Glass–Steagall Act in FALL OF THE REPUBLIC --

Washington is owned by the private global banking cartel that owns Wall Street. International law does not apply to this criminal cartel. They stole trillions of dollars from the American people with help from corrupt politicians over a stretch of many decades, culminating in the government bailout in 2008, and they have not been held accountable.

These bandits and looters could care less if America crashes and burns. In fact,

they want America to die because they want to institute a private world government upon its ruins. And they’re

doing a fantastic job at it because they’ve had decades of practice in nations in Latin America, Africa, and

Asia where they bought off greedy politicians, and robbed their people through the IMF/World Bank/WTO.

These bandits and looters could care less if America crashes and burns. In fact,

they want America to die because they want to institute a private world government upon its ruins. And they’re

doing a fantastic job at it because they’ve had decades of practice in nations in Latin America, Africa, and

Asia where they bought off greedy politicians, and robbed their people through the IMF/World Bank/WTO.

The entire business model of the private global banking tricksters is based on stealing the wealth of nations, and destroying national independence in order to allow lawless multinational corporations to completely take over. Read this article about how they do it.

Once nations are put into needless debt by these private global bankers, they put the squeeze on them by forcing them to pay back usurious loans that make them go bankrupt. After the inevitable mayhem that follows national collapse, they impose a military dictatorship so that the people can’t resist. Damon Vrabel calls it the “death of nations.” He writes:

The fact is that most countries are not sovereign (the few that are are being attacked by CIA/MI6/Mossad or the military). Instead they are administrative districts or customers of the global banking establishment whose power has grown steadily over time based on the math of the bond market, currently ruled by the US dollar, and the expansionary nature of fractional lending. Their cult of economists from places like Harvard, Chicago, and the London School have steadily eroded national sovereignty by forcing debt-based, floating currencies on countries.

Civilized nations stand up for themselves, they don’t bow down to private bankers. America can prove to the world that it is civilized, honest, and free by showing the global banking overlords the door.

The way to fight back against the global robbers at the privately owned Federal Reserve Bank/IMF/World Bank and the big banks is entirely peaceful. It is a matter of exposing their deviance and deception to the public, and then hitting the streets. An enemy can’t be defeated unless it remains in the shadows, striking at will. Directing public light at the private global banking cartel’s evil influence over nations that are thought to be free and independent by the people is the only way to bring an end to their crimes, and treachery against Mankind.

A new civilization based on the divine values of freedom, justice, truth, and mutual respect among nations, and private institutions, can’t be born unless we all come together as global citizens and fight back against the unlawful rule of the private global banking cartel. Our countries are suffering because of their greed and ruthless control.

The austerity measures that are being called for by the banks and the elite is bringing chaos onto the streets of Europe on a scale never before seen, and it won’t be long before America enters the stage. We are nearing the moment when the globalist conspirators behind the plans for a new world order will openly declare the end of America. When they do, we shall declare the end of them, and fight for the rebirth of America, and all of Mankind.

Only an order based on the rule of law and freedom should be accepted. The conspiratorial elite intend to achieve a new world order through this period of engineered chaos not by law, but by brutal force because it is the only way to impose a criminal, bank-owned government on a global scale. Despite their rhetoric, these devilish traitors are not visionary thinkers because corrupt designs for a world state isn’t new in history. Their arrogance is a cover. They will fail hard. And America will be set free from bondage, along with other nations.

“This is global government, a private corporate global government, taking over every major society with the same formula. It is fraudulent, and it must be resisted, or we have no future. We cannot allow this new dark age to begin,” says radio host Alex Jones in a YouTube video message entitled “It’s the Bankers or Us.” Watch his message, and spread it.

There is a peaceful global revolution against the private global banking cartel, and it can’t be stopped. Join it and help everyone live free, or die a slave under the empire of debt.

DERIVATIVES: The Debt Bomb

The derivatives market is the Las Vegas of the world's financial super elite, worth anywhere between 2 to 8 quadrillion dollars compared to about 70 trillion dollars of world GDP. We look at the so-called financial innovations of Wall Street from Collateralized Debt Obligations to Mortgage Backed Securities.

We also look at US government's complicity; White House and Congress both vested interests not only as recipients of Wall Street largess in the form of campaign donations but as major players with criminal asymmetrical information and influence advantages.

LINKS :

U.S. Military Killing Its Own Troops!

Global Debt Crisis Simply Explained

http://www.infowars.com/america-is-held-hostage-by-global-private-bankers/

UK Begins Beta Testing of Cashless Society

Physical currency to "disappear within 20 years"

by Paul Joseph Watson | June 23, 2014

A shopping street in Manchester has banned cash as part of an experiment to see if Brits will accept a cashless society, while all London buses will stop accepting cash payments from next month onwards.

The purpose behind the experiment, which will take place in Chorlton, South Manchester, is to “test customers and business reaction to the idea” and is being overseen by credit card processor Handepay.

According to the Manchester Evening News, the experiment is being conducted with the expectation that, “physical currency will disappear inside 20 years.”

Meanwhile in London, the city’s network of buses will stop accepting cash payments from July 6, with customers needing to use an Oyster card, pre-paid ticket or contactless payment cards in order to travel.

“This is a major effort to move in preparation for the cashless society,” writes economist Martin Armstrong, adding, “While the goldbugs have been touting that gold will rise and the dollar will collapse because of fiat money, technology has passed them by making their arguments barbaric relics of the past.”

While the whole idea is being marketed as an inevitable consequence of the decline in cash payments and the rise of credit cards and contactless payment technology, many in the privacy community see the elimination of cash as another means of abolishing anonymity.

Following the Edward Snowden revelations last year, it emerged that the NSA was “sweeping up the entire haystack” of credit card transactions for analysis while, “obtaining purchase information from credit card companies.”

Alternatives to cash that could still provide anonymity, such as crypto-currencies like Bitcoin, are slowly being adopted by more stores and chains, but at nowhere near the rate required to provide a viable competitor to the likes of Google Wallet and Paypal.

Facebook @ https://www.facebook.com/paul.j.watson.71

FOLLOW Paul Joseph Watson @ https://twitter.com/PrisonPlanet

*********************

Paul Joseph Watson is the editor at large of Infowars.com and Prison Planet.com.

Google – The New Bank – Rollover BitCoin & Banks – Its

the Internet Revolution

The real birth in electronic money is not Bitcoin, but Google

Wallet

The real birth in electronic money is not Bitcoin, but Google Wallet. Standing in line at Starbucks you will see the under 25 crowd pay with their cell phones. Sorry, but Google is already there. Bitcoin cannot compete nor will traditional banks. Just as Amazon reduced book publishers to a subservient role at their direction, and book stores went out of business, while the internet is rendering newspapers obsolete, the trend to pay attention to is Google Wallet, which is targeting the traditional banks.

Google has launched in the US market its electronic purse known as the Google Wallet. This form of electronic money enables users to pay for the internet as well as a rising number of stores like Starbucks. However, Google Wallet also allows you to send and receive money. In Europe, the search engine already has a banking license and could start at any time. Because Google’s Android operating system runs on many smartphones, the company has the ready market globally. Google Wallet has the best conditions to establish their electronic money in Europe including Germany and Switzerland than any other system. The younger the generation, the greater the market share Google already has in place. Extending their business into banking will be much easier than anyone anticipates. Google is poised to emerge as a bank that nobody seems to quite appreciate at this time.

Apple’ latest iPhone is also equipped with a fingerprint sensor. The strategy in product development is clear. With this technology, your cell phone can become the most secure credit card because it will require your fingerprint to function. Apple is using this technology in its music platform iTunes that again is used in a greater proportion as you move down the age group..

Facebook is also applying for a banking license in Ireland. They intend to offer banking using its vast worldwide online network throughout Europe. We are looking at a younger generation moving rapidly to electronic money much faster than the older generations even think is possible.

We will see Google and Facebook emerge with electronic accounts for a client-base that will increasingly move away from brick-and-mortar banks rendering them obsolete just as Amazon wiped out a lot of bookstores. A Camera shop that has been here in my neighborhood for 40 years is closing at the end of June. When I ask why? The response was they cannot compete any long with their expenses.

Banks are dinosaurs and are simply incapable of competition. They are as incapable of competing as the local camera store or the newspapers that cater to the older generations, not the younger. This is a wave of Creative Destruction that is in part contributing to the rising systemic unemployment as technology renders many jobs obsolete.

The Internet giants of Google, Apple and Facebook already have the millions of customers established. They are tracking their buying behavior precisely. They can target customers like never before and making the next step in banking to lending will be a breeze. Credit applications are already being approved electronically in minutes. This makes much of the banking staff redundant.

Moving to electronic money is being aided by this technology shift. So while the older generation pray for Bitcoin, the real money is in the hands of Google, Apple, and Facebook who do not have to sell their names to get people to trust them and like PayPal, you can keep your account in your home currency and pay in whatever currency you desire.

Companies will ne moving more and more toward this shift in money. Once we see Google, Apple, and Facebook move to the next big step of lending, say goodbye to the banks of old. If someone online buys a book or bids for something on Ebay, his Internet company might will simply then offer you the right loan. Consumer loans are relatively set formulas and computers by default calculate the risks and decide approve of not.

In Germany just over a 25% of all Internet purchases is now being paid for using the Ebay’s subsidiary PayPal, with estimates in volume exceeding almost 150 billion euros. Ebay’s subsidiary has startled the financial industry and offers credit. You can link a credit card to the account and charge that card automatically.The German banks are too traditional to even contemplate how to compete.

As the economy turns down, banks will be unable to comepte with rising costs in a down market. In Germany, the Samwer brothers who have the online shoe retailer Zalando added Lendico, which has a similar concept like Lending Club. This is part of the internet revolution that is as significant as the industrial revolution was back during the 19th century. Banking is a rapidly collapsing industry just as newspapers. Mainstream news will not be around much longer for the younger generation pay no real attention to them and shows like MSNBC and FOX are really just propaganda selling their political views rather than reporting a fair and balanced news service. Banking will be unrecognizable in another decade.

Central Banks in Other Countries to Require Biometrics to Bank

By Melissa Melton on June 24, 2014

(Originally published at The Daily Sheeple.)

You think the big brother surveillance state is getting creepy here in America, check out what central banks are doing in other countries.

Via All Africa:

In line with the ongoing initiative of the Central Bank of Nigeria (CBN) and the Bankers’ Committee (comprising Chief Executives of the nation’s deposit money banks), banks across the country are to begin capturing of customer biometric data as part of Bank Verification Numbers (BVN).

The rollout of the BVN solution for the identification and verification of bank customers is expected to begin in 1,000 selected bank branches across Lagos, as a prelude to a nationwide rollout.

This is in alignment with the phased approach adopted in executing the three-tiered Know-Your-Customer (KYC) and cashless policy of the CBN.

That’s right. In addition to the Central Bank of Nigeria’s new cashless policy — which aims at “reducing” the amount of paper money and coins circulating in the economy and encouraging more electronic transactions by adding a ‘cash handling charge’ — a new biometric program will require customers to sign up for a Bank Verification Number and present themselves at any branch for fingerprinting (all 10 fingers), facial image capture, and more.

No customer will be able to do any banking whatsoever without those fingerprints.

Some articles have also tossed around voice recognition and retina scans as well.

All to “revolutionize” banking…for people’s safety and security, of course.

CBN Governor Lamido Sanusi launched the new biometric registration at the head office on behalf of the Bankers’ Committee in February. Punch quoted Sanusi as saying, “We have launched the Bank Verification Number today, the timetable suggests that within 18 months, every customer would have been registered. This is a day that we would remember for many reasons, not for where we are but where we are likely to get from here. Nobody can steal this identity except he or she steals my fingers…”

Apparently this guy hasn’t seen a whole lot of science fiction films.

The nation of India has instituted similar measures, recently rolling out a massive biometric identity system which aims to collect the iris and fingerprints of every single one of its over a billion citizens, linked to a 12-digit identity number.

Never mind that iris scanners and fingerprint IDs have all been easily fooled. Someone has been reading a lot of the Bible lately, specifically Revelations.

These types of measures are being rolled out in developing nations first, but don’t worry, they’ll make their way here soon enough.

Eventually, no one will be able to buy or sell anything without giving up their biometrics to big brother and his database.

U.S. Bank and Wells Fargo are already piloting voice recognition biometrics as I type this.

A CASHLESS

DIGITAL DISASTER EXAMPLE:

Food Stamp Dependency, Riots Lead to Martial Law

Americans will be caught in the middle between

rioters and the police state

Kit Daniels

Infowars.com

October 16, 2013

By encouraging mass dependency on the welfare state, the Obama administration is ensuring that nationwide rioting due to a large-scale collapse of the food stamp program will “justify” an explosive expansion of the police state.

The administration’s goal to dramatically increase food stamp enrollment, officially known as the Supplemental Nutrition Assistance Program (SNAP), follows a strategy called pressure from above and below, in which the government deliberately creates problems in order to offer “solutions” which only expand government powers at the expense of individual rights.

The government’s “solution” to nationwide rioting due to a crash in the food stamp system will no doubt involve a federalized police state takeover, perhaps even martial law, with Department of Homeland Security tanks and VIPR squads roaming America’s streets to supposedly “restore order” out of the chaos while ignoring the Bill of Rights with impunity.

Regional “mini-riots” have already occurred during an electronics benefit transfer (EBT) system glitch last Saturday.

Now that over 47.7 million Americans, nearly 1/6th of the U.S. population, are dependent on food assistance and that the United States Department of Agriculture, which oversees SNAP, ordered states to withhold electronic transfers of benefits for the month of November until further notice, the rise of the police state under the guise of riot response may very well come into fruition.

“The hidden objective will be to expand the power of the bureaucracy and to move the country closer to the ultimate goal of total government,” wrote G. Edward Griffin in a related essay.

The government’s deliberate push for welfare dependency is obvious considering that the USDA spent vast amounts of taxpayer money to encourage illegal immigrants to apply for food stamps through television and print ads.

On July 19, 2012, the Daily Caller reported that the USDA began working with the Mexican government to “increase participation in SNAP.”

Knowing that there was more to the story, Judicial Watch made a Freedom of Information Act request the next day asking for “any and all records and communications” relating to the USDA/Mexico food stamp partnership.

Nine months later, Judicial Watch received welfare promotional documents including a Spanish-language flyer targeted to illegal immigrants, telling them that they do not need to “divulge information” regarding their “immigration status” in order to receive welfare benefits for their children.

The USDA was running Spanish-language television ads promoting the food stamp program to illegal immigrants as early as 2006, during the Bush administration.

Once Obama took over, however, welfare enrollment exploded.

“Since President Obama came into office, SNAP participation has increased at 10 times the rate of job creation,” Sen. John Thune (R-SD) said. “This explosive growth in both the SNAP enrollment and federal cost of the program is alarming.”

This skyrocketing increase in government dependency is no accident.

By pushing for massive enrollment into SNAP, the Obama administration is making a sizable number of people dependent on welfare to the point where they will riot if they are denied access to food stamps, which the government controls at whim.

The government can therefore trigger violent food stamp riots, either intentionally or through incompetence, and DHS can exploit the ensuing chaos to expand its power while unleashing its stockpile of armored tanks and two billion rounds of ammunition onto We the People.

Under a two-prong attack of pressure from above and pressure from below, the American people will be in serious danger of losing their lives, their rights and what remains of the republic.

This article was posted: Wednesday, October 16, 2013 at 9:37 am

Tags: constitution, domestic news, food, police state

A CASHLESS DIGITAL DISASTER EXAMPLE

LINK : FOOD CONTROL GENOCIDE

A CASHLESS DIGITAL DISASTER EXAMPLE

LINK: Food Crisis

In the video below, Alex Jones highlights how the Guardian Centers video is yet another startling indication that authorities in the United States are preparing for civil unrest as America increasingly begins to resemble a militarized police state.

U.S. Army Training to Fight Black Americans

LINKS: Posse Comitatus Act , Posse Comitatus2 , REX 84 , Fema Camps , Fema Camps 2 , Re-education Camps

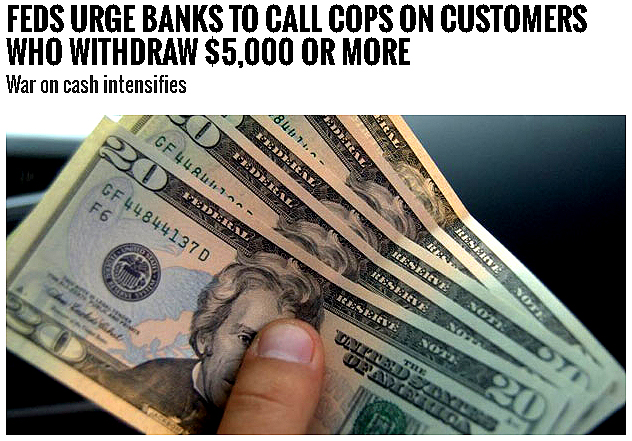

Feds Urge Banks to Call Cops on Customers Who Withdraw $5,000 or More

War on cash intensifies

by Paul Joseph Watson | March 24, 2015

The Justice Department is ordering bank employees to consider calling the cops on customers who withdraw $5,000 dollars or more, a chilling example of how the war on cash is intensifying.

Banks are already required to file ‘suspicious activity reports’ on their customers, with threats of fines and even jail time for directors if financial institutions don’t meet quotas.

But as investor and financial blogger Simon Black points out, last week, “A senior official from the Justice Department spoke to a group of bankers about the need for them to rat out their customers to the police.”

Assistant attorney general Leslie Caldwell gave a speech in which he urged banks to “alert law enforcement authorities about the problem” so that police can “seize the funds” or at least “initiate an investigation”.

As Black highlights, according to the handbook for the Federal Financial Institution Examination Council, such suspicious activity includes, “Transactions conducted or attempted by, at, or through the bank (or an affiliate) and aggregating $5,000 or more…”

Black provides a chilling scenario under which an attempt to withdraw your own money from your bank account could end with a home visit from the cops.

“As you pull into your driveway later there’s an unexpected surprise waiting for you: two police officers would like to have a word with you about your intended withdrawal earlier,” writes Black, who accuses banks of already operating as “unpaid government spies”.

“Do you need to withdraw cash to purchase a used car from a private seller? Or perhaps you are pulling out some emergency cash for a loved one,” writes Mac Slavo.

“Either one of these activities are now considered suspicious and if your cash withdrawal amounts to even a few thousand dollars your bank teller is under a legal requirement to alert officials about your suspected criminal activity. And before you argue that you can’t possibly be a suspect because you have done nothing wrong, consider that even being suspected of being a suspect is now enough to land you on a terrorist watchlist in America.”

The war on cash is intensifying as authorities attempt to crack down on one of the few remaining modes of anonymity.

Over in France, Finance Minister Michel Sapin hailed the introduction of measures set to come into force in September which will restrict French citizens from making cash payments over 1,000 euros.

The new regulations, introduced in the name of fighting terrorism, will also see cash deposits of over 10,000 euros during a single month reported to anti-fraud authorities.

Meanwhile, in the UK, HSBC is now interrogating its account holders on how they earn and spend their money as well as restricting large cash withdrawals for customers from £5000 upwards.

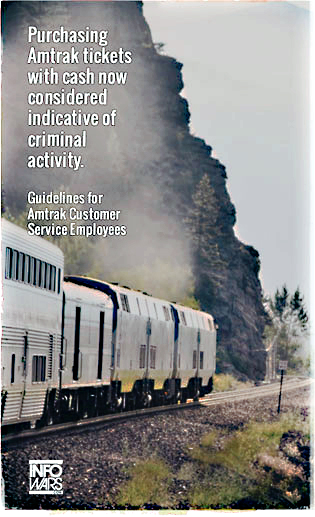

Back in America, purchasing Amtrak train tickets with cash is being treated as a suspicious activity as part of a number of behaviors that are “indicative of criminal activity”.

Banks are also making it harder for customers to withdraw and deposit cash, with Chase imposing new capital controls that mandate identification for cash deposits and ban cash being deposited into another person’s account.

In October 2013, we also reported on how Chase instituted policy changes which banned international wire transfers while restricting cash activity for business customers (both deposits and withdrawals) to a $50,000 limit per statement cycle.

Facebook @ https://www.facebook.com/paul.j.watson.71

FOLLOW Paul Joseph Watson @ https://twitter.com/PrisonPlanet

*********************

Paul Joseph Watson is the editor at large of Infowars.com and Prison Planet.com.

MORE INFORMATION ON HOW MONEY WORKS HERE : The Federal Reserve

Push to Put Your Money in Google’s CIA Cloud Wallet

Infowars.com

August 3, 2012

In Google’s Brave New World, all of your money will be in the “cloud” – a metaphor for data stored and retrieved over the internet – and you will pay for stuff with a swipe of a mobile device.

Google rolled out this “service” in 2011 and calls it “Google Wallet.” It stores credit and debit card information on Google’s servers. Google has partnered with the multinational banksters at Citigroup and the scheme currently works with MasterCard and Visa. It works with 300,000 plus merchants using Sprint’s Nexus S 4G phones. Google has announced it will partner with all vendors of non-Android phones, including Apple, RIM, and Microsoft.

Imagine all your credit card and debit data sitting on the CIA’s servers. Now imagine some time in the not too distant future when you become an enemy of the state – maybe it was that post critical of the Pentagon on Facebook or that scathing email you sent to your congress critter – and suddenly you can no longer access your money because you are locked out of the “cloud.”

If you think Google wouldn’t do this, think again. It is a key component of the

global elite’s control grid, now rolling out at breakneck speed.

If you think Google wouldn’t do this, think again. It is a key component of the

global elite’s control grid, now rolling out at breakneck speed.

Back in 2006, we reported on Google’s relationship with the CIA. Robert Steele, a 20-year Marine Corps infantry and intelligence officer and a former clandestine services case officer with the CIA, told Alex Jones the CIA helped bankroll Google from the very start.

“I think Google took money from the CIA when it was poor and it was starting up and unfortunately our system right now floods money into spying and other illegal and largely unethical activities, and it doesn’t fund what I call the open source world,” said Steele, citing “trusted individuals” as his sources for the claim.

“They’ve been together for quite a while,” added Steele.

Google, moreover, is a key player in the military-industrial complex. “Google is linked to the U.S. spy and military systems through its Google Earth software venture. The technology behind this software was originally developed by Keyhole Inc., a company funded by In-Q-Tel, a venture capital firm which is in turn openly funded and operated on behalf of the CIA,” writes Eric Sommer.

“Moreover, Googles’ connection with the CIA and its venture capital firm extends to sharing at least one key member of personnel. In 2004, the Director of Technology Assessment at In-Q-Tel, Rob Painter, moved from his old job directly serving the CIA to become ‘Senior Federal Manager’ at Google,” Sommer continues.

Now that millions are addicted to mobile devices, the trick is to get them to agree to put their money in the cloud and use their phones to pay for everything.

Total control can’t be far behind.

This article was posted: Friday, August 3, 2012 at 2:42 pm

Tags: big brother, domestic spying, police state, technology

LINK: C.I.A.

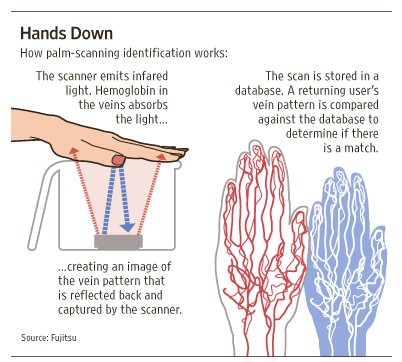

Biometric Vein Scan Payment System Launched

Trenton, New Jersey (My9NJ) - We live in a world where the security of our finances is just as important of a concern as the security of our homes.

Identity theft, fraudulent payments, and accidental misuse of funds are all realities in our fast paced economy.

In recent years however, technology has played a huge role in securing financial assets. PINs and security codes have been the status quo for basic financial security, but two friends in New Jersey are taking that concept a step further by using vein scans to confirm a person's identity to secure financial transactions.

It’s called Pulse Wallet and it is a point-of-sale register and biometric payment terminal. PulseWallet lets customers link their credit cards and other payment methods to their palms so they can leave their wallets at home.

The co-founders are Matt Saricicek and Aimann Rasheed.

They say there are benefits to this new technology in all sorts of marketplaces.

“We were thinking about a convenient way to make a payment like using yourself, because you’re more unique than anything out there, said Saricicek.

“Its part of you and you can’t lose it and you don’t even know what it is. It’s a password that you don’t know you have as soon as you place it your good to go, so it’s something no one can steal, said Rasheed.

Pulse Wallet says it airlines want to use it as a new type of boarding pass.

Select retailers in New Jersey are in a beta program for the next three to six months. Mass production of the devices is set to roll out in the spring.

The technology actually scans palm vein patterns underneath the skin. The company claims it is more

secure than fingerprints because there are no traces for someone to replicate and the scanning requires blood flow

for a proper read.

The company actually addresses the issue of the security involving a severed hand. The company states in its

frequently asked questions: "Firstly we hope that this will never happen. However, even if someone, somehow, got

away with sneaking a chopped off hand into any store, they wouldn’t be able to use it at check-out due to a lack of

blood flow in the severed hand. "

Pulse Wallet says it can also function like a normal credit swiping system if users or merchants choose to opt-out on registering a their biometric profile.

http://www.my9nj.com/story/24654417/a-new-way-to-make-payments

PalmSecure Biometric Scanner

INTUS-PalmSecure-Wall-3

Fujitsu PalmSecure technology

Fujitsu announced that its palm readers will soon be installed in bank kiosks, building

lobbies, and other places where you might need to verify your identity at a checkpoint of some sort.

So far, Fujitsu's signed on Italy's UniCredit bank, which kicked off a test program late last year. As we've

reported in the past, you don't even have to touch the sensor; you can merely hover over it.

http://notebookitalia.it/fujitsu-palm...

Palm Vein Scanners Could Eventually

Replace Your Wallet with Your Hand

Fujitsu's palm vein biometric system uses infrared sensors to capture an image of the veins in your hand. For more, read http://spectrum.ieee.org/biomedical/i...

THE RACE

TO BIOMETRIC UBIQUITY

Cashless Society: India Implements First Biometric

ID Program for all of its

1.2 Billion Residents

Brandon Turbeville

Infowars.com

January 12, 2012

Over the past few months, I have written several articles dealing with the coming cashless society and the developing technological control grid. I also have written about the surge of government attempts to gain access to and force the use of biometric data for the purposes of identification, tracking, tracing, and surveillance.

Unfortunately, the reactions I receive from the general public are almost always

the same. While some recognize the danger, most simply deny that governments have the capability or even the

desire to create a system in which the population is constantly monitored by virtue of their most private and

even biological information. Others, either gripped by apathy or ignorance, cannot believe that the gadgets

given to them from the massive tech corporations are designed for anything other than their entertainment and

enjoyment.

Unfortunately, the reactions I receive from the general public are almost always

the same. While some recognize the danger, most simply deny that governments have the capability or even the

desire to create a system in which the population is constantly monitored by virtue of their most private and

even biological information. Others, either gripped by apathy or ignorance, cannot believe that the gadgets

given to them from the massive tech corporations are designed for anything other than their entertainment and

enjoyment.

However, current events in India should serve not just as a warning, but also as a foreshadowing of the events to come in the Western world, specifically the United States.

Recently, India has launched a nationwide program involving the allocation of a Unique Identification Number (UID) to every single one of its 1.2 billion residents. Each of the numbers will be tied to the biometric data of the recipient using three different forms of information – fingerprints, iris scans, and pictures of the face. All ten digits of the hand will be recorded, and both eyes will be scanned.

[VID]

The project will be directed by the Unique Identification Authority of India (UIDAI) under the premise of preventing identity theft and social welfare fraud. India has rather extensive social welfare and safety net programs, ranging from medical support and heating assistance to others aimed at helping the poor. Fraud is a rampant problem in India, especially in relation to these programs due to a preponderance of corrupt politicians and bureaucrats who often stuff welfare rolls with fake names and take the money for themselves.

Yet, although the justification for the billion person database is the increased ability to accurately disperse social welfare benefits, it will not be just the Indian government’s social welfare programs that have access to and utilize the UIDAI. Indeed, even before the program has been completed, major banks, state/local governments, and other institutions are planning to use the UIDAI for identification verification purposes and, of course, payment and accessibility.

As Aaron Saenz of the Singularity Hub writes:

Yet the UID is going to be used for much more than social welfare programs. The UIDAI is in discussion with many institutions (banks, local/state governments, etc.) to allow them to use the UID as a means of identity verification. These institutions will pay the UIDAI some fee to cover costs and generate revenue. There seems to be little doubt that once it is established, the UID will become a preferred method (if not the preferred method) of identification in India.

Saenz also sees the eventuality of the UIDAI program becoming a means of payment and accessibility. He continues:

Ultimately, I wouldn’t be surprised if the UID, with its biometric data, could be used as a means of payment (when linked to a bank account), or as an access key to homes and cars. Purchase a meal with your fingerprint and unlock your door with the twinkle in your eye. Similar results could be expected in other nations that adopted biometric identification systems.

Saenz, and other proponents of the UID (UIDAI), have been diligent in pointing out that the program “is just a number, not an ID card.” However, this claim is debatable. Saenz himself admits that State issued driver’s licenses and identification cards will reference the UID information.

The question then becomes how much of that information will be referenced, and how that will be accomplished? Will the information be included on the card? Will only part of the information be included on the card? Or will the card reference back to the digital UID information to be then reconciled with the information that is present on the card? Although the UID is obviously going to be utilized by other institutions outside of the social welfare programs, no answers to these questions have been provided.

But, in the end, does it really matter if the information is collated into an ID card format if the government already has access to that information digitally? More than likely, a national ID card will appear as a supplement to the database already created by UID. Regardless, the private biometric information has still been taken from the individual. The database is still there.

Indeed, government “officials” have already stated that the database will be used by intelligence agencies for the purpose of monitoring “bank transactions, cellphone purchases and the movements of individuals and groups suspected of fomenting terrorism.” This will be very easy to do since the UID number will be entered anytime an individual “accesses services from government departments, driver’s license offices and hospitals, as well as insurance, telecom, and banking companies.”

Nevertheless, proponents have also touted the fact that, at this point, the UID program is optional. But the program will obviously not be optional for very long. As I have discussed in previous articles, the introduction of a program such as a national ID card, biometric data, or cashless payment technologies is always followed by the program becoming mandatory. The ultimate goal of an all-encompassing cashless surveillance program with no opt-out provisions is always introduced by stealth and the Gradualist Technique.

At first, the program is introduced as a way to speed up transactions, increase efficiency, and provide convenience. Soon, however, governments and businesses begin to transition out of the older methods of payment and identification and focus more on the new technology. Identification using the traditional methods remain as an option, but become viewed as cumbersome. Eventually, the alternative methods are phased out completely and mandates replace what was once a personal choice.

As soon as Indian banks, businesses, and government social service offices begin to require identification using the UID, the ability to remain off the system and lead what passes for a normal life will disappear.

This is exactly the intention with India’s new biometric ID program. In fact, the cashless society is a stated goal of the UID program. CEO of MindTree’s IT Services, the company that was awarded the government contract for development and maintenance of the UID, explained in an interview with ComputerWeekly that the “ID scheme will support a cashless society. He said all vendors will have a biometric reader and citizens can pay for things with a fingerprint scan. Even a bag of rice.”

No doubt, even after such an admission by a man who was instrumental in the development of the program, many who read this article will still dismiss it as a “conspiracy theory.”

Nonetheless, this new monumental data mining effort by the Indian government dovetails with recent efforts in the Western world to develop an electronic surveillance grid capable of tracking, tracing, and recording every single movement and communication of every single citizen within a nation’s borders.

New technologies which are being introduced inside the United States, the UK, and Australia such as vein scanners, biometric employee time and attendance systems, voice recognition devices, and behavior analysis systems are all geared toward Total Information Awareness of every human being on the planet.

Only a totalitarian form of government would desire this information; and only a very determined totalitarian government would actively work toward establishing it. India is only the first nation to openly sweep up its entire national population into such a massive biometric database net. We cannot let our nation be the next.

This post first appeared on Activist Post.

Brandon Turbeville is an author out of Mullins, South Carolina. He has a Bachelor’s Degree from Francis Marion University where he earned the Pee Dee Electric Scholar’s Award as an undergraduate. He has had numerous articles published dealing with a wide variety of subjects including health, economics, and civil liberties. He also the author of Codex Alimentarius – The End of Health Freedom, 7 Real Conspiracies and Five Sense Solutions. Brandon Turbeville is available for podcast, radio, and TV interviews. Please contact us at [email protected]

This article was posted: Thursday, January 12, 2012 at 8:02 am

http://findbiometrics.com/lockheed-martin-helping-us-military-to-organize-biometric-data/

http://www.youtube.com/user/findbiometrics

MORE INFORMATION HERE: BIOMETRICS

LINK: THE WORLD BANK / IMF

SMARTcards in India

– The Move Towards a

Cashless Society

Infowars.com

June 14, 2012

The World Bank helped finance a project in India that may be the tip of the iceberg leading into a cashless society. The project has been ongoing since 2008, but more recent activity has SMARTcards back in the news.

“SMARTcards” are arguably the best way for workers to save their money, as evidenced by a few workers in the “news piece” below who say it’s “safer” than actual money, however, all this seems like one big step in the right direction for a one-world global currency.

The application process is slightly invasive as well, requiring fingerprint scans of all 10 fingers.

At the end of last month, it was reported by Haveeru Online, a Maldives publication, that ID cards were being converted into SMARTcards.

Last week the Indian government spurred controversy yet again when it was announced they spent $63,000 upgrading toilets in a government building and on SMARTcards (seemingly for access to the bathrooms?). After receiving negative feedback on the plan they decided not to go through with the SMARTcard portion, as one blogger notes.

LINK: WORLD BANK

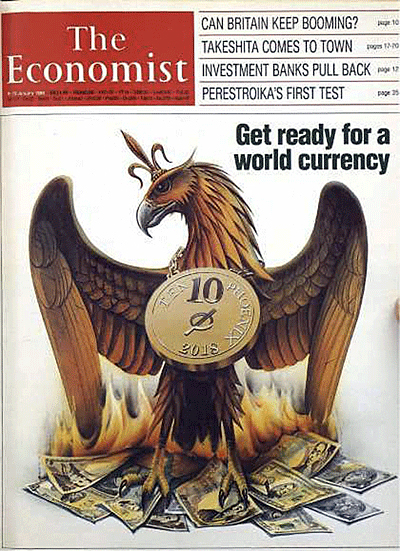

Government Plan Would Transform Israel Into The World’s First Cashless Society

by Michael Snyder | American Dream | May 27, 2014

Will Israel be the first cashless society on the entire planet? A committee chaired by Israeli Prime Minister Benjamin Netanyahu’s chief of staff has come up with a three phase plan to “all but do away with cash transactions in Israel”. Individuals and businesses would still be permitted to conduct cash transactions in small amounts (at least initially), but the eventual goal is to force Israeli citizens to conduct as much business as possible using electronic forms of payment. In fact, it has been reported that Israeli officials believe that “cash is bad” because it fuels the underground economy and allows people to avoid paying taxes. It is hoped that requiring most transactions to be conducted in cash will reduce crime and help balance the national budget. And once 98 or 99 percent of all transactions are cashless, it will not be difficult for the Israeli government (or any other government) to go the rest of the way and ban cash transactions altogether. But is a cashless society actually desirable? This is a question that people all over the world will have to start asking as governments increasingly restrict the use of cash.

Back in September, it was announced that the Israeli government had formed a committee to “examine ways to eliminate cash from the Israeli economy”…

The government on Tuesday authorized establishment of a committee that will examine ways to eliminate cash from the Israeli economy – the better to prevent citizens from cheating on their taxes. The committee will be chaired by Harel Locker, director of the Prime Minister’s Office.

This committee had the full backing of Prime Minister Benjamin Netanyahu, and some of the goals of the committee included finding ways to increase tax revenue and prevent money laundering…

Officials in the Prime Minister’s Office declared that “around the world, it is recognized that cash is a key element of the illegal economy and money laundering. It allows a wide gap between reported and actual incomes, with the corresponding effect on tax revenues.” By eliminating cash, the PMO said, “it will be possible to expand the tax base, and prevent money laundering.” The committee will study the issue from all its perspectives and make recommendations, the PMO said.

The committee has had quite a few months to examine these issues, and now they have come back with their recommendations. Just this week we learned that a three phase plan is being proposed…

A special committee headed by Prime Minister Benjamin Netanyahu’s chief of staff, Harel Locker, has recommended a three-phase plan to all but do away with cash transactions in Israel.

The motivation for examining a cash-less economy is combatting money laundering and other tax-evasion tactics, thereby maximizing potential tax collection and greatly expanding the tax base. This is important considering the enormous strain put on Israel’s national budget by the army, healthcare system and other public services.

The committee estimated that the black market represents over 20 percent of Israel’s GDP, and cash is the facilitating factor. Cash enables tax evasion, money laundering and even financing terrorism.

So what do the specifics of the plan look like?

Well, there will be very strict limits on the use of cash for individuals and businesses, any violations will be considered criminal offenses, and all Israeli banks will be required to issue debit cards to all account holders…

What the committee would like to see happen, pending government approval, is greater restriction on the use of cash, limiting the use of checks as a means of payment and exchange for cash, and promotion of the use of electronic (and therefore verifiable) means of payment.

The following guidelines were set out by the committee for the short-term:

- Limit business transactions done in cash or by check to NIS 7,500 ($2,150) immediately, and reduce that further to NIS 5,000 ($1,433) one year from the date of legislation;

- Limit private transactions done in cash or by check to NIS 15,000 ($4,300);

- Any violation of these limitswould be a criminal offensewarranting a stiff fine.

In conjunction with these new restrictions, Israeli banks would be required to provide all account holders with debit cards to further promote electronic payments.

But of course this move toward a cashless society is not just happening in Israel.

In Sweden, it is estimated that just 3 percent of all transactions involve cash at this point. In fact, according to an article in the Washington Post, some Swedish banks do not handle cash at all anymore…

In most Swedish cities, public buses don’t accept cash; tickets are prepaid or purchased with a cell phone text message. A small but growing number of businesses only take cards, and some bank offices — which make money on electronic transactions — have stopped handling cash altogether.

“There are towns where it isn’t at all possible anymore to enter a bank and use cash,” complains Curt Persson, chairman of Sweden’s National Pensioners’ Organization.

And the U.S. is starting to move in that direction as well.

According to a study conducted by MasterCard, approximately 80 percent of all consumer transactions in the United States are now cashless.

But isn’t there a downside to all of this?

Just about everything that we do in life involves money. So yes, a government can track electronic payments to make sure taxes are being paid and money laundering is not happening, but it would also enable a government to do so much more.

If a government can track all of your transactions, it will essentially be able to monitor everywhere you go and pretty much keep track of virtually everything that you do.

If you doubt this, just try to live without any money some time.

You won’t get very far without putting some gas in your vehicle.

And without being able to buy food, you will get hungry pretty quickly.

Are you starting to understand?

This is why governments love the idea of moving toward a cashless society. It would give them an immensely powerful surveillance tool.

So let us hope that this does not happen in Israel or anywhere else in the world either.

Biometrics in Schools. Your Finger is a Barcode

Biometrics in Schools: Your Finger is a Barcode

This invasive technology is being rolled out across schools in the UK and Europe. The next step before a cashless

totalitarian society. This company is a subsidiary to General Dynamics Information Technology, the same corporation

that owns the patent to the VeriChip!

BIOMETRIC

SCANNER

AT SEA WORLD

March, 2004

Alex Jones - Cashless Society

|

|

|

|

|

|

|

|

Saturday the 13th of March, 2004

Infowars.com/Alex Jones

March 15, 2004

I woke up on Saturday the 13th of March, 2004 and told my wife that I hadn't been to Sea World since my visit to the Orlando park 20 years ago. We decided to jump in the car and drive south from Austin to the aquatic zoo in San Antonio.

Upon arriving, we walked up to the ticket counter and began talking to the attendant. He told us that a season pass was only $8 more than a daily pass. At that point I said, "great, we'll buy season passes." What he didn't tell me is that I would have to go enroll in their "passport office."

I learned that 30 seconds after I bought it, and they directed me to an office that resembled a driver's licence facility. After standing in line, we got our passes. Then, we were directed back to the turn styles.

I was shocked when told by the security guard at the turn style, that I would have to biometrically scan my right hand in order to enter the park. I refused and said that it was against my religion. I told them that it was a part of a federal program in conjunction with major corporations to prepare us for the cashless society that is being set up to track all of our purchases, activities, and is being used to build detailed psychological profiles on all of us.

At that point she said, "wow, I'm glad you're telling me all of this," and looked very concerned. Other attendants and security guards were nodding their heads and smiling at me. She told me that a lot of people were uncomfortable scanning, and that if I didn't' want to I didn't have to.

I asked her and the gathering knot of employees why they didn't just use picture IDs. I had seen all the derelict cameras at the "passport office" and was wondering why they didn't take a picture of me then. She replied that she did not know, that the old IDs did have a picture on them, which had worked just fine.

We had a video camera in my wife's backpack, but we didn't think to use it because this was so spontaneous. Later, after we had seen a few of the exhibits, Violet told me that I ought to go back and interview them.

By Wednesday we'll have a short report containing the video of our second interview with them.

Grocery stores, banks, public schools: they're all putting in Biometrics. 42 states through a Federal mandate have now installed these systems in order to get a Driver's licence. This is about getting rid of our jobs, creating the control grid and getting us into their system. It's about getting rid of the Sea World attendants' job and replacing her with an automated tracking system.

New Disney RFID Bracelet

Creepy New Disney RFID Bracelet to Allow Park Mascots

to Greet Your Child By Name

Frankly, Disney creeps me out, and my research affirms that those feelings are not at all

misplaced. When I saw that one of the new capabilities of Disney's ever-so-magical RFID bracelet program was to

allow the middle-aged guy with no background check who dresses like Goofy and wonders the park greeting kids all

day to know people's children *by name*, I thought this definitely requires a report.So remember kids, don't talk

to strangers (even if they know your name and are dressed like a giant smiling mouse)...at Disneyworld.

Website: TruthstreamMedia.com

Twitter: @TruthstreamNews

FB: Facebook.com/TruthstreamMedia

Trendy Cashless Society?

Welcome to the Electronic Concentration Camp

Ads are everywhere inundating us with the

idea that it's going to be so cool and hip and trendy when our wallets (and currency) are totally digital,

everything is automated, and they try to make us get barcodes tattooed on our bodies to verify our accounts... but

I think it's going to be a little more like In Time meets The Net meets Gattaca meets Hunger Games meets Terminator

meets Blade Runner meets The Matrix meets Idiocracy.

Fun times. Use cash while you still can.

Related

Electronic Tattoos and Passwords You Can Swallow: Google's Regina Dugan Is a Badass:

http://allthingsd.com/20130529/electr...

We'll be uploading our entire MINDS to computers by 2045 and our bodies will be replaced by machines within 90

years, Google expert claims: http://www.dailymail.co.uk/sciencetec...

666 It Has

Begun

Published on Mar 3, 2015

InfoWars.com Darrin McBreen explores the coming of the Mark of the Beast. RFID microchips implanted under the skin and wearable technology (Smart Tattoos) will soon be mandatory. Meanwhile the European Union and U.S. Cybercom develop plans for a worldwide standardized Internet ID system. Will you accept the mark of the beast?

LINKS: CASHLESS TRACKABLE SOCIETY , Microchip Implants , Big Brother/Sis And Surveillance Systems , The NSA (National Security Agency) , GOOGLE GLASS , DHS SPY GRID , SMART METERS , National I.D. Card , India Biometrics 1.2 Billion People , Communications Takeover by EAS , Cell Phones Are Tracking Devices , RFID chip Mandatory at Schools , Facedeals scans your face to customize deals , 10 Reasons Why Nothing You Do On The Internet Will EVER Be Private Again

Predicted: Digital Slave

Currency

Biometrics lead to a system of control more dangerous and

deceptive than anything seen throughout history

by Infowars | June 26, 2014

The social engineers who control the planet have been extremely open and brazen about their plans to create a totally controlled society in which humans act and operate as biological androids.

[vid]

Technology has been developed over the past 100 years to carry out dehumanization and eugenics in order create a system more dangerous and deceptive than anything seen throughout history.

Alex goes back into the Infowars archive to cover his arrest shown in his first film America Destroyed By Design, where he illustrated that even as early as the 1990s, biometrics were being implemented at drivers license facilities by way of thumbprint scanning in order to bring in a unified national ID card.

TRACKABLE SOCIETY

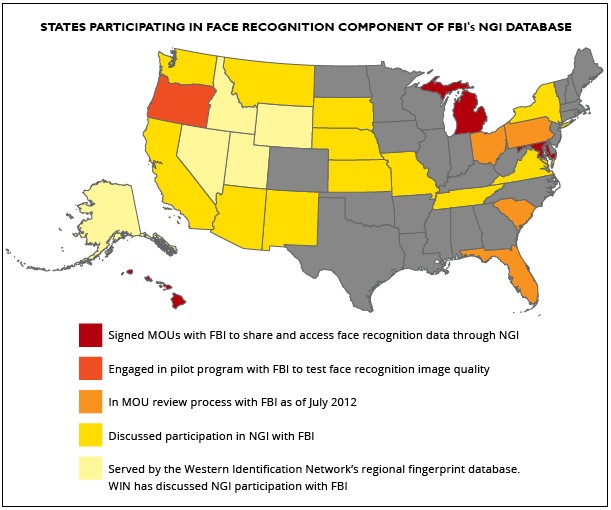

FBI Will Have Up To One Third Of Americans On Biometric Database By Next Year

Privacy group warns “even if you have never been arrested you could be implicated as a criminal suspect”

Steve Watson

Infowars.com

April 15, 2014

A leading privacy watchdog has warned that the FBI plans to have up to a third of all Americans on a facial recognition database by next year.

The Electronic Frontier Foundation notes in a communique that some 52 million Americans could be on the Next Generation Identification (NGI) biometric database by 2015, regardless of whether they have ever committed a crime or been arrested.

The group managed to obtain information pertaining to the program via a freedom of information request.

The database will also hold fingerprints, of which the FBI has around 100 million records, as well as retina scans and palm prints. Profiles on the system will contain other personal details such as name, address, age and race.